Between order and chaos. This is how one can characterize the current behavior of the currency market. On the one hand, it correctly reacts to different rates of economic growth and inflation, as well as to the monetary policies of central banks. On the other hand, unexpected events, including geopolitics and the US presidential elections, can create confusion in the Forex market. However, for now, the EUR/USD reacts to the readiness of European central banks to pursue monetary easing faster than the Federal Reserve does.

The Riksbank's rate cut brought investors back in March. At that time, the Swiss National Bank was the first among the Big Ten currencies to weaken its monetary policy and damage the franc. In May, the same thing happened with the Swedish krona, and then with the British pound. Moreover, the Bank of England did not need to significantly reduce its rate. It was enough just to hint at a rate cut in the coming months. And that's what BoE Governor Andrew Bailey did.

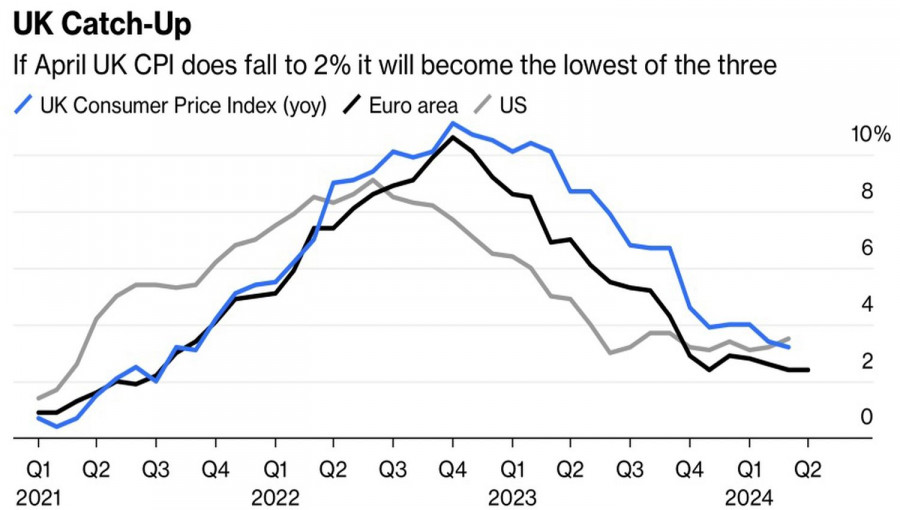

The dynamics of inflation in the US and Europe

Bailey emphasized progress in tackling high prices and he sent a clear signal that the BoE may lower rates more quickly than markets expect. Its start in June is by no means excluded, and the BoE expects inflation to reach the 2% target in the second quarter. This is not the end of the number of dovish signals from the central bank. Two MPC members have already voted to lower the rate compared to one in March. The rest have decided to leave the borrowing cost unchanged for now, but who knows how their opinion will change in June?

The SNB, Riksbank, BoE, as well as Hungary and the Czech Republic, which have already lowered rates, represent Europe. The fact that this time Europe decided not to wait for the Fed and began to weaken its monetary policy first puts pressure on all the currencies of the bloc. And the euro is no exception.

According to Credit Agricole, after a brief consolidation period, the USD index will resume its upward trend, driven by strong economic fundamentals in the US. European economies look significantly weaker, with risks of rapid inflation declining to the 2% target in the eurozone higher than in the US due to weaker domestic demand. This allows the company to recommend selling EUR/USD on rallies.

Such a strategy has the right to exist. Investors have realized that one report on the slowdown in the US labor market in April is not enough for the Fed to make decisions on reducing its rate. The central bank will need new data, and this means bringing back the downward trajectory of inflation. Until this happens, US dollar positions look stable. However, the euro will still face some challenges.

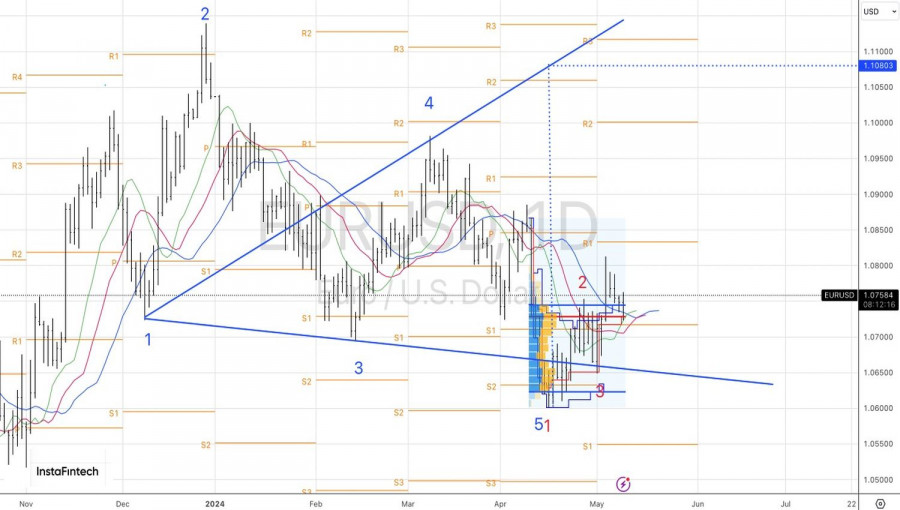

Technically, on the daily chart, the EUR/USD pair may return above the upper boundary of the fair value range of 1.062-1.0745. The fact that bears can't stay in this mark suggests their weakness and this provides an opportunity to increase long positions formed on the rebound to the upward movement.

The material has been provided by InstaForex Company - www.instaforex.com #

Download NOW!

Download NOW!

No comments:

Post a Comment