As U.S. inflation has slowed for several consecutive months and unemployment has risen, the market has started demanding almost three federal funds rate cuts from the Federal Reserve, more than the latest FOMC forecast. Investors expect signals from Fed Chair Jerome Powell and his colleagues in July about the start of monetary easing in September. However, reality may be different.

Reflecting on the past, the market was demanding six to seven rate cuts from the Fed at the start of the year. However, as consumer prices accelerated, they were willing to settle for one act of monetary easing. The U.S. dollar rose only to weaken by the end of the year. But history risks repeating itself. The consensus forecast of Reuters experts suggests that by the end of 2024, the Fed and the Bank of England will cut borrowing costs twice, and the ECB will do so three times. 56% of respondents believe that inflation will be higher than currently expected.

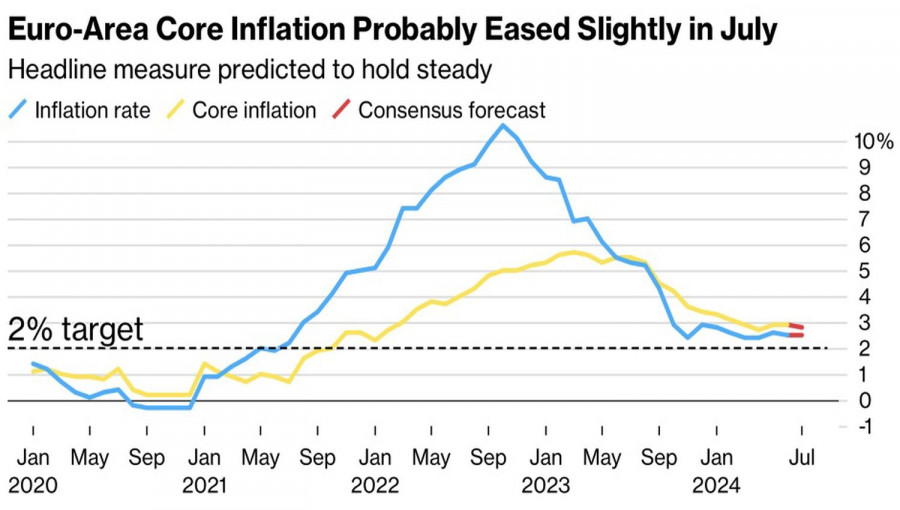

European inflation dynamics

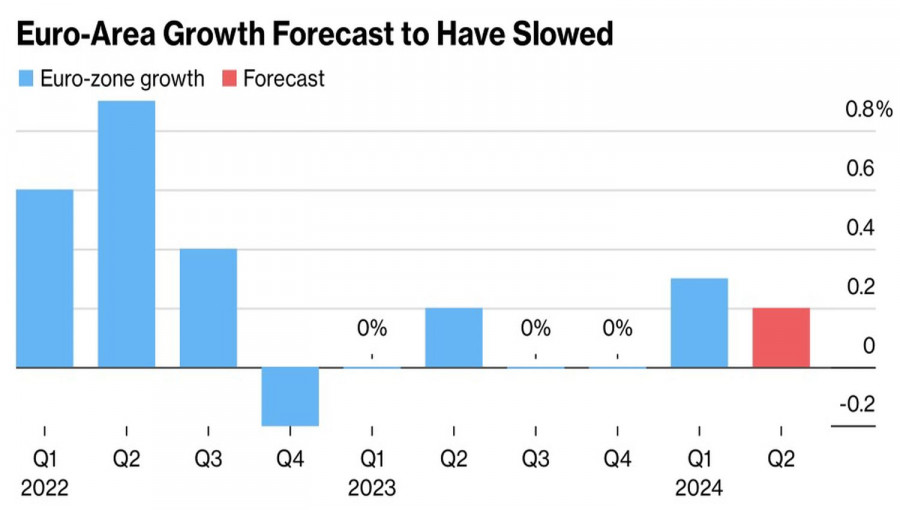

People often mistake their desires for reality. Markets are no exception. The decline of EUR/USD is driven by expectations of a slowdown in the European CPI from 2.5% to 2.4% and core inflation from 2.9% to 2.8% year-over-year in July. Simultaneously, GDP growth rates are forecasted to drop from 0.3% to 0.2% quarter-over-quarter. If this happens, it will push the European Central Bank to lower its rates at one of its upcoming meetings. This is unsurprising, as the Governing Council's decisions depend on data.

The U.S. presidential race is also putting significant pressure on the regional currency. The leading candidate, Donald Trump, has pledged to increase tariffs on imports from China to 60% and from other countries to 10%. If these policies are enacted, they could disrupt global supply chains and potentially slow down the global economy. This is particularly concerning for pro-cyclical currencies like the euro and the pound.

European economic dynamics

At the same time, the fall of EUR/USD ahead of important data looks like a trap set by major players. In reality, signals from the Fed about lowering rates in September and a further slowdown in the U.S. labor market are more detrimental to the main currency pair than the cooling of European inflation and GDP. As for Donald Trump, he has not yet won, so it is too early to talk about a renewed trade war or currency interventions.

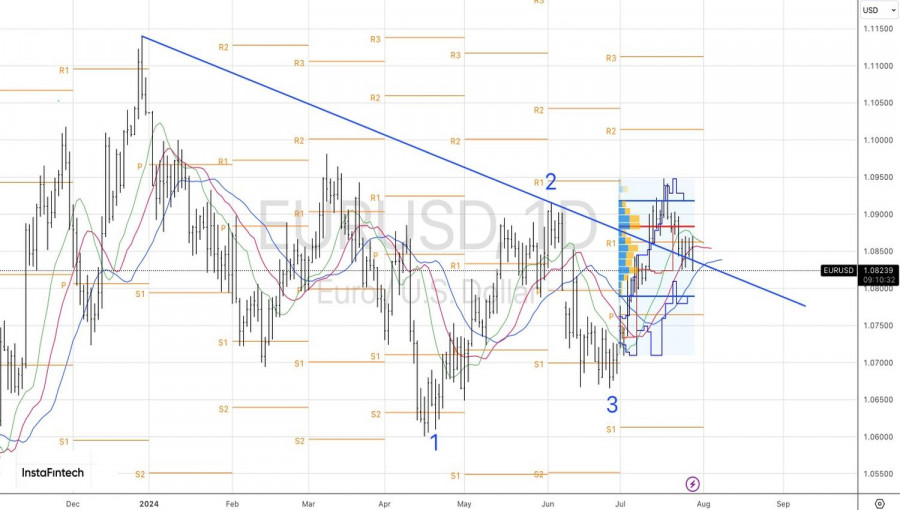

As mentioned earlier, the 1.083 level is a red line for EUR/USD. Falling below it increases the risks of continued decline; however, everything will depend on the events of the week leading up to August 2. The breach of support may be a false start.

Technically, on the daily chart, EUR/USD has moved outside the short-term consolidation range between 1.083 and 1.087. A return to its midpoint near 1.085 activates the Fake-out pattern and becomes a basis for buying. Similarly, a rebound from the lower boundary of the fair value range and the pivot level at 1.080 could also be a signal for long positions.

The material has been provided by InstaForex Company - www.instaforex.com #

Download NOW!

Download NOW!

No comments:

Post a Comment