Forecast for March 27:

Analytical review of H1-scale currency pairs:

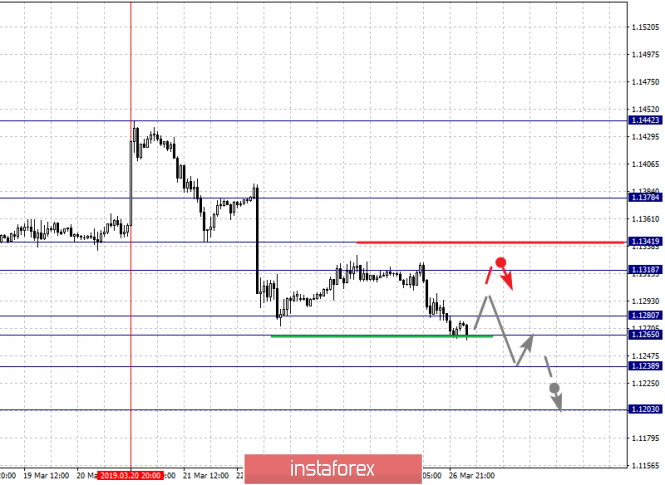

For the Euro / Dollar pair, the key levels on the H1 scale are: 1.1378, 1.1341, 1.1318, 1.1280, 1.1265, 1.1238 and 1.1203. Here, we continue to follow the development of the downward structure of March 20. Continuation of the movement to the bottom is expected after the price passes the noise range of 1.1280 - 1.1265, in this case the goal is 1.1238. For the potential value for the downward movement, we consider the level of 1.1203, after reaching which, we expect to go into a correction.

The short-term upward movement is possible in the corridor 1.1318 - 1.1341. The breakdown of the latter value will lead to in-depth movement. Here, the target is 1.1378. This level is a key support for the upward structure.

The main trend is the formation of the downward structure of March 20.

Trading recommendations:

Buy 1.1318 Take profit: 1.1340

Buy 1.1345 Take profit: 1.1376

Sell: 1.1265 Take profit: 1.1240

Sell: 1.1236 Take profit: 1.1205

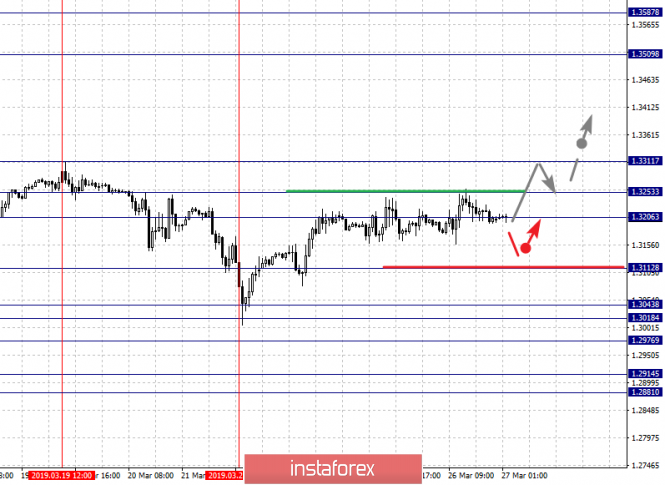

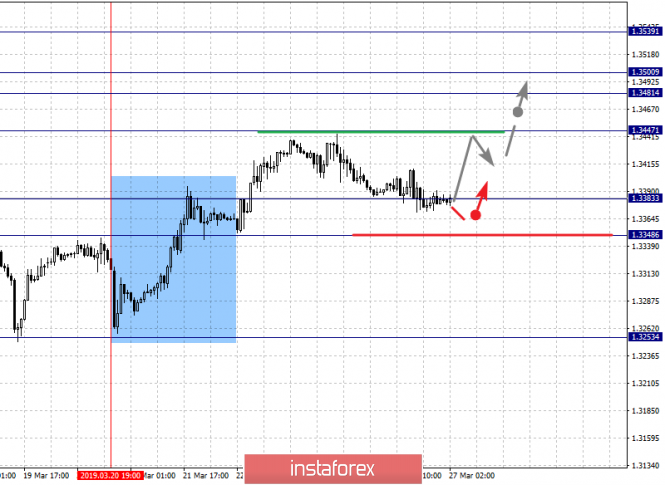

For the Pound / Dollar pair, the key levels on the H1 scale are 1.3253, 1.3206, 1.3161, 1.3043, 1.3018, 1.2976, 1.2914 and 1.2881. Here, the situation is in equilibrium: the downward structure of March 19 and the upward potential of March 21. Short-term upward movement is possible in the corridor 1.3206 - 1.3253. The latter is a key support for the downward structure of March 19. Its breakdown will have to develop the upward cycle. Here, the first target is 1.3311.

