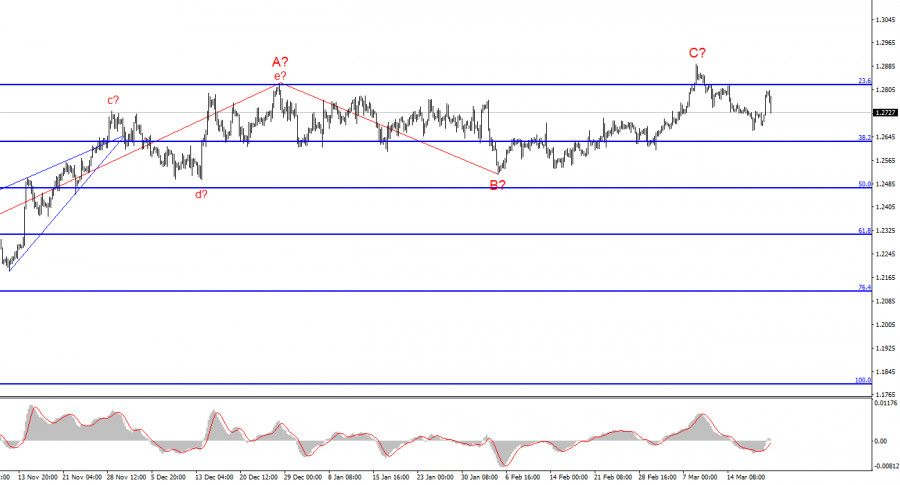

The wave analysis for the GBP/USD pair remains quite clear and, at the same time, remains complex. The construction of a new downtrend segment continues, the first wave of which took on a quite elongated form. The second wave also turned out to be quite elongated, giving us every reason to expect the prolonged construction of the third wave.

At the moment, the construction of wave 2 or b is complete. Wave 2 or b took on a three-wave form, but its internal wave structure is very complex. Theoretically, wave 2 or b can extend up to 100% of wave 1 or a. An unsuccessful attempt to break through the level of 1.2876, which corresponds to 76.4% Fibonacci, may indicate the long-awaited completion of the upward wave.

The targets for the decrease of the pair within the assumed wave 3 or c are located below the level of 1.2039, which corresponds to the low of wave 1 or a. Unfortunately, wave analysis tends to become more complex and does not correspond to the news background. At the moment, I do not abandon the working scenario, but the market does not see reasons for long-term sales of the pair yet.

The GBP/USD pair rate decreased by 130 basis points on Thursday and continued to decline on Friday. Only with the opening of the European trading session did the British pound quotes begin to recover. Today, there was only one event that could support demand for the pound sterling. In the morning, the retail trade report was released in the UK. Trading volumes for February turned out to be better than market expectations, although, in reality, they increased by 0%. The increase in trading volumes in January was revised from 3.4% to 3.6%. Therefore, this report can be considered positive for the pound. Besides fuel sales, sales increased by 0.2% against negative forecasts, and the January value was revised to +3.4%. During the European session, market participants did not pay any attention to this report, and the pound continued to decline. However, American market participants did not miss it, so in the first hours of this session, demand for the pound slightly increased.

However, demand for the pound will continue to decline. The current week has shown that the Bank of England is not as far from the first policy easing as the market thinks, and the Fed is not as close to the first rate cut. Based on this, expectations for the Fed's rate are underestimated and for the Bank of England's rate are overestimated. This fact should convince the market to increase demand for the US currency. Wave analysis still points down. The news background very rarely favors the pound.

General conclusions

The wave pattern of the GBP/USD pair still suggests a decrease. At the moment, I still consider selling the pair with targets located below the level of 1.2039, as wave 3 or c will start sooner or later. However, as long as wave 2 or b is not completed with one hundred percent probability, an increase in the pair can be expected up to the level of 1.3140, which corresponds to 100.0% Fibonacci. The construction of wave 3 or c may have already begun, but the retreat of quotes from the peaks reached still needs to be bigger to be confident in this conclusion.

