Since the beginning of the year, I've been saying the same thing: I believe that the Federal Reserve is not in a rush to lower rates. In fact, we may not even see a Fed rate cut in 2024. This is quite possible, considering the current inflation rate. In recent months, it has only been accelerating, and it has not stopped. There is no guarantee that it will stop accelerating, and will not reach the Consumer Price Index, for example, at 4%. How many economists will be talking about the prospects of a rate cut in 2024 with such inflation levels as of at least June?

I also want to point out that some members of the FOMC have started feeling uneasy. Fed Chair Jerome Powell tried to "save face" until the last moment, and only a couple of weeks ago, he announced that the disinflation process had stopped, and expressed uncertainty regarding the timing for a potential rate cut. At the same time, other Fed officials are already hinting at the need for policy tightening. Michelle Bowman said inflation will likely remain elevated for some time. She mentioned expecting slow declines in the CPI, but she also mentioned that it's possible interest rates may have to move higher.

Bowman deserves applause for these comments. The Fed official was one of the first to suggest that with rising inflation, it's necessary to discuss tightening rather than easing policy. Based on her words, the Fed may raise rates once or twice in 2024 instead of the five or six cuts that market participants were expecting at the beginning of the year. This means that the market would "miss the mark" by approximately 8 easing rounds in this case. In my opinion, this is a huge difference between expectations and reality that simply cannot go unnoticed. This year, the euro has only declined against the dollar by 350 basis points, and in my opinion, that's very little considering the news that comes in almost every day.

Bowman also noted that geopolitical risks are an important factor negatively impacting inflation. She added that increased immigration, labor shortages, and consumer demand could lead to even more sustained inflation in the United States.

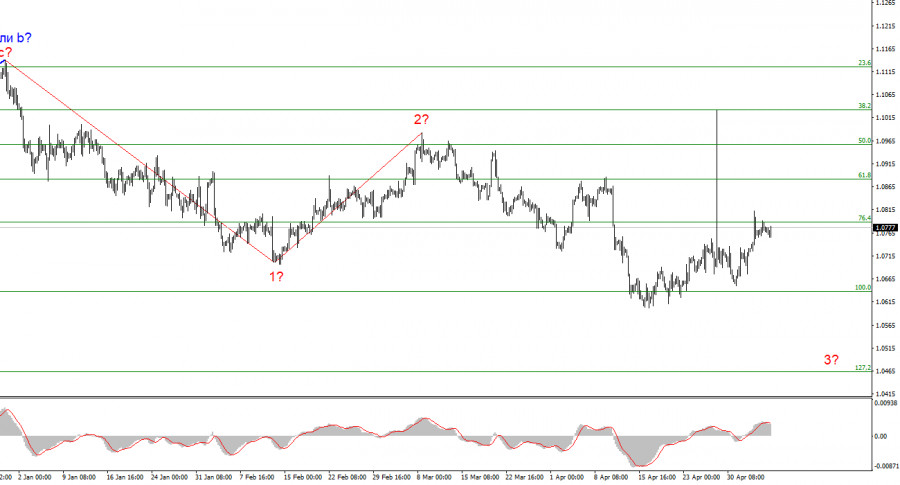

Wave analysis for EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that a bearish wave set is being formed. Waves 2 or b and 2 in 3 or c are complete, so in the near future, I expect an impulsive downward wave 3 in 3 or c to form with a significant decline in the instrument. I am considering short positions with targets near the 1.0462 mark, as the news background works in the dollar's favor. A successful attempt to break 1.0787, which is equal to 76.4% Fibonacci, will indicate that the market is ready for new short positions.

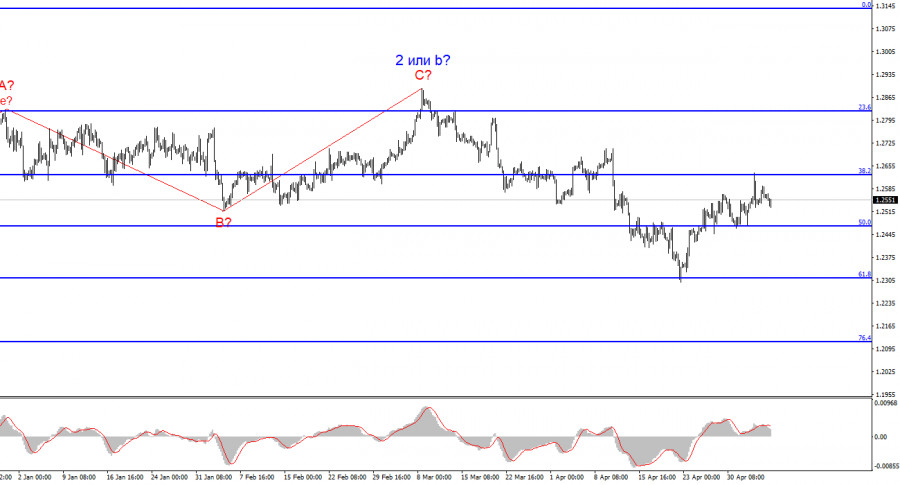

Wave analysis for GBP/USD:

The wave pattern of the GBP/USD instrument suggests a decline. I am considering selling the instrument with targets below the 1.2039 level, because I believe that wave 3 or c has started to form. A successful attempt to break 1.2472, which corresponds to 50.0% Fibonacci, indicates that the market is ready to build a descending wave. An unsuccessful attempt at 1.2625, which equates to 38.2% Fibonacci, would indicate that an internal, corrective wave of 3 or c, is complete.

Key principles of my analysis:

Wave structures should be simple and understandable. Complex structures are difficult to work with, and they often bring changes.

If you are not confident about the market's movement, it would be better not to enter it.

We cannot guarantee the direction of movement. Don't forget about Stop Loss orders.

Wave analysis can be combined with other types of analysis and trading strategies.

The material has been provided by InstaForex Company - www.instaforex.com #

Download NOW!

Download NOW!

No comments:

Post a Comment