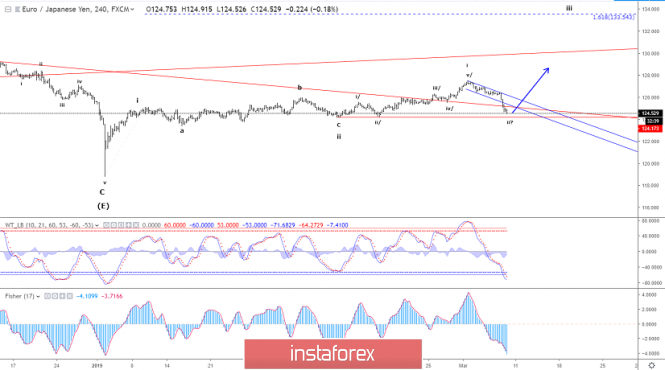

A very dovish ECB meeting drove the EUR lower yesterday. The clear break below 125.98 invalidated the bullish count and we have been back to the drawing-board to look at the alternate scenarios.

Support at 124.17 is the pivot-point. As long as the price stays above 124.17 we could see renewed strength for a push higher to 127.50 and above. Under this scenario, we will need a break above minor resistance at 124.80 and more importantly a break above 125.05 to confirm the next push higher.

If, however the pivot-point at 124.17 is broken that will shift the view towards a bearish case and call for more downside pressure towards 123.15 and possibly even closer to 122.10.

R3: 125.34

R2: 125.02

R1: 124.80

Pivot: 124.17

S1: 123.76

S2: 123.37

S3: 123.15

Trading recommendation:

Our stop at 125.75 was hit for a 110 pips profit. We will re-buy EUR upon a break above 124.80 and place our stop at 124.10.

The material has been provided by InstaForex Company - www.instaforex.com

Download NOW!

Download NOW!

No comments:

Post a Comment