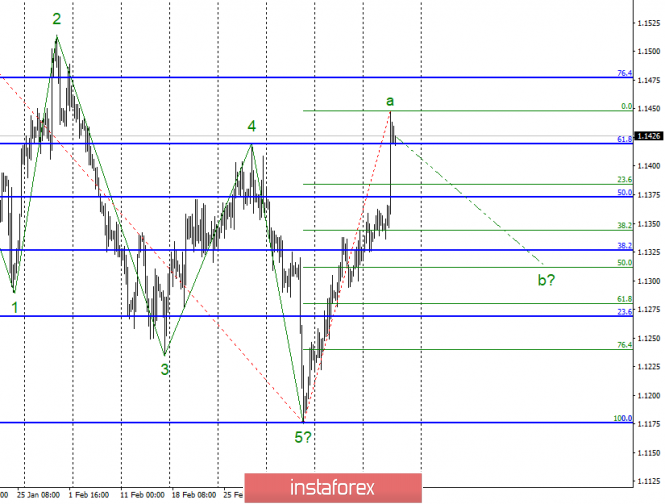

Wave counting analysis:

On Wednesday, March 20, trading ended for EUR / USD by 75 bp increase. The Fed, led by Jerome Powell, frankly disappointed the market with words about stopping the increase in the key rate. In addition, the GDP forecast for 2019 was reduced to 2.1% y / y, and for 2020 - to 1.9% y / y. Thus, wave a received a longer view, but is already ready for its completion. In this case, the pair will proceed to the construction of the wave and with targets located near the level of 50.0% on the Fibonacci grid constructed by the size of wave a. The wave may take a more extended form than it is now, but the more likely option is still the beginning of the construction of a corrective wave.

Sales targets:

1.1344 - 38.2% Fibonacci (small grid)

1.1311 - 50.0% Fibonacci (small grid)

Purchase goals:

1.1477 - 76.4% Fibonacci

General conclusions and trading recommendations:

The pair supposedly completed the construction of wave a or is close to completion. Now I recommend taking profits on purchases and preparing for short-term small sales with targets located around 1.1344 and 1.1311, which corresponds to 38.2% and 50.0% Fibonacci, based on building wave b.

The material has been provided by InstaForex Company - www.instaforex.com

Download NOW!

Download NOW!

No comments:

Post a Comment