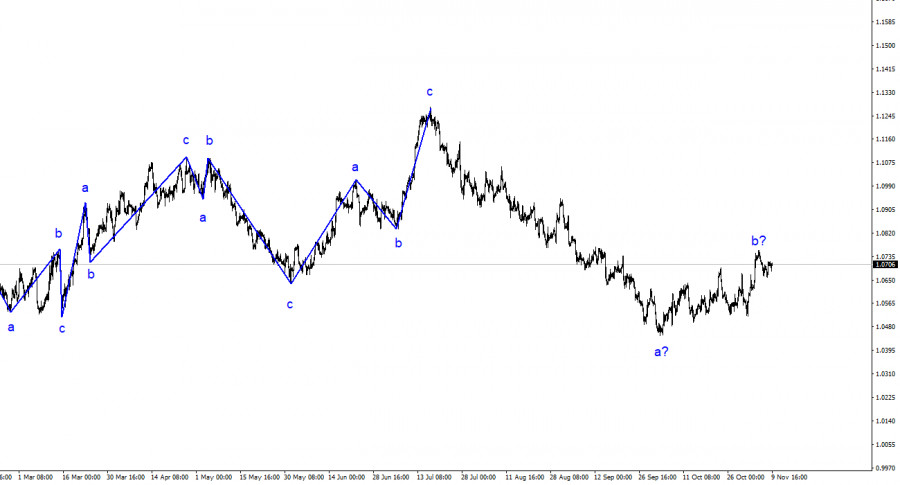

The wave analysis of the 4-hour chart for the euro/dollar pair remains quite clear. Over the past year, we have seen only three wave structures that constantly alternate with each other. Over the past months, I have regularly mentioned that I expect the pair to be near the 5th figure, from where the construction of the last upward three-wave structure began. This target was achieved after a two-month decline. After reaching this target, the construction of a corrective wave 2 or b began predictably, which has already taken on a clear five-wave and fully completed form. This means that a decline in the euro currency may resume this week.

Regardless of the outcome of wave 2 or b (it can be much more complicated), the overall decline in the European currency will not be completed, as in any case, the construction of the third wave of the downward trend requires. Inside the first wave, there are five internal waves, so it is complete. Inside the second wave, there are five waves, so it too may already be completed. I expect the construction of wave 3 or c.

Luis de Guindos shared interesting information.

The euro/dollar pair rate did not change on Thursday. In the first half of the day, there was a slight decrease in quotes; in the second - a slight increase. In general, the euro currency has neither become more expensive nor cheaper at the current moment, and the amplitude of movements is very weak. The wave analysis of the presumed wave 2 or b looks complete, but there is always a risk of even greater complication of the wave. So far, I do not see a rapid decline in the pair within wave 3 or c. Therefore, not everything is decided yet. The news background could help the markets in the current situation, but this week there are catastrophically few important events and reports. Since the beginning of this week, you cannot immediately remember what was interesting. Yesterday, Jerome Powell spoke, but not a word was said about rates or monetary policy. Yesterday there was a report on retail trade in the European Union, but its significance did not surprise either buyers or sellers. There were also several speeches by members of the ECB and Fed Governing Councils, but they did not provide the market with important information.

A bright example can be considered in today's speech by ECB Vice President Luis de Guindos. Instead of reporting whether another rate hike can be expected, he stated that a rate cut is not currently being considered. I understand that inflation in the EU has already dropped to 3%, but inflation in the US a few months ago also fell to 3% and then rose to 3.7%. Therefore, the ECB is still too early to celebrate victory. But de Guindos' rhetoric clearly did not contribute to an increase in demand for the euro.

General conclusions.

Based on the analysis conducted, I conclude that the construction of a downward set of waves continues. The targets around the level of 1.0463 were perfectly worked out, and the unsuccessful attempt to break through this level indicated a transition to the construction of a corrective wave. Wave 2 or b has taken on a completed form, so in the near future, I expect the construction of an impulsive downward wave 3 or c with a significant decrease in the pair. I still recommend sales with targets below the low of wave 1 or a. At first, be cautious, as wave 2 or b theoretically can take an even more extended form.

On a larger wave scale, the wave analysis of the ascending segment of the trend has taken on an extended form but is likely completed. We have seen five waves up, which are most likely the structure of a-b-c-d-e. Next, the pair built four three-wave structures: two down and two up. Now it has moved on to the stage of building another extended downward three-wave structure.

Download NOW!

Download NOW!

No comments:

Post a Comment