EUR has been struggling to gain and sustain the momentum it acquired against AUD since the price bounced off the 1.6750 area in the beginning of 2019. The Australian currency managed to keep its gains against the euro despite the economic challenges in the country.

In case the economic slowdown continues, the ECB may delay a planned increase in interest rates. According to ECB President Draghi, the bank will continue adaptive monetary policy. Though the risk of the financial instability increases as banks' profit declines amid the weak economic growth, the euro is still managing to hold its positions.

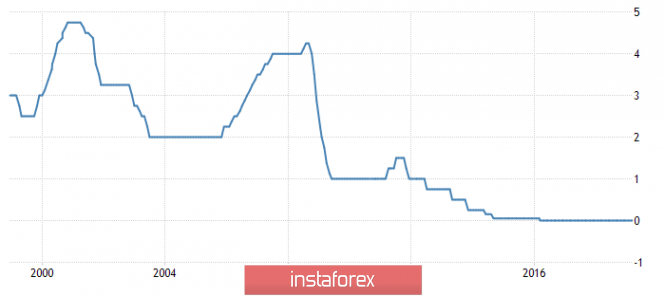

According to the statistical data, the eurozone's interest rate has not seen a significant rise above 5% since 2000, and starting from late 2016, the rates have been unchanged. The European Central Bank is looking forward to hike its rates this year, but as Brexit remains a major factor affecting the growth, the likehood of the rate's increase is uncertain.

Today Europe's M3 Money Supply report is going to be published. It is expected to advance to 3.9% from the previous value of 3.8%. Meanwhile, private loans are also anticipated to rise to 3.3% from the previous level of 3.2%. Though the economic reports that can effect the monetary policy met the expectations, any negative factor may lead to significant change in the ECB's further policy.

Recently, Governing Council member Francois Villeroy stated that the optimistic outlook of the ECB for 2019 might come true as the economy is not in recession, and the European regulator is prepared for any worse situation.

On the other hand, Australia is struggling with the housing sector decline, while mixed employment data helped the currency to sustain its gains against EUR. Australia's jobless rate fell to its 8-year low in February, but the employment change showed significant downturn to 4.6k from the previous figure of 38.3k.

Currently, AUD is expected to regain momentum against EUR, while the eurozone's economy is experiencing a slowdown ahead of this week's Brexit parliamentary vote. Though the euro'sgains may trigger some upward correction of the pair, the bearishtrend is still strong enoughto push the price lower.

The material has been provided by InstaForex Company - www.instaforex.com

Download NOW!

Download NOW!

No comments:

Post a Comment