The US ISM Manufacturing PMI increased to 50.3 in March, a reading that was well above expectations, as economic activity picked up after 16 months of contraction. Positive trends emerged in indicators such as growth in new orders and production output, while the prices paid sub-index rose 3.3 pp to 55.8, and wages rose to their highest level since mid-2022, supporting overall inflationary pressures.

Stronger-than-expected ISM data led to a sharp increase in Treasury bond yields, supporting the dollar. The likelihood of accelerated US economic growth has increased, but in any case, we should wait for the report on the service sector.

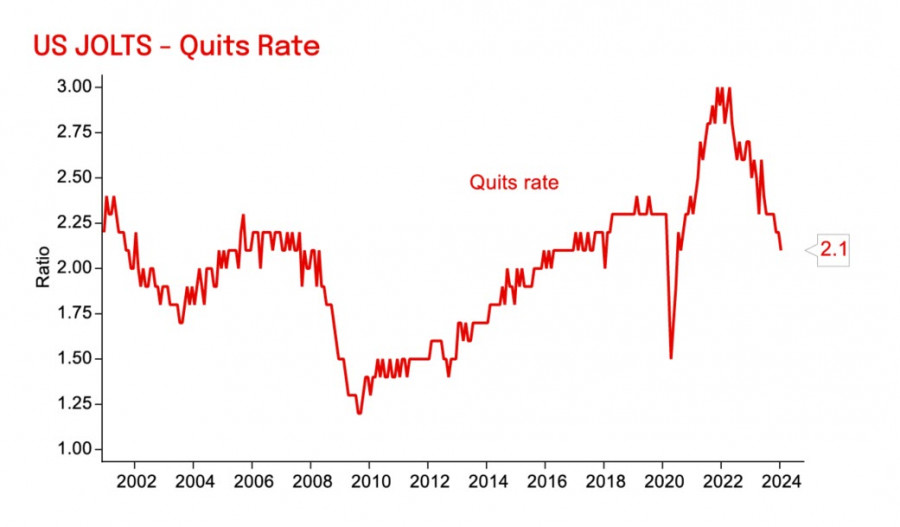

On Tuesday, the US was set to release the JOLT Job Openings report for February. With increased labor force availability, there is a possibility of a downward trend in job vacancies in the coming months, which would further support the case for the first Federal Reserve rate cut.

Europe did not release any significant reports as banks were closed on Friday and Monday. However, several European Central Bank officials spoke about rate prospects. Cipollone said that rate cuts could start as early as possible if inflation and wage data align with ECB expectations for easing price pressures. Villeroy said that the ECB may cut rates regardless of the Federal Reserve, a view supported by Holzmann, noting that the European economy was growing more slowly than its U.S. counterpart (which requires softer financial conditions, i.e., rate cuts). Stournaras said a total of four interest rate cuts is feasible in 2024.

As we can see, there is no consensus within the ECB. On Wednesday, the inflation report for March will be published, the PMI data on Thursday, and the retail sales report for February on Friday. While these reports will have some impact on the euro's prospects, the U.S. employment report will likely have a much stronger effect. Markets are unlikely to see significant movements until Friday.

The net long EUR position decreased by 2.343 billion during the reporting week, the largest weekly change among all major currencies. The total surplus has shrunk to 4.223 billion, the bullish bias remains intact, but is fading fast, and the price has dropped below the long-term average.

The EUR/USD pair is near the February low of 1.0695, indicating that this support will likely be tested in the short term. There is a high probability of further downward movement, and after a breakthrough, the target will shift to the area of the next support at 1.0530/50.Pentru mai multe detalii, va invitam sa vizitati stirea originala.

Stronger-than-expected ISM data led to a sharp increase in Treasury bond yields, supporting the dollar. The likelihood of accelerated US economic growth has increased, but in any case, we should wait for the report on the service sector.

On Tuesday, the US was set to release the JOLT Job Openings report for February. With increased labor force availability, there is a possibility of a downward trend in job vacancies in the coming months, which would further support the case for the first Federal Reserve rate cut.

Europe did not release any significant reports as banks were closed on Friday and Monday. However, several European Central Bank officials spoke about rate prospects. Cipollone said that rate cuts could start as early as possible if inflation and wage data align with ECB expectations for easing price pressures. Villeroy said that the ECB may cut rates regardless of the Federal Reserve, a view supported by Holzmann, noting that the European economy was growing more slowly than its U.S. counterpart (which requires softer financial conditions, i.e., rate cuts). Stournaras said a total of four interest rate cuts is feasible in 2024.

As we can see, there is no consensus within the ECB. On Wednesday, the inflation report for March will be published, the PMI data on Thursday, and the retail sales report for February on Friday. While these reports will have some impact on the euro's prospects, the U.S. employment report will likely have a much stronger effect. Markets are unlikely to see significant movements until Friday.

The net long EUR position decreased by 2.343 billion during the reporting week, the largest weekly change among all major currencies. The total surplus has shrunk to 4.223 billion, the bullish bias remains intact, but is fading fast, and the price has dropped below the long-term average.

The EUR/USD pair is near the February low of 1.0695, indicating that this support will likely be tested in the short term. There is a high probability of further downward movement, and after a breakthrough, the target will shift to the area of the next support at 1.0530/50.Pentru mai multe detalii, va invitam sa vizitati stirea originala.

Download NOW!

Download NOW!

No comments:

Post a Comment