The situation is a mixed bag, and even the U.S. doesn't call the shots. Europe has brought good news for two consecutive days. First, Eurozone business activity rose to a 11-month high, then the IFO German Business Climate Index continued to brighten. However, even positive news cannot stir up EUR/USD when the European Central Bank is set on easing monetary policy. Only weak U.S. data are helping the pair rise.

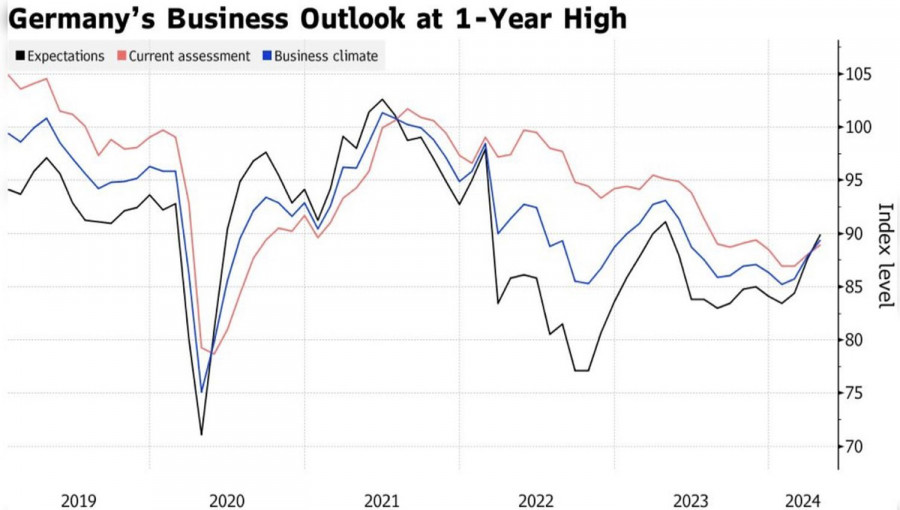

The German economy is gradually recovering. This is evidenced by the rise in purchasing managers' indices and improvement in business climate in April to its highest level in the past year. The Bundesbank no longer believes that GDP will shrink in the first quarter, which would have led the country into recession. According to ECB President Christine Lagarde, the German economy has turned around, and Chancellor Olaf Scholz expressed optimism, citing a strong labor market and a slowdown in inflation.

Dynamics of the German business climate

Once the main driver of the European economy, Germany suffered serious blows due to the armed conflict in Ukraine and the energy crisis. Fortunately, it has managed to recover from the impact. This provides support to the EUR/USD bulls, but they are wary of upcoming releases of U.S. data on GDP and inflation.

The U.S. economy remains strong, as evidenced by the faster-than-expected 2.6% m/m growth in durable goods orders in March, according to Bloomberg experts. Yes, an unpleasant surprise from business activity tarnished the reputation, but based on a single report, there is no sense in making strategic decisions to change the current trend.

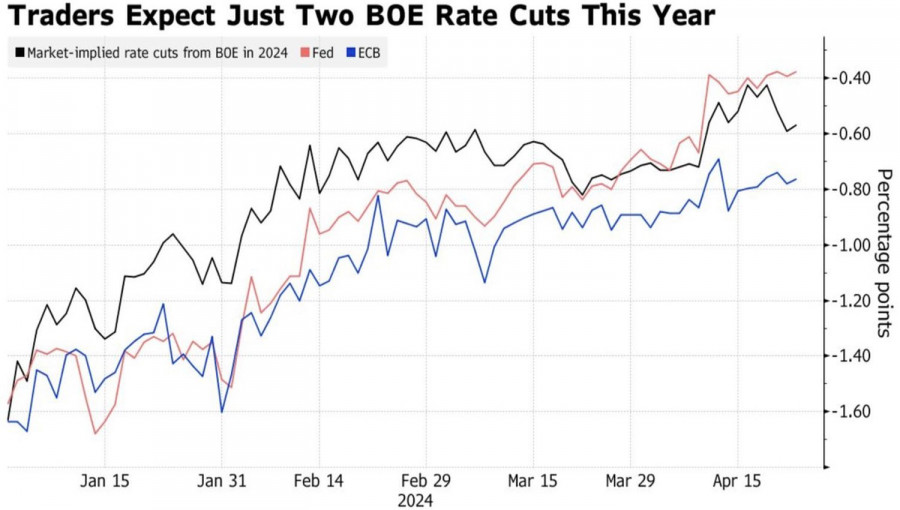

The market still expects the Federal Reserve to cut the federal funds rates by only 40 bps, which is half as much as the projected scale of the European Central Bank's monetary easing. Moreover, the ECB starts earlier than the Fed, in June. This exerts pressure on the bulls, no matter how strong data they receive from Germany.

Expectations dynamics on central bank rates

Undoubtedly, if the U.S. GDP for the first quarter falls short of the consensus estimate of 2.5%, and the Personal Consumption Expenditures (PCE) index slows down more than expected, the U.S. dollar will receive a blow from its own economy. Derivatives will revert to the March FOMC forecast of three acts of monetary easing, making it possible for the bulls to work on the correction.

Thus, everything is in the hands of central banks, and their verdicts depend on incoming data. Now, traders are back to digesting news, and investors eagerly await new releases.

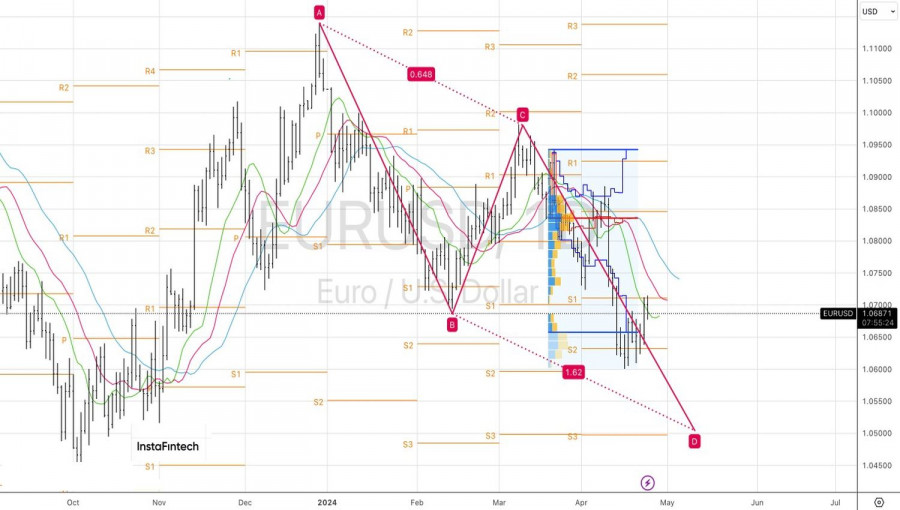

Technically, on the daily chart, EUR/USD is experiencing the realization of the 20-80 pattern. The bulls' failure to hold onto the pivot level of 1.071 has become a sign of their weakness, but the bears are not in a rush to regain the initiative. The pair continues to lean towards consolidation in the range of 1.061-1.071, and traders may consider selling strategies on rallies.

The material has been provided by InstaForex Company - www.instaforex.com #

Download NOW!

Download NOW!

No comments:

Post a Comment