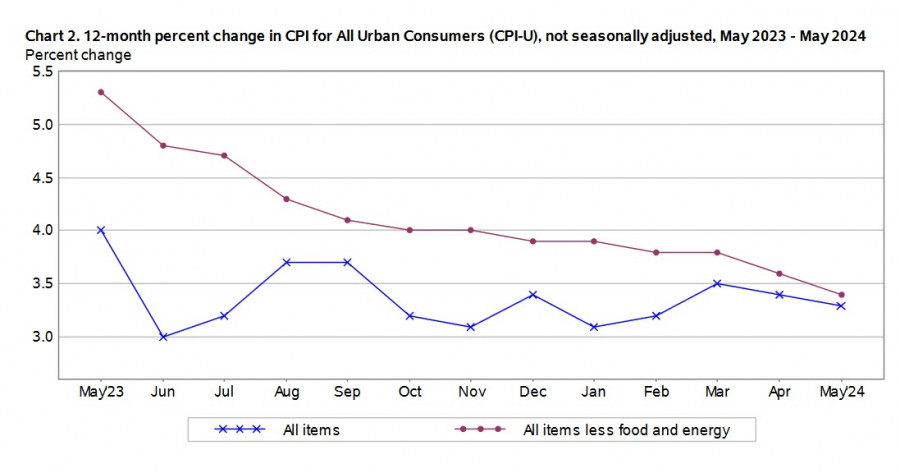

The US Consumer Price Index declined to 3.3% on a yearly basis in May from 3.4% in April, while the core index fell even more sharply from 3.6% to 3.4%. The slowdown in inflation completely offset the effect of the strong labor market. The bond market responded with a sharp decline in yields, and the likelihood of the first Federal Reserve rate cut in September has risen significantly.

The Federal Reserve held its meeting on Wednesday. The interest rate was expected to remain unchanged, but economic forecasts and the rate trajectory were highly likely to be revised. This signals a potential weakness of the US dollar, and we expected a sharp spike in volatility following the meeting.

The Bank of Japan will hold its meeting on Friday. A 0.1% rate hike is not expected, but a program to reduce bond purchases may be announced. Such a decision would be the BOJ's first clear step towards quantitative tightening after abandoning the large-scale stimulus program in March and beginning the path to policy normalization. Although the Bank states that it does not target foreign exchange rates, a change in the bond purchase regime or a clear hawkish signal would favor the yen's growth.

Forecasts vary widely. If the BOJ is too cautious, the yen may weaken further and head towards the 160 level, where intervention to prevent further depreciation would likely occur. If the measures are aggressive, bond yields will rise sharply, complicating the government's ability to service its accumulated obligations.

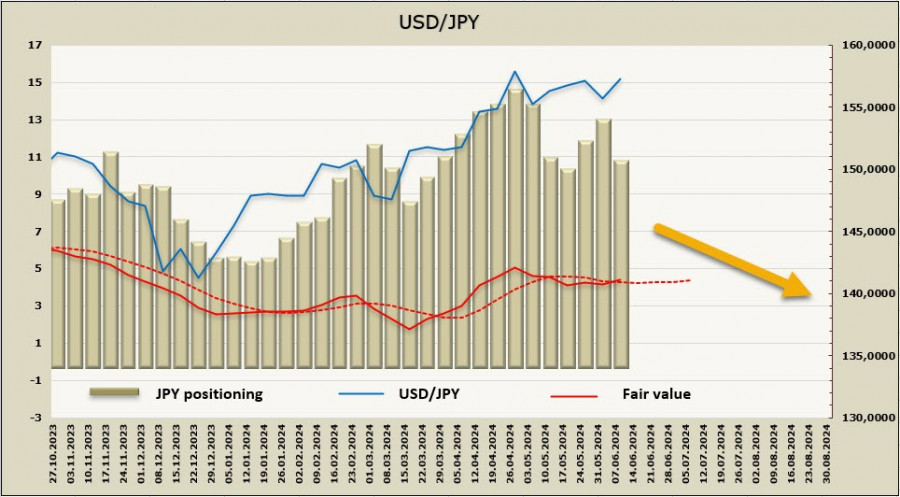

The net short JPY position decreased by $1.75 billion to -$10.6 billion, indicating that positioning remains strongly bearish but a trend towards reversal is emerging. However, the price is not falling, suggesting that conditions for a long-term purchase of the yen have not yet materialized.

USD/JPY is attempting to resume its uptrend, which happens whenever the BOJ avoids providing specifics about its future course of actions. The decline in Japanese bond yields occurred amidst growing uncertainty regarding the BOJ's plans. The substantial yield differential objectively forces the use of the Japanese currency in carry trade transactions, and this will continue until the BOJ proceeds with raising the rate.

Nevertheless, we believe that buying USD/JPY is too risky due to the high probability of another intervention. Therefore, it's still the same strategy – sell on rallies. If the pair rises above 159, the threat of intervention will increase significantly. While the pair remains below this level, local bullish impulses are possible.

The material has been provided by InstaForex Company - www.instaforex.com #

Download NOW!

Download NOW!

No comments:

Post a Comment