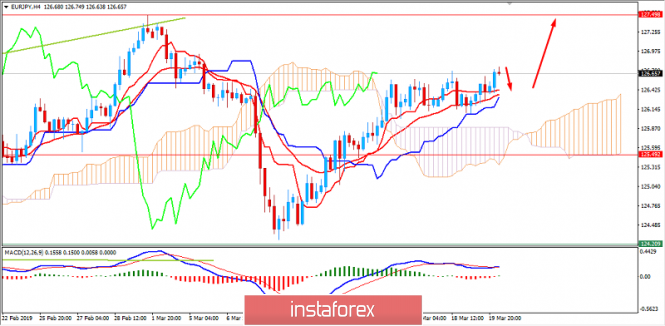

EUR managed to sustain bullish momentum since the break above 125.00-50 resistance area with a daily close. The price volatility resulted in certain corrections and indecision between the range of 126.00-50. The price recently broke above with an indication of further bullish pressure.

The eurozone is struggling with the economic slowdown ahead of BREXIT. Nevertheless, EUR manages to sustain bullish momentum over JPY. According to European Commission's Vice President Valdis, there is grwoing likelihood that the UK will leave the EU without a deal as developments in the UK parliament showcase broadbased disagreement with Prime Minister Theresa May's Brexit Deal. Additionally, recently the Bank of France downgraded outlook on economic growth to about 1.4% this year from 1.7% expansion in the previous forecast.

Italian Trade Balance report was published with a decrease to 0.32B from the previous figure of 2.76B which was expected to increase to 3.45B and German ZEW Sentiment rose to -3.6 from the previous figure of -13.4 which was expected to be at -11.0. Today German PPI report is going to be published which is expected to decrease to 0.2% from the previous value of 0.4%.

On the other hand, today Japan's Monetary Policy Meeting Minutes were posted where Bank of Japan's policymakers disagreed on the pace of central bank's monetary stimulus program as escalating external risk is affecting Japan's economic recovery. Recently the BOJ kept the key policy rate unchanged at -0.1% and 10-year bond yields below zero under a policy dubbed yield curve control. Ahead of National Core CPI report which is expected to be unchanged at 0.8% and Flash Manufacturing PMI expected to increase to 49.2 from the previous figure of 48.9, JPY is expected to be quite indecisive and weak.

Meanwhile, the market is showing mixed optimism on EUR despite an ecomomic slowdown ahead of the BREXIT event on March 29th. EUR is expected to keep momentum over JPY in the coming days. As the BOJ is going through disagreement and Japan's economy is facing external pressure, this is certainly bearish for the Japanese currency.

Now let us look at the technical view. The price recently broke above 126.50 area with a daily close while being carried by the dynamic level of 20 EMA, Tenkan, and Kijun line. As the price broke above the volatile price range, currently a retracement towards 126.50 area is expected before the price extends its climb with a target towards 127.50 area in the coming days. As the price remains above 125.00-50 support area, the bullish bias is expected to continue.

Download NOW!

Download NOW!

No comments:

Post a Comment