Over the past few days, crypto investors have been at the peak of their emotions due to the approaching date for the approval of spot BTC-ETFs, which are expected to change the balance of power in the financial markets once and for all. The anticipation process is accompanied by high trading activity, leading to increasing volatility levels. In such a situation, the market becomes particularly vulnerable to misinformation and fake news, as confirmed by the trading day's results on January 9th.

Bitcoin quotes made a powerful price impulse in both directions against the backdrop of fake news about the approval of BTC-ETF. As a result, the price tested the $47k level, then subsequently dropped to $45k, triggering significant volumes of liquidated positions. Bitcoin starts the new trading day near the $46k level, but what should investors expect after yesterday's excess?

Did the SEC Approve BTC-ETF?

This was the impression on the evening of January 9th, when a post on the official SEC Twitter account stated that the regulator approved spot BTC-ETFs. Against this backdrop, Bitcoin made a powerful upward spike to $47k, but subsequently began to decline to $45k. Concurrently, the head of the SEC, Gary Gensler, tweeted that the regulator's account had been hacked, and the statement about the launch of BTC-ETFs was not true.

A similar situation was observed at the end of October when an identical news piece triggered the start of a prolonged Bitcoin price rally. Despite the news being fake, investors continued to accumulate BTC volumes, so there is every reason to believe that the situation will repeat itself this time. Meanwhile, investors are expecting the approval of BTC-ETF applications on January 10th. Steven McClurg, co-founder and Chief Investment Officer of Valkyrie Investments, believes that the SEC will approve several applications on January 10th, and the products will start trading on exchanges on January 11th.

Is Bitcoin Overheated?

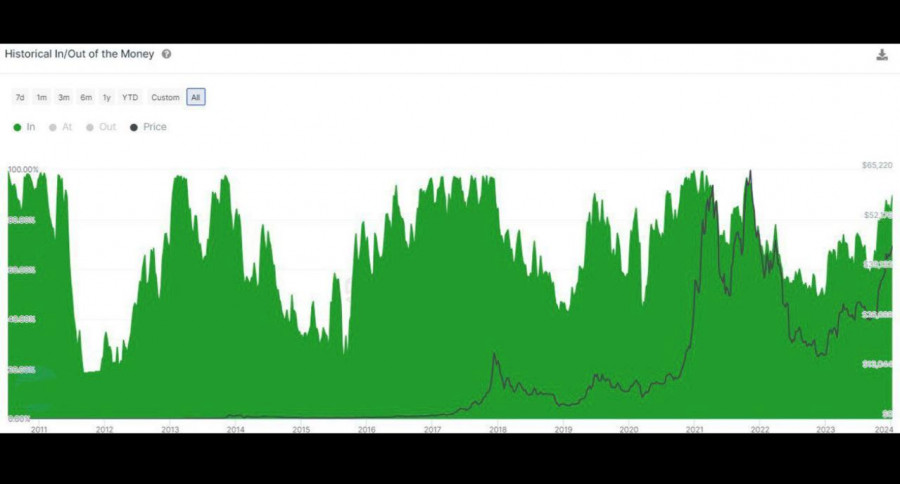

The high level of bullish sentiment, triggered by the powerful growth of BTC/USD quotes, potential approval of BTC-ETFs, and the approaching halving, creates conditions for Bitcoin overheating. Despite local pauses in the BTC price rally, as well as local crashes, the cryptocurrency remains in deficit. The percentage of free Bitcoin supply on exchanges has fallen below the 3% mark.

Additionally, more than 90% of all BTC holders are in profit when the cryptocurrency price reaches the $46k mark. As of January 10th, Bitcoin is trading near the $46k level. In the short term, such a high percentage of unrealized profit may lead to a local downturn, triggered by the "overheating" of the BTC market. This scenario fits perfectly with the approval of BTC-ETFs, which could bring the percentage of profitable BTC to 95%.

BTC/USD Analysis

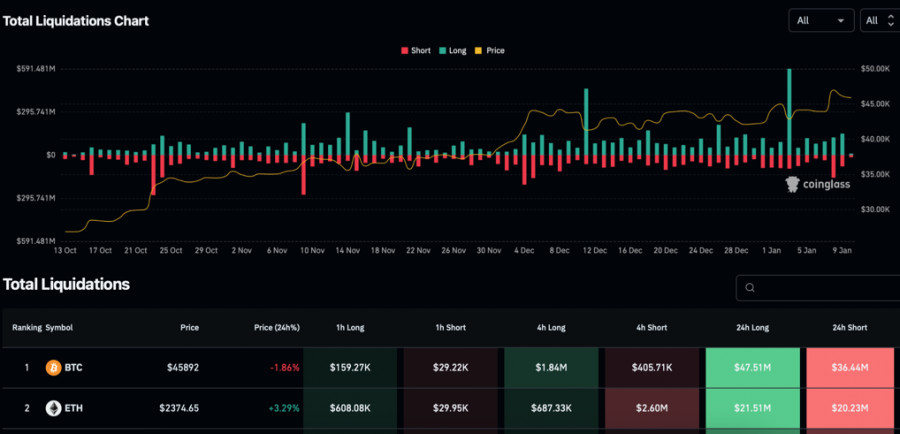

Following yesterday's trading day in the Bitcoin market, a major manipulation occurred, resulting in the liquidation of long and short positions totaling over $250 million. As of January 10th, the asset is trading near $46k with daily trading volumes around $38 billion. High volatility is also noted, making BTC trading dangerous and the likelihood of price movements in both directions more probable.

At this point in time, trading BTC/USD using technical analysis is extremely risky, as the market is still reacting to news, even fake ones. Proper construction of key levels and astute placement of pending orders are more effective tools for trading. Given the approaching positive decision from the SEC, a retest of the $47k level is expected, but subsequently, the asset will go into a correction below $45k.

Conclusion

Bitcoin is approaching the end of its current bullish phase, where the approval of the spot BTC-ETF will be the moment of truth. In the long term, this will bring billions of dollars of investment to the cryptocurrency market, but in the short term, it will be the final chord in the BTC/USD's upward movement. A significant period of consolidation and redistribution of BTC volumes is approaching before the next attempt to update the local price high.

Download NOW!

Download NOW!

No comments:

Post a Comment