The US dollar continues to face unfavorable sentiment in the market. Despite the dollar asserting its strength against the euro in the past weeks, the market still holds a more positive view towards the euro, not to mention the British pound. Despite the fact that both instruments should have started building the expected wave 3 or C, the market continues to hover around without a clear direction.

Lately, many analysts have started to doubt whether the FOMC will begin easing its monetary policy in March or May. There are several reasons against it. For instance, inflation in the US remains above 3%, and after the December report, it might even rise further. If inflation is rising in the US, how can the FOMC justify lowering interest rates? This is the first inconsistency.

The second inconsistency lies in the strength of the American economy. Recall that in the third quarter, it grew by almost 5%. Recent reports on unemployment and the labor market have been strong, despite market biases. So, everything is fine with the American economy, there is no threat of recession, inflation is significantly higher than the target, and yet the market believes that the FOMC will be the first to start easing?

In my opinion, the Federal Reserve has the ability to keep its interest rate at a peak level longer than the Bank of England and the European Central Bank. Despite Vujcic's statements from the ECB on Monday that there is no risk of a European economic recession, I believe that the European economy is actually more at risk than the American one. If the ECB is not inclined to lower rates before the summer, then the Fed certainly has no reason to do so.

Analyst Antje Praefcke also believes that the labor market in the US remains strong. He notes that the first rate cut may happen much later than the market currently believes. However, in his opinion, the market is not ready to change its expectations regarding future actions of the Fed, which is a big problem for the dollar, as it cannot rise if there is no demand in the market.

Praefcke believes that the market reacts more to news that confirms its expectations of an imminent policy easing in the US, so the dollar will have a hard time in the near future. However, I would like to add that when the market realizes the fallacy of its beliefs, there could be a sharp increase in demand for the US currency.

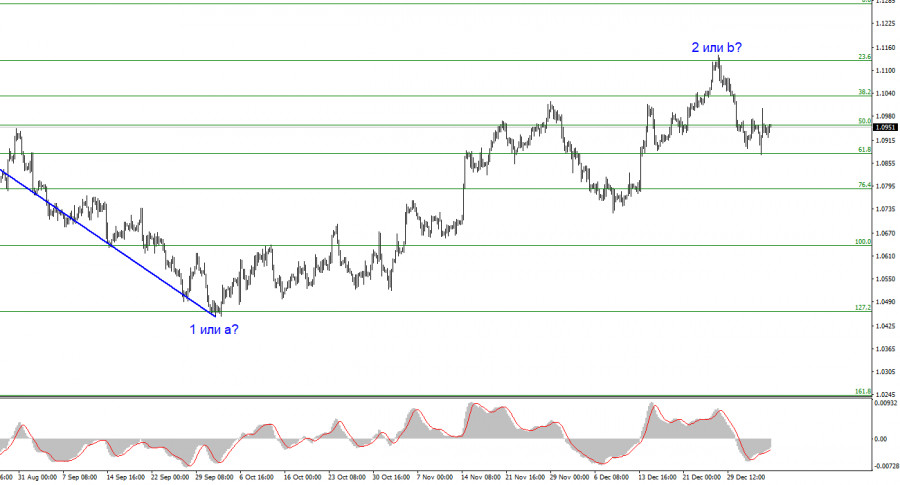

Based on the analysis, I conclude that a bearish wave pattern is being formed. The pair has reached the targets around the 1.0463 mark, and the fact that the pair has yet to surpass this level indicates that the market is ready to build a corrective wave. Wave 2 or b has taken on a completed form, so in the near future, I expect an impulsive descending wave 3 or c to form with a significant decline in the instrument. An unsuccessful attempt to break the 1.1125 level, which corresponds to 23.6% Fibonacci, indicates the market is prepared to sell.

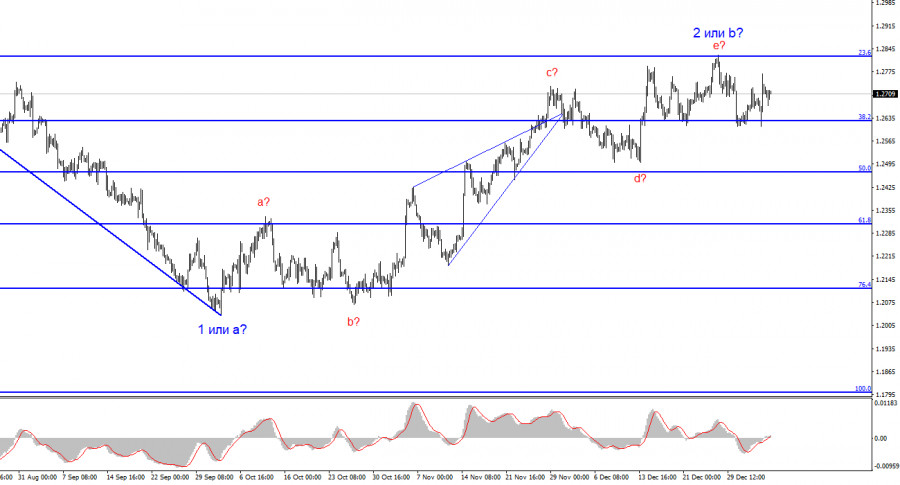

The wave pattern for the GBP/USD pair suggests a decline. At this time, I can recommend selling the instrument with targets below the 1.2039 mark because wave 2 or b will eventually end, and it could do so at any moment. In fact, we are already seeing some signs of it coming to an end. However, I wouldn't rush to conclusions and short positions. I would wait for a successful attempt to break the 1.2472 level, afterwards it will be much easier to expect the pair to fall further.

Download NOW!

Download NOW!

No comments:

Post a Comment