The GBP/USD pair rebounded downward on Wednesday after rising on Tuesday, but the British currency continues to grow. This rise is unsurprising, and we have been discussing an impending upward correction for the past few weeks. However, there is one significant point that once again suggests that the British pound could soar.

The market continues to ignore positive developments for the U.S. dollar and negative ones for the pound with all its might. Let's compare just two reports and the market's reaction to them. On Tuesday, the U.S. Producer Price Index (PPI) was only 0.1% below expert forecasts. The dollar fell by 100 pips during the day. Okay, it fell by 65 pips immediately after the PPI report. Yesterday morning, an inflation report was released in the UK, showing that prices rose, but less than expected. What does this mean? Only the Bank of England may continue to ease monetary policy at its next meeting, as prices did not rise as much as traders had anticipated. How much did the British currency fall? By 30 pips. So, does the market consider the U.S. PPI report far more important than the UK's core and headline inflation figures?

We don't believe that's the case. The issue is that the market continues to interpret the entire macroeconomic backdrop in a way that suits it. Does it expect a 50 basis point rate cut from the Federal Reserve in September? Therefore, any slowdown in any inflation indicator is a reason for even greater dollar sales. Does weak inflation growth in the UK suggest selling the pound? We'll either ignore this report or process it with formal selling. That's why the dollar, as usual, falls sharply and recovers weakly.

It's worth noting that the PPI fell more than forecasts by 0.1%, but its previous value was revised upward by 0.1%. Thus, there was no real reason to dispose of the U.S. dollar in "galloping mode" on Tuesday. However, such logical conclusions are of no interest to the market at the moment. Also, the core inflation in the UK slowed by 0.2% year-on-year in July, stronger than forecasts. This was another reason to sell the pound, which the market chose not to act upon. But why?

This week, we can also recall the drop in the unemployment rate in June and the rise in unemployment benefit claims in July, which triggered an increase in the British currency. The market responded positively to the unemployment rate but ignored the negative unemployment benefit claims, even though their number was "only" nine times higher than forecasts. Not to mention wages, which slowed to 4.5% year-on-year, significantly increasing the likelihood of further inflation decline and, consequently, bringing closer the moment of the BoE's second monetary policy easing. However, the market did not take these data into account. We will not address the U.S. inflation report in this article; it will be covered in the adjacent article on EUR/USD.

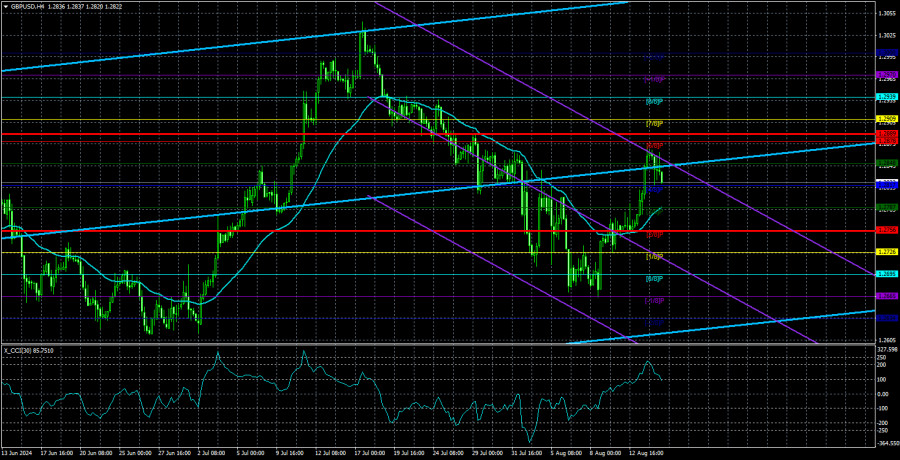

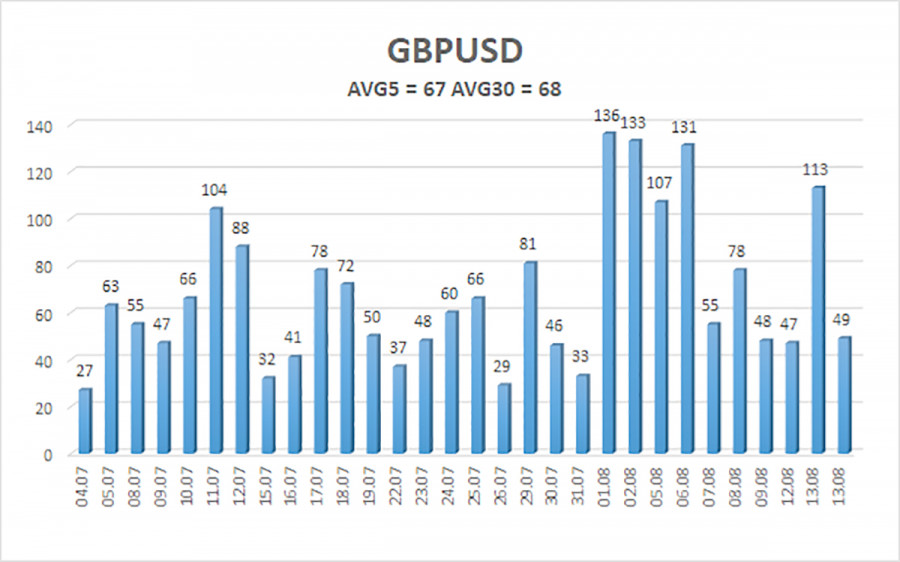

The average volatility of GBP/USD over the last five trading days is 67 pips. This is considered an average value for the pair. Therefore, on Thursday, August 15, we expect movement within the range limited by 1.2755 and 1.2889. The upper channel of the linear regression is directed upward, indicating the continuation of the upward trend. The CCI indicator may soon enter the overbought zone again.

Nearest Support Levels:

- S1 – 1.2817

- S2 – 1.2787

- S3 – 1.2756

Nearest Resistance Levels:

- R1 – 1.2848

- R2 – 1.2878

- R3 – 1.2909

We recommend checking out other articles by the author:

Review of EUR/USD on August 15; The market no longer had enough strength for inflation in the US

Trading Recommendations:

The GBP/USD pair continues to hover around the moving average line and has a good chance for further downward momentum. We are not considering long positions at this time, as we believe that the market has already addressed all the bullish factors for the British currency (which are not much) several times. Short positions could be considered at least after the price consolidates below the moving average. The pound sterling may continue to correct upwards this week, as previously warned by the CCI indicator.

Explanations for Illustrations:

Linear Regression Channels: help determine the current trend. If both are directed in the same direction, it means the trend is strong.

Moving Average Line (settings 20,0, smoothed): determines the short-term trend and the direction in which trading should be conducted.

Murray Levels: target levels for movements and corrections.

Volatility Levels (red lines): the probable price channel in which the pair will spend the next 24 hours, based on current volatility indicators.

CCI Indicator: Entering the oversold area (below 250) or the overbought area (above +250) means a trend reversal is approaching.

The material has been provided by InstaForex Company - www.instaforex.com #

Download NOW!

Download NOW!

No comments:

Post a Comment