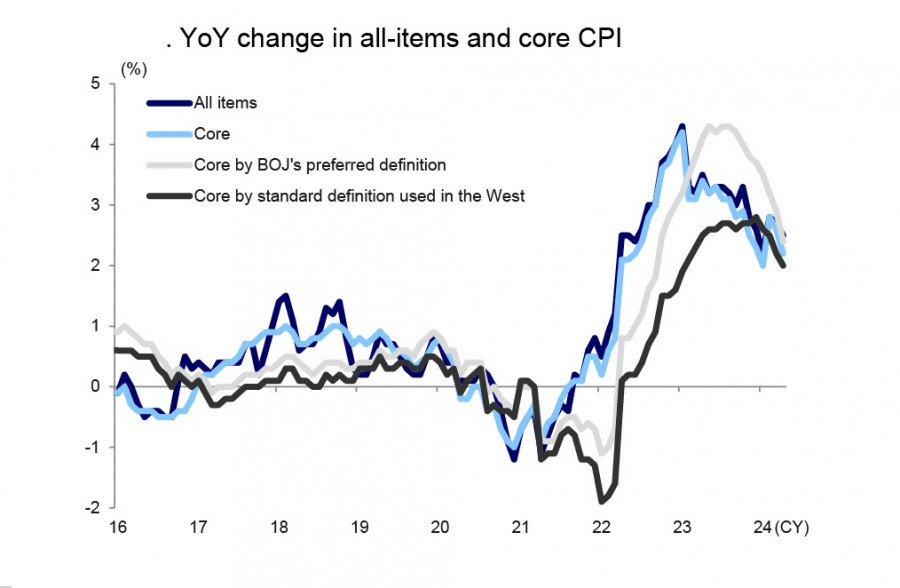

Core consumer prices in Japan (excluding fresh food) rose 2.2% in April from a year earlier, down from 2.6% in March. It was the slowest pace of increase since September 2022. The Bank of Japan still expects that the results of the spring wage negotiations will have an impact on service prices, but the data has yet to provide clear evidence of this happening.

BOJ board member Seiji Adachi said on Wednesday that monetary policy responses could be a possible choice if a weaker yen is seen affecting inflation, but premature rate hikes should be avoided. According to him, consumer inflation is currently slowing down, but it will likely accelerate again from summer to fall this year, which might require the BOJ to expedite interest rate hikes.

The yield on 10-year Japanese bonds has exceeded 1% and will likely rise further, narrowing the yield spread and benefiting the yen in the long term. BOJ Governor Kazuo Ueda on Saturday said the bank's "basic stance" is that long-term bond yields should be set by the markets. However, this is challenging for the BOJ, which has for years been hoovering up Japanese Government Bonds (JGBs) in its battle against deflation and now owns more than 50% of the entire market. Rising yields increase the likelihood of further rate hikes and generally contribute to reducing bearish sentiment on the yen.

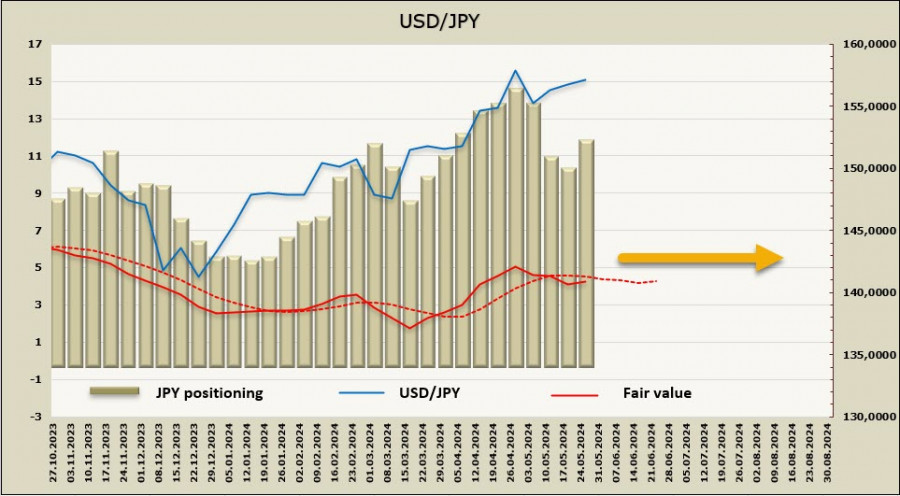

Overall, the yen is too weak to expect a global reversal in the near term. A 0.1% rate hike does not solve the issue; it is necessary to wait for other central banks, primarily the Federal Reserve, to start lowering rates. Only these steps can help the yen strengthen.

The net short JPY position increased by $1.47 billion to -$11.5 billion for the reported week. A bearish bias on the yen. The price is below the long-term average and is trying to head upwards, but there is no clear direction yet.

The USD/JPY pair continues to trade near multi-year highs. Objective factors (primarily the direction of financial flows) are pushing it upwards, but the likelihood of another intervention is increasing, making a bullish play excessively risky. The safest strategy at this stage is to sell on rises, anticipating a long-term reversal. The nearest target is 153.40/60, followed by the local low of 151.78.

The material has been provided by InstaForex Company - www.instaforex.com #

Download NOW!

Download NOW!

No comments:

Post a Comment