The US labor market report turned out to be weak. While the number of new jobs in June exceeded the forecast (206,000 vs. 190,000), the figures for the last two months were revised down by a substantial 111,000, which completely changed the picture. The average increase over the past three months is 145,000, the lowest since January 2021, and the four-week average for unemployment benefit claims is at its peak since August 2023.

The labor market continues to slow down, and if this trend continues, the Federal Reserve may have to start lowering rates without waiting for inflation to return to the target level of 2%.

In a broad sense, the nonfarm payrolls support the dollar's weakness, as markets have strengthened their expectations for the first Fed rate cut in September and another one by the end of the year. The dollar has fallen against most major currencies, and the trend is not in its favor.

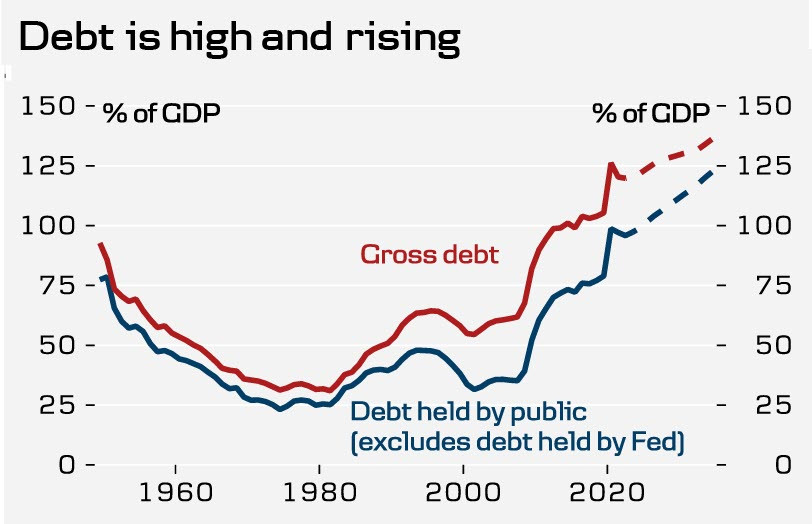

When analyzing the state of the US economy, the likelihood of a full-scale recession is increasingly being mentioned. Interest payments on government debt amount to 2.4% of GDP, which is more than defense spending. According to CBO forecasts, these payments will rise to 4.1% over the next 10 years. The inability to continue increasing the national debt is being discussed at the Federal Reserve Board level, which may require changes to budget rules and spending cuts, given that the federal budget deficit this year is expected to be at least 7%. This implies a reduction in expenditures.

The November elections threaten to turn into an open confrontation between Republicans and Democrats, as the current President Biden, who wants to run for a second term, clearly shows signs of personality degradation and will not be able to fully perform the duties of the president.

Last week was uneventful due to the Independence Day holidays, but the coming week could heat up in terms of increased volatility. Major banks will start releasing their earnings reports, updated inflation data will be released on Thursday, and producer prices and consumer sentiment estimates will be released on Friday. However, the key event is likely to be Fed Chair Powell's testimony before the Senate Banking Committee, where it is expected that Powell will provide explanations regarding the Fed's monetary policy, which in itself could trigger sharp market movements.

We expect a further decline in the dollar index, with commodity currencies likely to benefit, while European currencies will remain under slight pressure.

The material has been provided by InstaForex Company - www.instaforex.com #

Download NOW!

Download NOW!

No comments:

Post a Comment