Forecast for March 28:

Analytical review of H1-scale currency pairs:

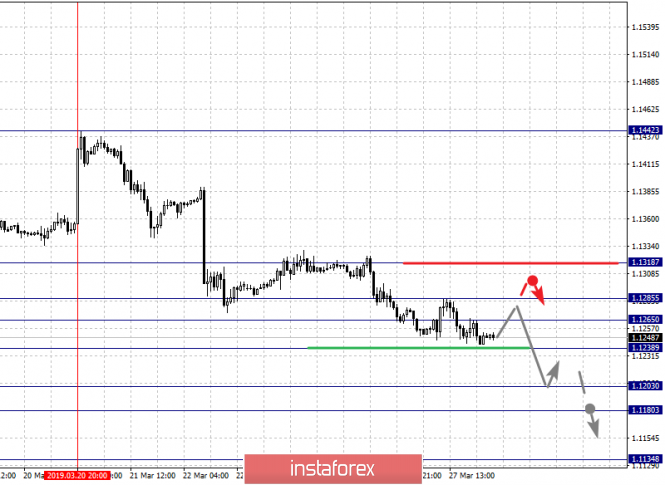

For the euro / dollar pair, the key levels on the H1 scale are: 1.1318, 1.1285, 1.1265, 1.1238, 1.1203, 1.1180 and 1.1134. Here, we continue to follow the development of the downward structure of March 20. Continuation of the movement to the bottom is expected after the breakdown of the level 1.1238. In this case, the target is 1.1203. The price consolidation is in the corridor 1.1203 - 1.1180 . We consider the level 1.1134 to be a potential value for the bottom. After reaching this level, we expect a rollback to the top.

Short-term upward movement is possible in the corridor 1.1265 - 1.1285, and breaking the last value will lead to in-depth movement. Here, the goal is 1.1318. This level is a key support for the downward structure.

The main trend is the downward structure of March 20.

Trading recommendations:

Buy 1.1265 Take profit: 1.1283

Buy 1.1287 Take profit: 1.1318

Sell: 1.1236 Take profit: 1.1205

Sell: 1.1203 Take profit: 1.1181

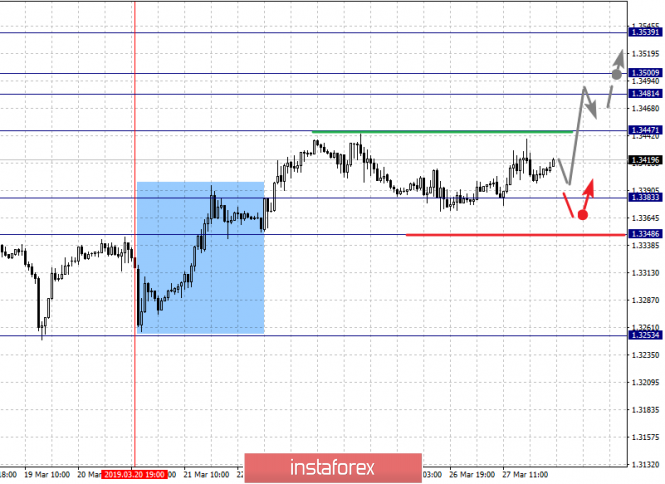

For the pound / dollar pair, the key levels on the H1 scale are 1.3434, 1.3379, 1.3302, 1.3271, 1.3223, 1.3132, 1.3092 and 1.3018. Here, we are following the ascending structure of March 21. Continuation of the movement to the top is expected after the breakdown of the level 1.3223. In this case, the goal is 1.3271. The passage at the price of the noise range 1.3271 - 1.3302 should be accompanied by a pronounced upward movement. Here, the goal is 1.3379. Near this level is the price consolidation. For the potential value to the top, we consider the level of 1.3434. After reaching which, we expect a rollback to the bottom.

Short-term downward movement is possible in the range of 1.3132 - 1.3092. Hence, the probability of a reversal to the top and the breakdown of level 1.3092 will have to develop a downward structure. In this case, the first potential target is 1.3018.

The main trend is the ascending structure of March 21.

