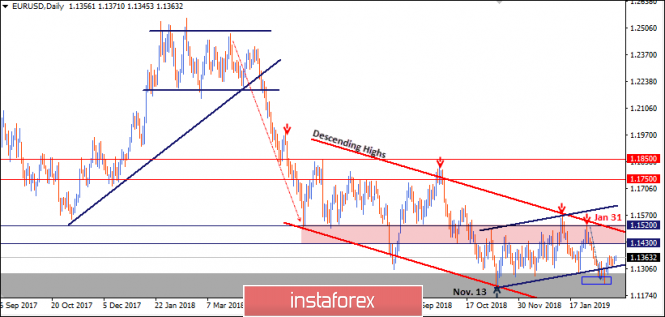

Since June 2018, the EUR/USD pair has been moving sideways with slight bearish tendency within the depicted bearish Channel (In RED).

On November 13, the EUR/USD pair demonstrated recent bullish recovery around 1.1220-1.1250 where the current bullish movement above the depicted short-term bullish channel (In BLUE) was initiated.

Bullish fixation above 1.1430 was needed to enhance further bullish movement towards 1.1520. However, the market has been demonstrating obvious bearish rejection around 1.1430 few times so far.

The EUR/USD pair has lost its bullish momentum since January 31 when a bearish engulfing candlestick was demonstrated around 1.1514 where another descending high was established then.

This allowed the current bearish movement to occur towards 1.1300-1.1270 where the lower limit of the depicted DAILY channel came to meet the pair.

Since February 20, the EUR/USD pair has been demonstrating weak bullish recovery with sideway consolidations around the depicted price zone (1.1300-1.1270). Temporary bearish breakdown of the depicted technical limit was demonstrated as well.

Yesterday, significant bullish recovery has emerged indicating a high probability of a quick bullish visit towards 1.1400-1.1460 where the upper limit of the daily movement channel is located.

On the other hand, Please note that a bearish flag pattern may become confirmed if bearish persistence below 1.1250 is achieved on the daily basis. Pattern target is projected towards 1.1000.

Trade Recommendations:

A counter-trend BUY entry was already suggested near the price level (1.1285) (the lower limit of the depicted movement channel).

T/P level to be located around 1.1350 and 1.1420 while S/L should be advanced to entry level (1.1285) to offset the associated risk.

The material has been provided by InstaForex Company - www.instaforex.com

Download NOW!

Download NOW!

No comments:

Post a Comment