USD managed to gain impulsive momentum against NZD recently. The NZD/USD pair is trading inside the resistance area of 0.6900-50. Summarizing the policy update of the Reserve Bank of New Zealand, the board kept the official cash rate steady and expressed the dovish rhetoric. Following the policy statement, NZD lost ground. Despite worse-than-expected GDP report, USD managed to sustain the momentum over NZD.

Earlier in March, USD lost favor with investors due to Fed's cautious approach to monetary policy. Recently, several Fed's officials have made comments on interest rates. They share the common viewpoint that the US Federal Reserve is not going to raise interest rate this year and even by 2020. Moerover, analysts assume the scenario of even a rate cut next year. Last week the Fed kept the interest rate unchanged at 2.50%. Earlier in the year, the central bank considered at least 1 rate hikes, but the agenda was revised to no rate hikes in 2019. Such a soft change in Fed's tone took the shine off USD. The regulator explains the decision by a global economic slowdown and political uncertainties like BREXIT and the US - China trade war. On the whole, the Fed confirmed its intention to adopt a patient approach to monetary tightening in the long run.

According to Fed's policymakers, the US economy is still on a sound footing. The likelihood of recession in 2019 and 2020 is slim. The US economic growth is easing to more sustainable long-term levels. The US - China trade war is going to affect the US economy. Thus, investors pin hopes on a successful trade deal between the two largest global economies.

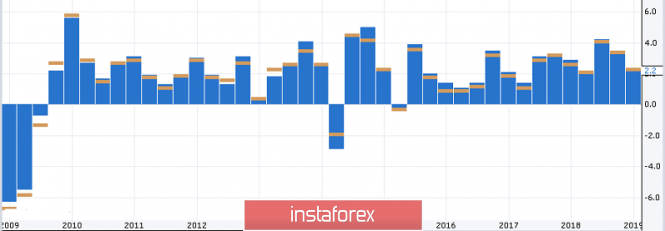

Yesterday the US Commerce Department posted revised GDP report. The US economy eased a pace of growth to 2.2% in Q4 2018 from 2.6% in the previous quarter, undershooting the forecast for a 2.4% increase. The downbeat figure undermined USD momentum over NZD but did not lead to any strong counter-move. Today US Personal Spending report is going to be published which is expected to increase to 0.3% from the previous value of -0.5% and Personal Income is also expected to increase to 0.3% from the previous value of -0.1%. Moreover, today FOMC member Quarles is going to speak about future monetary policy decision. His speech will hardly make an impact on USD gains.

Meanwhile, USD is expected to sustain momentum over NZD, though the pair is set to trade with corrections and volatility. Though NZD is the weaker currency in the pair, NZD could assert strength versus USD for a while.

The material has been provided by InstaForex Company - www.instaforex.com

Download NOW!

Download NOW!

No comments:

Post a Comment