Trading recommendations:

Buy: 1.3223 Take profit: 1.3270

Buy: 1.3303 Take profit: 1.3379

Sell: 1.3132 Take profit: 1.3093

Sell: 1.3090 Take profit: 1.3020

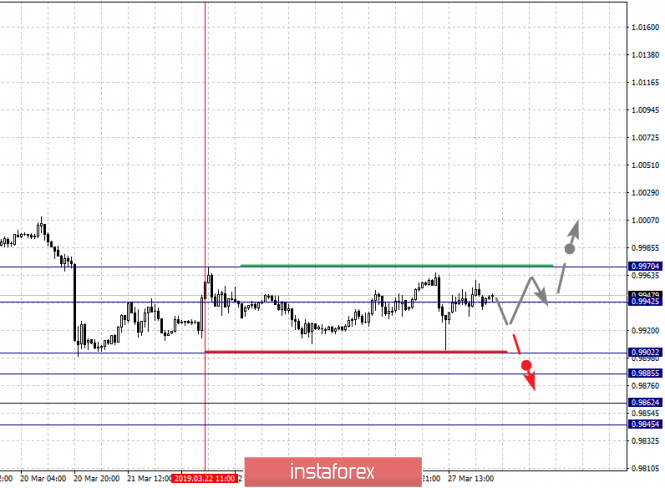

For the dollar / franc pair, the key levels on the H1 scale are: 0.9970, 0.9942, 0.9928, 0.9902, 0.9885, 0.9862 and 0.9845. Here, the situation is in equilibrium. Short-term downward movement is possible in the corridor 0.9902 - 0.9885. The breakdown of the latter value should be accompanied by a pronounced downward movement. Here, the goal is 0.9862. For the potential value of the bottom, we consider the level of 0.9845. After reaching which, we expect a consolidation.

Short-term upward movement is possible in the corridor 0.9942 - 0.9970. The breakdown of the latter value will have to form an upward structure. In this case, the goals have not been defined yet.

The main trend is the equilibrium situation.

Trading recommendations:

Buy: 0.9943 Take profit: 0.9970

Sell: 0.9902 Take profit: 0.9886

Sell: 0.9883 Take profit: 0.9862

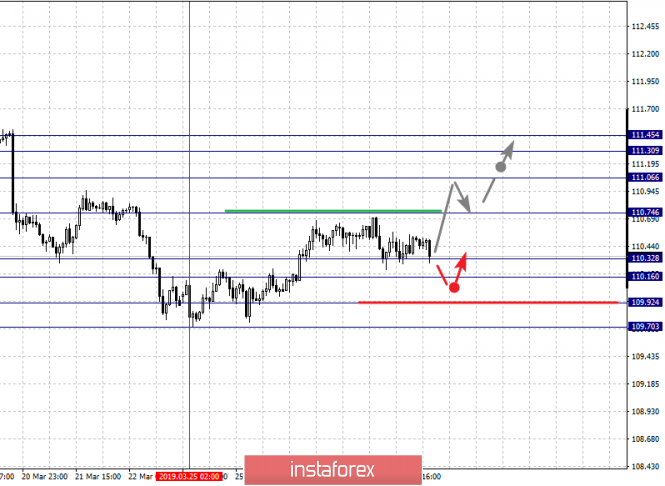

For the dollar / yen pair, the key levels on the H1 scale are: 111.45, 111.30, 111.06, 110.74, 110.32, 110.16, 109.92 and 109.70.

Short-term downward movement is possible in the corridor 110.32 - 110.16. The breakdown of the latter value will lead to a prolonged correction. Here, the goal is 109.92. This level is a key support for the upward structure. Its breakdown will lead to the development of a downward trend. In this case, the first goal is 109.70.

The main trend: the rising structure of March 25.

Trading recommendations:

Buy: 110.75 Take profit: 111.05

Buy: 111.07 Take profit: 111.30

Sell: 110.32 Take profit: 110.16

Sell: 110.14 Take profit: 109.92

For Canadian dollar / dollar pair, the key levels on the H1 scale are: 1.3539, 1.3500, 1.3481, 1.3447, 1.3383 and 1.3348. Here, we are following the development of the ascending structure of March 20. Continuation of the movement to the top is expected after the breakdown of 1.3447. In this case, the goal is 1.3481. The price consolidation is in the corridor 1.3481 - 1.3500. For the potential value of the top, we consider the level of 1.3539. After reaching which, we expect to go into a correction.

Short-term downward movement is possible in the corridor 1.3383 - 1.3348. The breakdown of the latter value will have to be made for the pronounced initial conditions of the downward cycle.

The main trend is the ascending structure of March 20, the stage of correction.

Trading recommendations:

Buy: 1.3447 Take profit: 1.3480

Buy: 1.3500 Take profit: 1.3539

Sell: 1.3381 Take profit: 1.3350

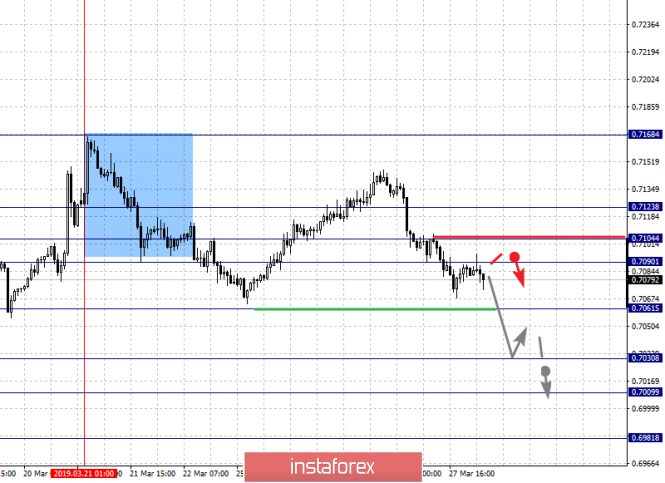

For the Australian dollar / dollar, the key levels on the H1 scale are : 0.7123, 0.7104, 0.7090, 0.7061, 0.7030, 0.7009 and 0.6981. Here, the next target for the downward movement will be determined from the downward structure on March 21st. Continuation of the movement to the bottom is expected after the breakdown to 0.7060. In this case, the goal is 0.7030. The breakdown of which will lead to short-term downward movement in the corridor 0.7030 - 0.7009. For the potential value of the bottom, we consider the level of 0.6981. And from this level, we expect a rollback to the top.

Short-term upward movement is possible in the corridor of 0.7090 - 0.7104. The breakdown of the latter value will lead to a prolonged correction. Here, the target is 0.7123. This level is a key support for the downward structure.

The main trend is the downward structure of March 21.

Trading recommendations:

Buy: 0.7090 Take profit: 0.7102

Buy: 0.7106 Take profit: 0.7120

Sell: 0.7060 Take profit: 0.7032

Sell: 0.7028 Take profit: 0.7010

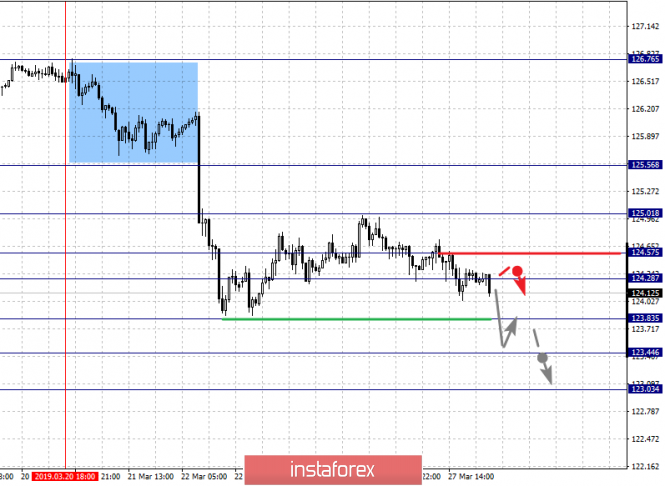

For the euro / yen pair, the key levels on the H1 scale are: 125.56, 125.01, 124.57, 124.28, 123.83, 123.44 and 123.03. Here, we are following the development of the downward structure of March 20. Continuation of the movement to the bottom is expected at level 123.83 after the breakdown. Here, the target is 123.44. The price consolidation is in the corridor 123.83 - 123.44. For the potential value of the downward movement, we consider the level of 123.03. After reaching which, we expect a rollback to the top.

The consolidated movement is possible in the corridor 124.28 - 124.57. The breakdown of the latter value will lead to a prolonged correction. Here, the target is 125.01. This level is a key support for the bottom. Its breakdown by price will allow us to count on the movement to the potential target 125.56.

The main trend is the downward structure of March 20.

Trading recommendations:

Buy: 124.60 Take profit: 125.00

Buy: 125.05 Take profit: 125.55

Sell: 123.80 Take profit: 123.48

Sell: 123.42 Take profit: 123.06

For the pound / yen pair, the key levels on the H1 scale are: 147.25, 146.56, 145.77, 144.94, 144.25, 143.72, 142.84 and 142.24. Here, we continue to follow the development of the downward cycle for March 14. Continuation of the movement to the bottom is expected after the breakdown of 144.94. In this case, the first goal is 144.25. Short-term downward movement is possible in the corridor 144.25 - 143.72. The breakdown of the latter value should be accompanied by a pronounced downward movement. Here, the target is 142.84. For the potential value of the bottom, we consider the level of 142.24. After reaching which, we expect a rollback to the top.

Short-term ascending movement is possible in the corridor 145.77 - 146.56. The breakdown of the latter value will lead to the development of the ascending structure. Here, the first goal is 147.25. And up to this level, we expect clearance of expressed initial conditions.

The main trend is the downward structure of March 14.

Trading recommendations:

Buy: 145.80 Take profit: 146.55

Buy: 146.65 Take profit: 147.25

Sell: 144.94 Take profit: 144.25

Sell: 143.70 Take profit: 142.86

The material has been provided by InstaForex Company - www.instaforex.com

Download NOW!

Download NOW!

No comments:

Post a Comment