Continuation of the movement to the bottom is expected after the breakdown 1.3112. In this case, the first goal is 1.3043. A passage at the price of the noise range 1.3043 - 1.3018 will lead to the development of a downward trend on the H1 scale. Here, the goal is 1.2976, and consolidation is near this level. The breakdown of the level 1.2976 should be accompanied by a pronounced downward movement. In this case, the target is 1.2914. For the potential value for the downward structure, we consider the level of 1.2881, after reaching which, we expect a rollback to the top.

The main trend is the equilibrium situation (the potential is shifted towards the upward structure of March 21).

Trading recommendations:

Buy: 1.3208 Take profit: 1.3250

Buy: 1.3255 Take profit: 1.3310

Sell: 1.3112 Take profit: 1.3045

Sell: 1.3016 Take profit: 1.2978

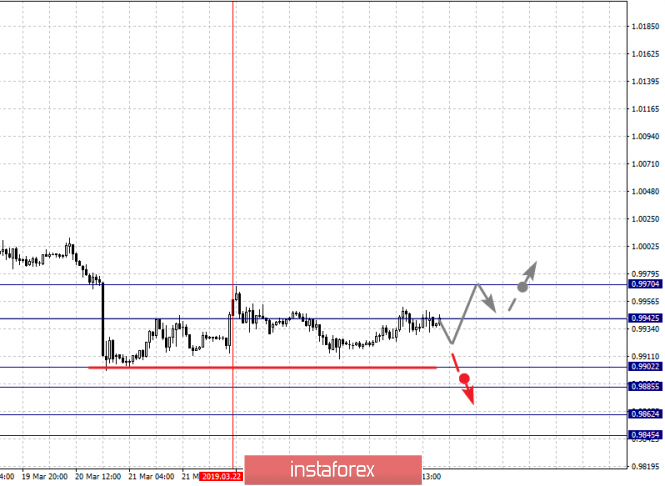

For the Dollar / Frank pair, the key levels on the H1 scale are: 0.9970, 0.9942, 0.9928, 0.9902, 0.9885, 0.9862 and 0.9845. Here, the price has entered an equilibrium situation and so far we do not observe pronounced initial conditions for the top. Short-term downward movement is possible in the corridor 0.9902 - 0.9885. The breakdown of the latter value should be accompanied by a pronounced downward movement. Here the goal is 0.9862. For the potential value of the bottom, we consider the level of 0.9845, after reaching which, we expect consolidation.

Short-term upward movement is possible in the corridor 0.9942 - 0.9970. The breakdown of the latter value will have to form an upward structure. In this case, the goals have not yet been defined.

The main trend is the equilibrium situation.

Trading recommendations:

