The most significant events of the current year have been the speeches of several members of the European Central Bank Governing Council last week. It's worth noting that both the British pound and the euro continue to enjoy relatively high demand, which must be supported by something. I certainly acknowledge that the market may have deferred making the most important decisions until next year. A sharp change in the direction of trade is indeed a crucial decision. Wave markings for both instruments have been suggesting the end of an upward wave for several weeks, but something has been holding the market back from reducing demand for the euro and the pound.

Returning to the ECB officials' speeches, Vice President Luis de Guindos said last week that it is not yet time to start easing monetary policy. He mentioned that the European economy will avoid a recession next year, and the interest rate is likely to start decreasing in the second half of the year.

President of the Bundesbank Joachim Nagel said days later that the market is expecting the ECB to ease its policy too quickly, but the central bank will need some time "to overcome the plateau." In other words, the ECB adheres to the idea that inflation may accelerate a bit more, so interest rates should be kept at their peak for a few more meetings.

Bank of Slovenia President Bostjan Vasle also reported that the market is too hasty in its expectations of an ECB rate cut. At present, the ECB Governing Council is considering the possibility of easing in two or three rounds, i.e., by 50-75 basis points. Some market participants, according to Vasle, expect interest rates to return almost to the levels of two years ago. Vasle also mentioned that inflation is expected to have a tendency to rise in the first half of next year, although no one expects a strong acceleration. However, if there is no slowdown, the ECB will maintain the current interest rate level.

I want to emphasize separately that the probability of the first Fed rate cut in March is currently around 80%. In other words, the market believes that the FOMC will be the first to start easing, which puts additional pressure on the US dollar. However, as soon as information about a later start of the easing procedure comes in, the market can quickly reverse, and that's what I expect.

Based on the analysis, I conclude that a bearish wave pattern is still being formed. The pair has reached the targets around the 1.0463 mark, and the fact that the pair has yet to surpass this level indicates that the market is ready to build a corrective wave. Wave 2 or b has taken on a completed form, so in the near future, I expect an impulsive descending wave 3 or c to form with a significant decline in the instrument. I still expect the pair to fall with targets below the low of wave 1 or a. An unsuccessful attempt to break the 38.2% level may indicate that the market is prepared to sell.

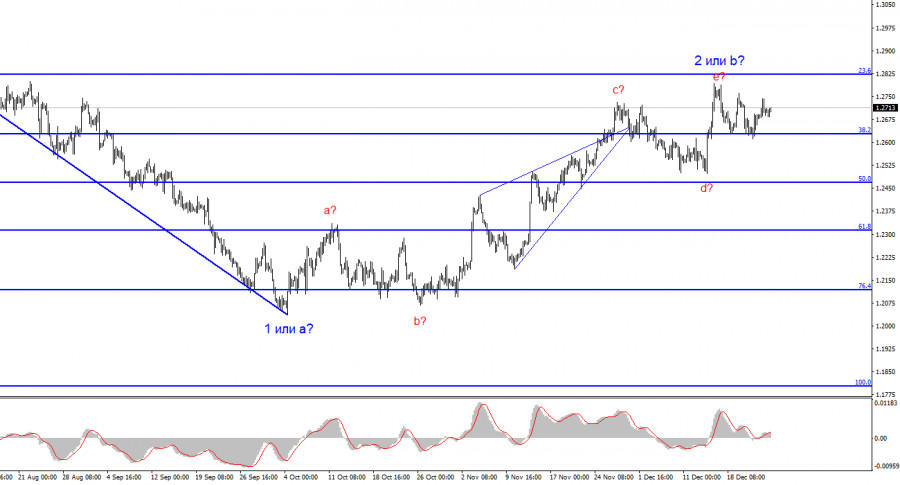

The wave pattern for the GBP/USD pair suggests a decline within the descending wave 3 or c. At this time, I can recommend selling the instrument with targets below the 1.2039 mark because wave 2 or b should end at some point, and it could do so at any moment. The longer it takes, the stronger the fall. The peak of the assumed wave e in 2 or b can be used for short positions, and an order limiting potential losses on transactions can be placed above it.

Download NOW!

Download NOW!

No comments:

Post a Comment