On a larger wave scale, the picture is similar to the EUR/USD pair, but there are still some differences. The descending correctional segment of the trend continues its construction, and its second wave has acquired an elongated form - up to 61.8% of the first wave. An unsuccessful attempt to break through this level may lead to the start of the construction of wave 3 or c.

The main principles of my analysis:

* Wave structures should be simple and understandable. Complex structures are difficult to play out; they often bring changes.

* If there is confidence in what is happening in the market, it is better to avoid entering it.

* There is no one hundred percent certainty in the direction of movement and there never can be. Remember about Stop Loss protective orders.

* Wave analysis can be combined with other types of analysis and trading strategies.

Pentru mai multe detalii, va invitam sa vizitati stirea originala.

At the moment, the construction of wave 2 or b is complete. Wave 2 or b took on a three-wave form, but its internal wave structure is very complex. Theoretically, wave 2 or b can extend up to 100% of wave 1 or a. An unsuccessful attempt to break through the level of 1.2876, which corresponds to 76.4% Fibonacci, may indicate the long-awaited completion of the upward wave.

The targets for the decrease of the pair within the assumed wave 3 or c are located below the level of 1.2039, which corresponds to the low of wave 1 or a. Unfortunately, wave analysis tends to become more complex and does not correspond to the news background. At the moment, I do not abandon the working scenario, but the market does not see reasons for long-term sales of the pair yet.

The GBP/USD pair rate decreased by 130 basis points on Thursday and continued to decline on Friday. Only with the opening of the European trading session did the British pound quotes begin to recover. Today, there was only one event that could support demand for the pound sterling. In the morning, the retail trade report was released in the UK. Trading volumes for February turned out to be better than market expectations, although, in reality, they increased by 0%. The increase in trading volumes in January was revised from 3.4% to 3.6%. Therefore, this report can be considered positive for the pound. Besides fuel sales, sales increased by 0.2% against negative forecasts, and the January value was revised to +3.4%. During the European session, market participants did not pay any attention to this report, and the pound continued to decline. However, American market participants did not miss it, so in the first hours of this session, demand for the pound slightly increased.

However, demand for the pound will continue to decline. The current week has shown that the Bank of England is not as far from the first policy easing as the market thinks, and the Fed is not as close to the first rate cut. Based on this, expectations for the Fed's rate are underestimated and for the Bank of England's rate are overestimated. This fact should convince the market to increase demand for the US currency. Wave analysis still points down. The news background very rarely favors the pound.

General conclusions

The wave pattern of the GBP/USD pair still suggests a decrease. At the moment, I still consider selling the pair with targets located below the level of 1.2039, as wave 3 or c will start sooner or later. However, as long as wave 2 or b is not completed with one hundred percent probability, an increase in the pair can be expected up to the level of 1.3140, which corresponds to 100.0% Fibonacci. The construction of wave 3 or c may have already begun, but the retreat of quotes from the peaks reached still needs to be bigger to be confident in this conclusion.

On a larger wave scale, the picture is similar to the EUR/USD pair, but there are still some differences. The descending correctional segment of the trend continues its construction, and its second wave has acquired an elongated form - up to 61.8% of the first wave. An unsuccessful attempt to break through this level may lead to the start of the construction of wave 3 or c.

The main principles of my analysis:

* Wave structures should be simple and understandable. Complex structures are difficult to play out; they often bring changes.

* If there is confidence in what is happening in the market, it is better to avoid entering it.

* There is no one hundred percent certainty in the direction of movement and there never can be. Remember about Stop Loss protective orders.

* Wave analysis can be combined with other types of analysis and trading strategies.

Pentru mai multe detalii, va invitam sa vizitati stirea originala.

Download NOW!

Download NOW!

No comments:

Post a Comment