EUR/USD

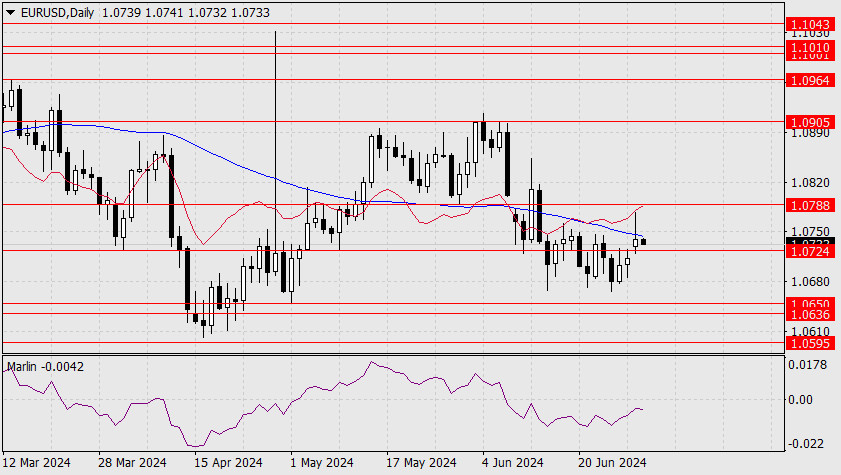

Yesterday, the euro closed below the Kijun-sen line with a large upper shadow. The euro has failed to reach the target level of 1.0788, and it is likely on track to close the gap below the 1.0724 level. However, all these actions are taking place within the framework of waiting for the upcoming holiday on Thursday and the key US employment data on Friday, which is the main event of the week. From a purely technical perspective, yesterday's outcome only reinforces the bearish outlook in the medium-term.

The forecast for new non-farm payroll jobs in June is 189,000 compared to 272,000 in May. However, the negative trend in the overall number of unemployed last month (Continued Jobless Claims) suggests a worse non-farm payroll figure, around 150,000-160,000, similar to what we saw in November last year when the structure of Continued Jobless Claims was similar. In such a case, the euro might fall along with the stock market due to a risk-off effect.

On the 4-hour chart, the euro seems to be trying to retest the support at 1.0724. If the euro intends to close the gap, it can breach this support level. We can confirm the euro's intention to continue the downward movement when the price consolidates below the Kijun-sen line (1.0702). By that time, the Marlin oscillator will likely be in the downtrend territory (below the zero line).

Pentru mai multe detalii, va invitam sa vizitati stirea originala.

Yesterday, the euro closed below the Kijun-sen line with a large upper shadow. The euro has failed to reach the target level of 1.0788, and it is likely on track to close the gap below the 1.0724 level. However, all these actions are taking place within the framework of waiting for the upcoming holiday on Thursday and the key US employment data on Friday, which is the main event of the week. From a purely technical perspective, yesterday's outcome only reinforces the bearish outlook in the medium-term.

The forecast for new non-farm payroll jobs in June is 189,000 compared to 272,000 in May. However, the negative trend in the overall number of unemployed last month (Continued Jobless Claims) suggests a worse non-farm payroll figure, around 150,000-160,000, similar to what we saw in November last year when the structure of Continued Jobless Claims was similar. In such a case, the euro might fall along with the stock market due to a risk-off effect.

On the 4-hour chart, the euro seems to be trying to retest the support at 1.0724. If the euro intends to close the gap, it can breach this support level. We can confirm the euro's intention to continue the downward movement when the price consolidates below the Kijun-sen line (1.0702). By that time, the Marlin oscillator will likely be in the downtrend territory (below the zero line).

Pentru mai multe detalii, va invitam sa vizitati stirea originala.

Download NOW!

Download NOW!

No comments:

Post a Comment