Third time's the charm. Did the Bank of Japan intervene in the Forex market for the third time in the past two and a half weeks? Or was the sharp decline in USD/JPY solely the result of slowing US inflation? Whatever the case, the drop certainly lifted the spirits of both the government and the central bank. Their fight against speculators is about to succeed, much like in 2022. Back then, the Federal Reserve's reluctance to raise the federal funds rate as aggressively as investors had expected provided the necessary relief. Hopes for a rate cut are returning to the markets this May.

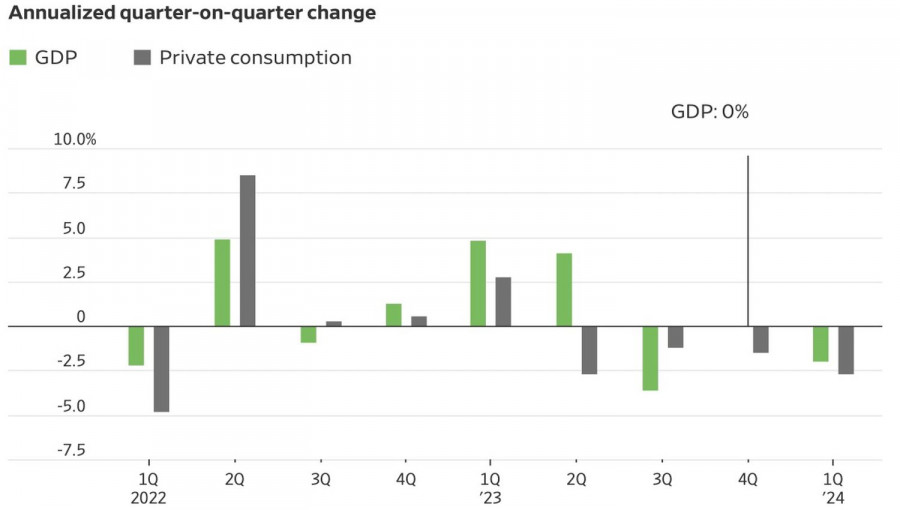

Japan's dependence on energy imports makes a weak yen a serious problem for the economy. The country's GDP contracted by 0.5% quarter-on-quarter and 2% year-on-year in the first quarter. The sluggish economic growth frustrates the population and haunts the government. This poor performance contrasts with the success of Japanese corporations, whose foreign earnings are converted into the significantly weakened yen of recent years. This allows stocks and indices to rise but leaves the authorities restless.

Dynamics of Japan's private consumption and GDP

It's no surprise that the government and the central bank decided to engage in currency interventions. Approximately $60 billion was spent on two of these interventions, a similar amount to what was used at the end of 2022. However, this time, the speculators did not back down. They pushed USD/JPY higher for seven consecutive trading days before the US dollar plunged.

Official Tokyo should thank the overly bearish speculators on the yen, who began closing their long positions in USD/JPY as soon as things started to heat up. This was triggered by the news of US inflation slowing to 3.4% in April. This effectively quashed fears of a federal funds rate hike. The futures market is now betting on rate cuts at two FOMC meetings—in September and December. This allows Treasury yields to fall and it also supports the yen against the US dollar.

According to Daiwa Securities, the Forex situation resembles last November when slowing US inflation led to falling Treasury yields and USD/JPY rates. Credit Agricole says that the pair is the most sensitive in the currency market to declines in US bond yields, so it could move south very quickly. Monex believes that it is unlikely to drop below 150 until the Fed eases its monetary policy.

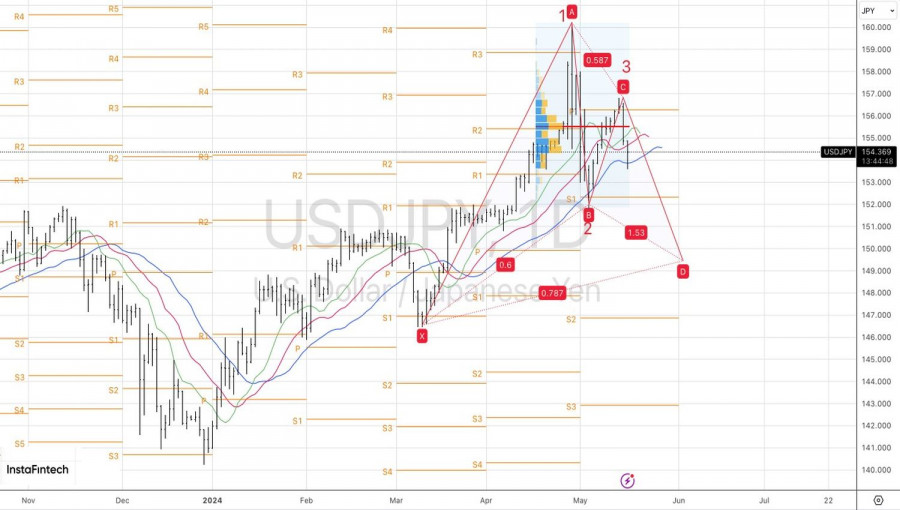

In my opinion, the USD/JPY uptrend has been broken due to the return of the divergence theme in the monetary policies of the Fed and the BOJ in the Forex market.

Technically, there is a 1-2-3 pattern on the daily chart. According to the rules of harmonious trading, its target is located near the 149.5 mark. It makes sense to hold and increase the short positions on the US dollar against the Japanese yen, formed from 156.3, during pullbacks.

The material has been provided by InstaForex Company - www.instaforex.com #

Download NOW!

Download NOW!

No comments:

Post a Comment