GBP/USD moved by 29 pips on Friday. In general, there is nothing more to analyze as there were no movements in the market. Over the past two weeks, the British currency has slightly corrected lower, but we still doubt that this slight drop is the start of a trend even within the 4-hour time frame. The pound has signaled the end of the upward trend numerous times in the past few months, and each time, the growth resumed with almost no decline. The market shows it is ready to buy the British currency regardless of circumstances. COT reports indicate a massive dominance of bulls. Macroeconomic data (irrespective of their nature) only lead to the pair's growth. Market participants are not interested in the fundamental background. Moreover, market volatility is low.

Therefore, all the major events of the coming week are significant only formally. We have already mentioned that even from the Federal Reserve meeting, nothing substantial should be expected. Fed Chair Jerome Powell is unlikely to hint at a rate cut, and the FOMC committee will unlikely make important decisions to adjust this policy. This is because inflation in the US is still far from the target level, so there are no grounds for a rate cut soon. Moreover, the latest US GDP report showed that the American economy is doing well, providing the central bank additional time. Now, the Fed has no reason to rush.

Apart from the Fed meeting, the US will publish reports on unemployment, the labor market, ISM business activity indices, and JOLTs and ADP reports. Of course, these are very important data, but again, considering the volatility, we understand that strong movements should not be expected. Positive US data may be overlooked, while negative data could prompt a response. We do not even see the point in speculating about what the actual values of the aforementioned reports will be.

The Bank of England meeting will take place in the UK, which is essentially the week's key event. The BoE may begin to lower its rates as inflation allows it to do so. If we are correct, the BoE will follow the European Central Bank, and the Fed's rate will remain at its peak for a long time. If the market does not start actively buying the dollar even after this, it will only confirm the complete illogicality of the current movements of the GBP/USD pair. In principle, even official forecasts predict a rate cut on August 1. This is not just our opinion. And no matter how much the British central bank tries to convince the market that something has yet to be decided and that inflation in the services sector is too high, the main indicator is the core Consumer Price Index, not the CPI in specific sectors. Thus, we believe that the BoE will also start easing monetary policy, but whether the British pound will start depreciating is a big question.

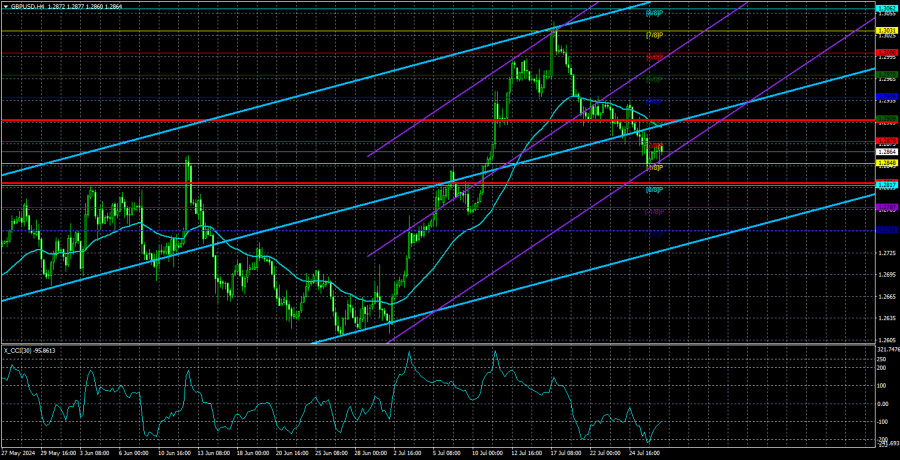

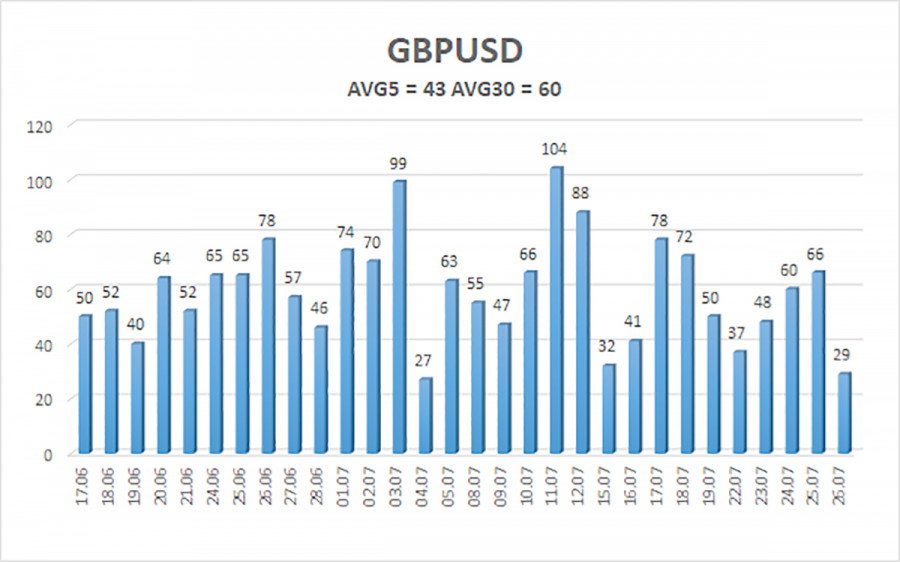

The average volatility of the GBP/USD pair over the last five trading days is 43 pips. This is considered a low value for the pound/dollar pair. On Monday, July 29, we expect movement within the range limited by 1.2821 and 1.2907. The higher linear regression channel is directed upwards, signaling the continuation of the upward trend. The CCI indicator has entered the overbought area twice, signaling a potential decline. In addition, there is a divergence between the last two price peaks and the indicator.

Nearest Support Levels:

- S1 – 1.2848

- S2 – 1.2817

- S3 – 1.2787

Nearest Resistance Levels:

- R1 – 1.2878

- R2 – 1.2909

- R3 – 1.2939

Trading Recommendations:

The GBP/USD pair has finally settled below the moving average line and has a real chance for a significant decline. Volatility remains low, but short positions are currently valid, with initial targets at 1.2878 and 1.2848. A bullish correction might occur, after which the decline is expected to resume. We are not considering long positions at the moment, as all the bullish factors for the British currency (which are not much) have already been factored in by the market multiple times. Even if the pound shows a new upward movement, it will not add logic to such a movement.

Explanations for Illustrations:

Linear Regression Channels – help determine the current trend. If both are directed in the same direction, it means the trend is strong.

Moving Average Line (settings 20,0, smoothed) – determines the short-term trend and the direction in which trading should be conducted.

Murray Levels – target levels for movements and corrections.

Volatility Levels (red lines) – the probable price channel in which the pair will spend the next 24 hours, based on current volatility indicators.

CCI Indicator: Entering the oversold area (below 250) or the overbought area (above +250) means a trend reversal is approaching.

The material has been provided by InstaForex Company - www.instaforex.com #

Download NOW!

Download NOW!

No comments:

Post a Comment