Buy : 0.9943 Take profit: 0.9970

Sell: 0.9902 Take profit: 0.9886

Sell: 0.9883 Take profit: 0.9862

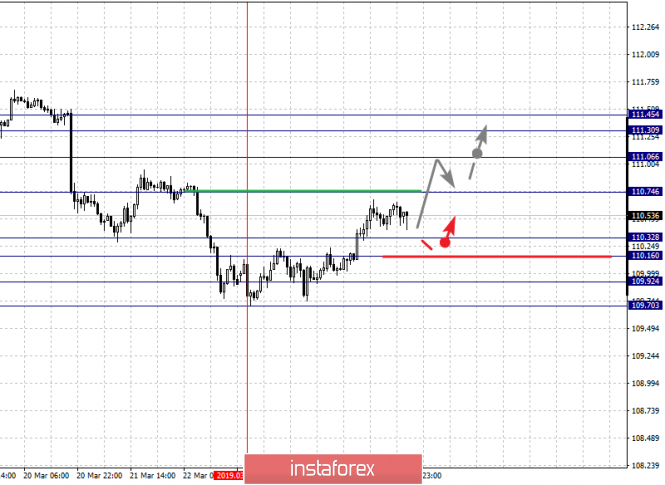

For the Dollar / Yen pair, the key levels on the scale are: 111.45, 111.30, 111.06, 110.74, 110.32, 110.16, 109.92 and 109.70. Here, the price has issued a pronounced ascending structure of March 25. Continuation of the movement to the top is expected after the breakdown of 110.74. In this case the goal is 111.06, which is near the price consolidation. For the potential value of the top, we consider the level of 111.45, after reaching which, we expect a rollback to the bottom.

Short-term downward movement is possible in the corridor 110.32 - 110.16. The breakdown of the latter value will lead to a prolonged correction. Here, the goal is 109.92. This level is a key support for the upward structure. Its breakdown will lead to the development of a downward trend. In this case, the first goal is 109.70.

The main trend is the rising structure of March 25.

Trading recommendations:

Buy: 110.75 Take profit: 111.05

Buy: 111.07 Take profit: 111.30

Sell: 110.32 Take profit: 110.16

Sell: 110.14 Take profit: 109.92

For the Canadian dollar/ Dollar pair, the key levels on the H1 scale are: 1.3539, 1.3500, 1.3481, 1.3447, 1.3383 and 1.3348. Here, we are following the development of the ascending structure of March 20. Continuation of the movement to the top is expected after the breakdown of 1.3447. In this case, the goal is 1.3481, in the corridor of the 1.3481 – 1.3500 consolidation. For the potential value of the top, we consider the level 1.3539, upon reaching which, we expect a correction.

Short-term downward movement is possible in the corridor 1.3383-1.3348. The breakdown of the last value will have to form the expressed initial conditions for the downward cycle.

Buy: 1.3447 Take profit: 1.3480

Buy : 1.3500 Take profit: 1.3539

Sell: 1.3381 Take profit: 1.3350

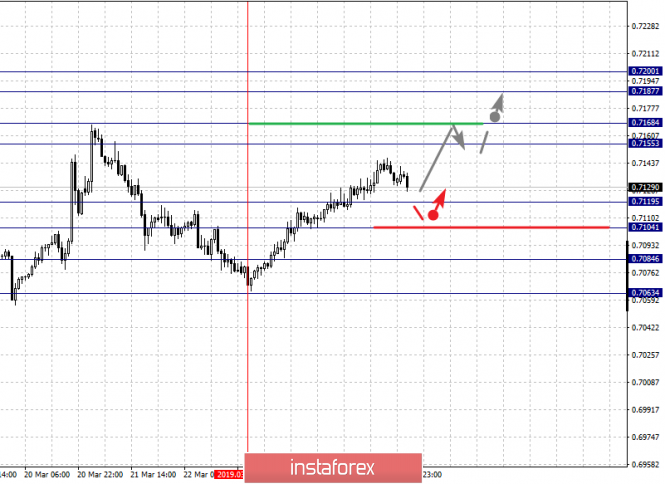

For the Australian dollar / Dollar pair, the key levels on the H1 scale are : 0.7200, 0.7187, 0.7168, 0.7155, 0.7119, 0.7104, 0.7084 and 0.7063.

The main trend is the formation of the ascending structure of March 25. Here, we are following the formation of the ascending structure of March 25. Short-term movement to the top is expected in the range of 0.7155 - 0.7168. The breakdown of the latter value will allow movement to a potential target - 0.7200. After reaching this level, we expect consolidation in the corridor 0.7187 - 0.7200, as well as rollback to the bottom.

Short-term downward movement is possible in the corridor 0.7119 - 0.7104. The breakdown of the latter value will lead to a prolonged correction. Here, the target is 0.7084. This level is a key support for the upward structure from March 25. Its breakdown will allow to count on movement to a potential target - 0.7063.

