I have repeatedly said that market opinion on the Federal Reserve's rates continues to change. This has been ongoing for several months, and there seems to be no end in sight to this process. For me, there is nothing strange about this, as the Fed continues to base its monetary policy decisions on inflation indicators. If inflation does not decrease, then it cannot show a firm dovish stance. It is evident to me that until inflation starts slowing down again, the Fed will not start easing policy.

However, most market participants seem to be hardened optimists and continue to expect the Fed to move to lower rates as soon as possible. I personally find it hard to say what their forecasts are based on. Following the February data, the Consumer Price Index accelerated, so it simply doesn't make sense to expect dovish rhetoric from FOMC members in the coming weeks. On the other hand, any hawkish rhetoric represents a potential opportunity for the US dollar to strengthen in the market.

Federal Reserve Bank of Atlanta President Raphael Bostic said the economy has proved more resilient than anticipated. He said he now expects just a single quarter-point interest rate cut this year. So smoothly and imperceptibly, one of the most influential policy makers within the Fed is now talking about just one round of easing instead of the 5-6 that the market had hoped for earlier in the year. But this is the objective reality that I have been talking about for several months.

Bostic also stated that the unemployment rate is unlikely to change significantly from its current level of 3.9%, and inflation is slowing down much more slowly than the Fed expected. Based on this, the market may start to increase demand for the dollar in the near future. It matters not only when the Fed will start cutting rates but also how many times it will do so over a certain period. Fed Chair Jerome Powell already said last week that the Fed now expects fewer rounds of easing in 2025, and inflation forecasts have been revised upwards. All of this tells us one thing - the market still expects too much from the FOMC.

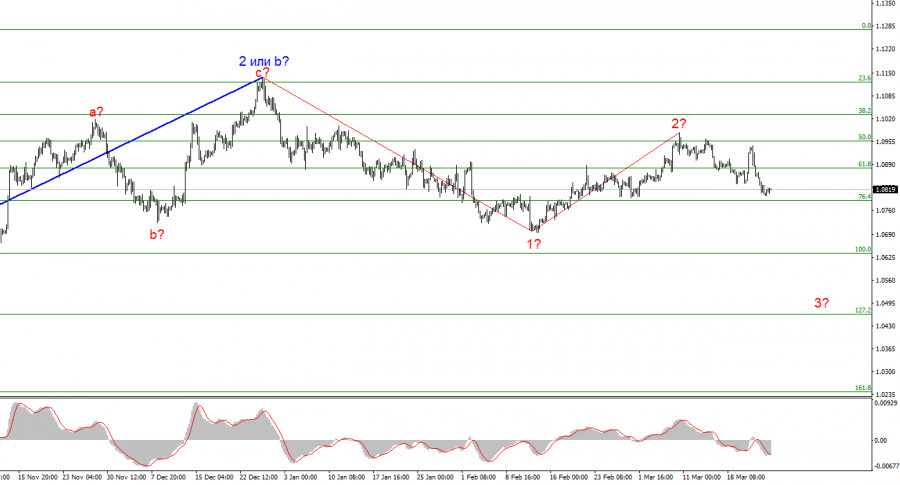

Wave analysis for EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that a bearish wave set is being formed. Wave 2 or b is complete, so in the near future, I expect an impulsive downward wave 3 or c to form with a significant decline in the instrument. An internal corrective wave is currently being formed, which could have already ended. I am considering short positions with targets near the 1.0462 mark, which corresponds to 127.2% according to Fibonacci.

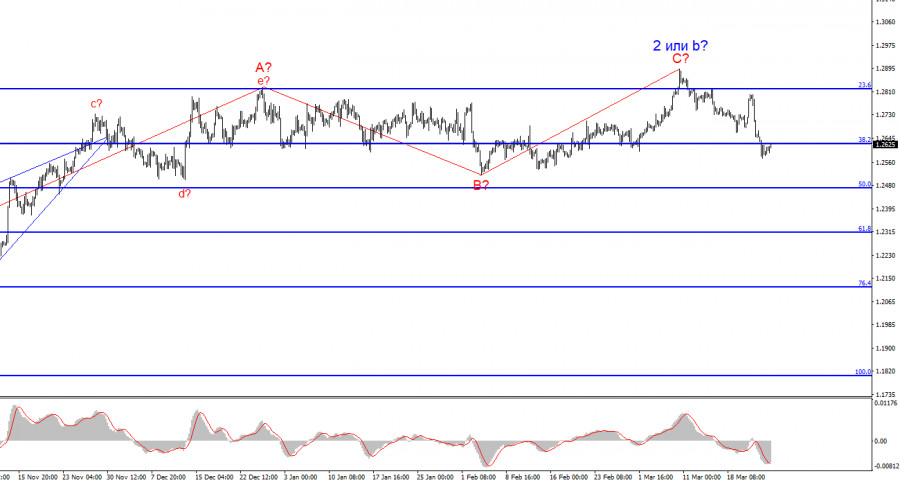

Wave analysis for GBP/USD:

The wave pattern of the GBP/USD instrument suggests a decline. I am considering selling the instrument with targets below the 1.2039 level, because I believe that wave 3 or c will start sooner or later. However, unless wave 2 or b ends, the instrument can still rise to the level of 1.3140, which corresponds to 100.0% Fibonacci. The construction of wave 3 or c may have already started, but the quotes haven't moved far away from the peaks, so we cannot confirm this.

Key principles of my analysis:

Wave structures should be simple and understandable. Complex structures are difficult to work with, and they often bring changes.

If you are not confident about the market's movement, it would be better not to enter it.

We cannot guarantee the direction of movement. Don't forget about Stop Loss orders.

Wave analysis can be combined with other types of analysis and trading strategies.

The material has been provided by InstaForex Company - www.instaforex.com #

Download NOW!

Download NOW!

No comments:

Post a Comment