The issue of the state of the U.S. economy is the most contentious one at the moment. Some traders and analysts either do not believe this or simply refuse to see the objective reality. Let me briefly explain what I mean. The U.S. economy has shown excellent growth rates in recent quarters. These growth rates would have been considered "excellent" even if interest rates were kept at levels from two to three years ago when monetary policy was very "soft," and the Federal Reserve was concerned about inflationary pressures rather than its decline. However, the interest rate is currently at its peak, and the U.S. economy is growing at a rate of 5% in the third quarter.

So where is the contradiction? The contradiction lies in how the market perceives the data on U.S. GDP. I have the feeling that the market does not see "+5%" but "-5%." Talks of a recession that is "about to hit the American economy" have been going on for over a year. And the U.S. economy is not just growing every quarter, it is also accelerating. It turns out that the market is waiting for a recession, waiting for a slowdown in growth, but this is not happening. That's why I have repeatedly mentioned the peculiarity of the dollar's decline.

Now, U.S. Treasury Secretary Janet Yellen said that the market is overly pessimistic about the economy. In her opinion, this pessimism is completely unfounded. Yellen expects a "soft landing" for the economy, and at this point, it is obvious to me that she is right. Certainly, in the next few quarters, we are unlikely to see a figure of +5%, but even growth of just 1% would be an excellent result. I would like to remind you that the European and British economies have not shown any growth for over a year now.

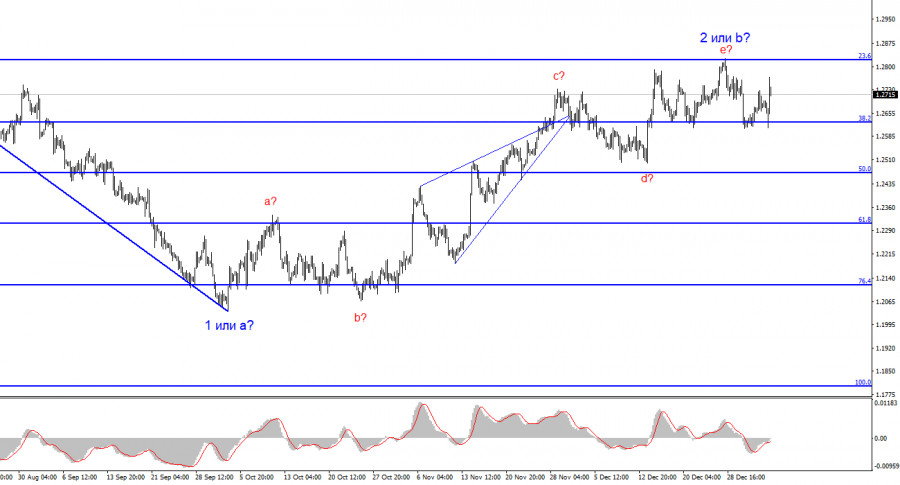

Considering the fact that the Bank of England may lower interest rates in 2024 the same number of times as the Fed, and the UK economy is much weaker than the American one, I still see no reason to continue building an upward corrective wave 2 or b. As for the European Central Bank, there is currently not much information available about future interest rates, but the ECB's interest rate is 1% lower than the Fed's rate. It would be logical if the ECB starts easing policy last.

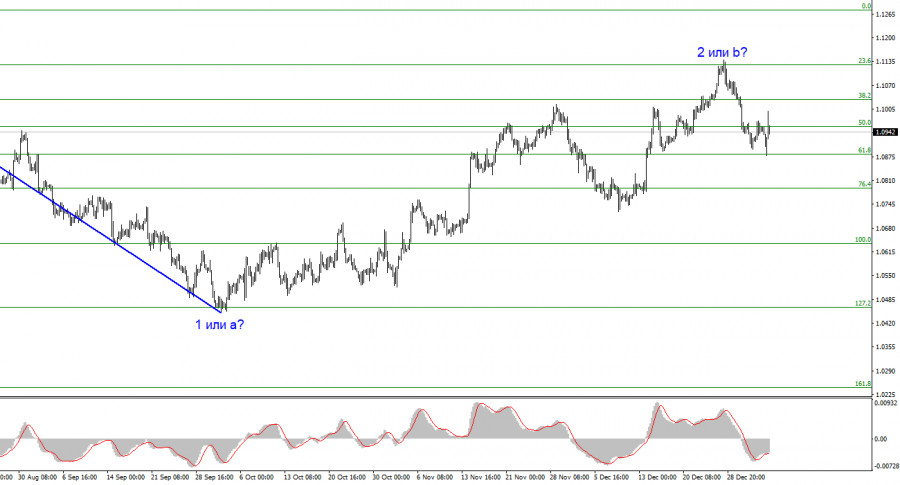

Based on the analysis, I conclude that a bearish wave pattern is being formed. The pair has reached the targets around the 1.0463 mark, and the fact that the pair has yet to surpass this level indicates that the market is ready to build a corrective wave. Wave 2 or b has taken on a completed form, so in the near future, I expect an impulsive descending wave 3 or c to form with a significant decline in the instrument. An unsuccessful attempt to break the 1.1125 level, which corresponds to 23.6% Fibonacci, indicates the market is prepared to sell.

The wave pattern for the GBP/USD pair suggests a decline. At this time, I can recommend selling the instrument with targets below the 1.2039 mark because wave 2 or b will eventually end, and it could do so at any moment. In fact, we are already seeing some signs of it ending. However, I wouldn't rush to conclusions and short positions. I would wait for a successful attempt to break the 1.2627 level, afterwards it will be much easier to expect the pair to fall further.

Download NOW!

Download NOW!

No comments:

Post a Comment