Trading recommendations:

Buy: 0.7155 Take profit: 0.7166

Buy: 0.7170 Take profit: 0.7187

Sell : 0.7119 Take profit : 0.7106

Sell: 0.7102 Take profit: 0.7085

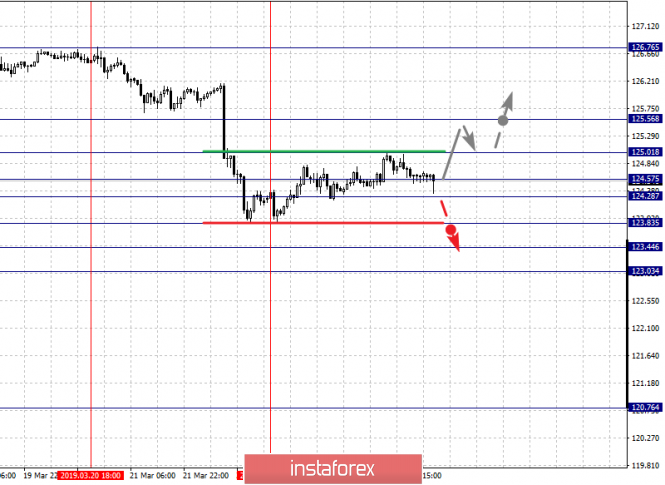

For the Euro / Yen pair, the key levels on the H1 scale are: 125.56, 125.01, 124.57, 124.28, 123.83, 123.44 and 123.03. Here, we are following the development of the downward structure from March 20, at the moment the price is in the correction. Continuation of the movement to the bottom is expected after the breakdown of 123.83. Here the target is 123.44, in the corridor 123.83 - 123.44 of price consolidation. For the potential value for the downward movement, we consider the level of 123.03, after reaching which, we expect a rollback to the top.

Consolidation is possible in the corridor 124.28 - 124.57. The breakdown of the latter value will lead to a prolonged correction. Here, the target is 125.01. This level is a key support for the bottom. Its breakdown by price will allow us to count on the movement to the potential target - 125.56.

The main trend is the downward structure of March 20, the stage of correction.

Trading recommendations:

Buy: 124.60 Take profit: 125.00

Buy: 125.05 Take profit: 125.55

Sell: 123.80 Take profit: 123.48

Sell: 123.42 Take profit: 123.06

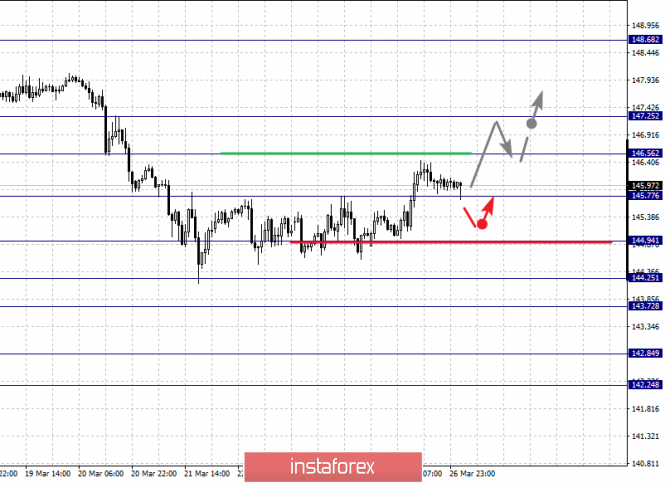

For the Pound / Yen pair, the key levels on the H1 scale are : 147.25, 146.56, 145.77, 144.94, 144.25, 143.72, 142.84 and 142.24. Here, we continue to follow the development of the downward cycle of March 14. Continuation of the movement to the bottom is expected after the breakdown of 144.94. In this case, the first goal is 144.25. Short-term downward movement is possible in the corridor 144.25 - 143.72. The breakdown of the latter value should be accompanied by a pronounced downward movement. Here, the target is 142.84. For the potential value of the bottom, we consider the level of 142.24, after reaching which, we expect a rollback to the top.

Short-term ascending movement is possible in the corridor 145.77 - 146.56. The breakdown of the latter value will lead to the development of the ascending structure. Here, the first goal is 147.25, and up to this level, we expect clearance of expressed initial conditions.

Trading recommendations:

Buy: 145.80 Take profit: 146.55

Buy: 146.65 Take profit: 147.25

Sell: 144.94 Take profit: 144.25

Sell: 143.70 Take profit: 142.86

The material has been provided by InstaForex Company - www.instaforex.com

Download NOW!

Download NOW!

No comments:

Post a Comment