The unexpected rise in Germany's industrial orders by 0.2% MoM in September provided a new impetus for the "bullish" attacks on EUR/USD. The indicator has been increasing for the second consecutive month, reducing concerns about the future of the German economy. In the third quarter, it contracted by 0.1%, but the situation may improve in the fourth quarter, which is good news for the euro.

At the heart of the July–September peak in EUR/USD were divergences in economic growth and monetary policy. The first factor gave rise to the idea of American exceptionalism. The United States seemed to investors as the cleanest shirt in the basket of dirty laundry, and its GDP managed to grow by 4.9% in the third quarter. In contrast, the eurozone balanced between stagflation and recession. This made the markets think the ECB had finished tightening its monetary policy.

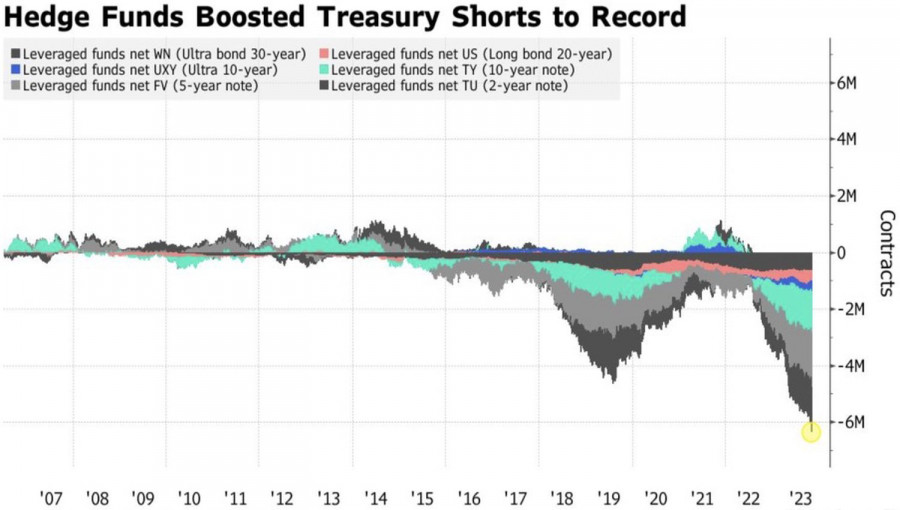

The Fed, on the other hand, actively supported the idea of resuming the cycle of monetary restriction. Hawkish rhetoric, coupled with the Treasury's intention to increase bond issuance volumes in July–September, formed the basis for the rally in U.S. debt yields. By the end of the week, hedge funds had increased their net shorts on these securities to record levels.

Dynamics of Hedge Fund Positions on U.S. Bonds

The situation had reached its boiling point. Speculators needed only one event to be gripped by fear, prompting them to unwind their short positions. In reality, there were three such events: the Treasury pointed to a smaller bond issuance volume, the Fed began to ponder whether it should continue raising rates, and the U.S. employment data for October was disappointing. As a result, Treasury bond yields plummeted, stock indices soared, and EUR/USD surged to the 1.08 level.

What's next? Narrowing divergences in economic growth between the U.S. and the eurozone and in monetary policy between the Fed and the ECB will support the continuation of the euro rally against the dollar. Indeed, the markets are confident that the Federal Reserve and the European Central Bank have completed their cycles of monetary policy tightening. The strong data on German industrial orders inspire hope that the currency bloc will avoid a technical recession in 2023. In contrast, U.S. GDP risks slowing down from 4.9% to 0.9%.

The primary risk for the EUR/USD buying strategy is the escalation of geopolitical conflict in the Middle East involving Iran and other states. According to World Bank forecasts, under such a scenario, oil prices will rise above $150 per barrel, and Europe will face an energy crisis again. Since the beginning of the year, natural gas has become 40% cheaper, but technical maintenance in Norway, strikes in Australia, and the war in Israel have led to an increase in its cost.

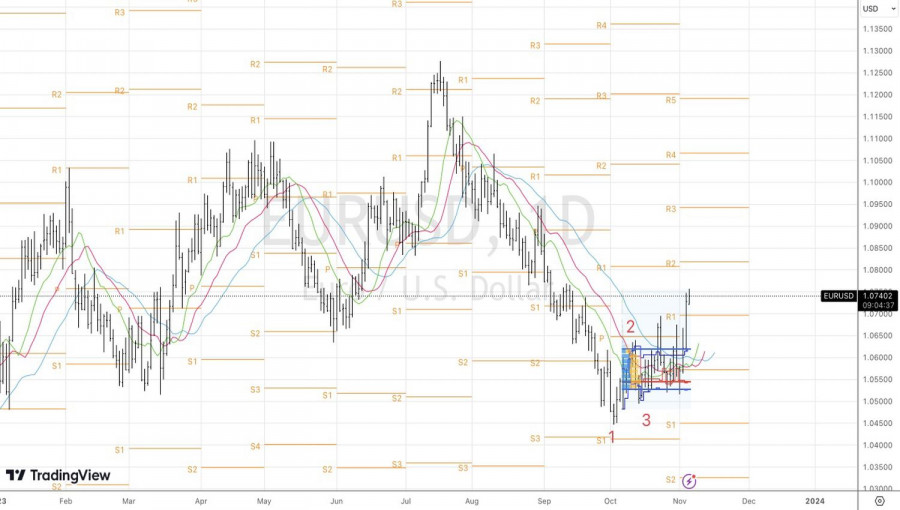

Technically, the pullback of EUR/USD initiated with the help of the 1-2-3 pattern is gaining momentum. Bulls hesitated for a while, but even a decline in quotes to the support at 1.07–1.0715 will bring new buyers into the market and allow us to increase our previously formed long positions with targets at 1.08 and 1.09.

Download NOW!

Download NOW!

No comments:

Post a Comment