USD has been dominating CAD recently in an impulsive manner which is expected to continue further with increased volatility in the coming days.

The Bank of Canada is going to unveil the overnight rate today which is expected to be unchanged at 1.75% along with BOC Rate Statement. The unchanged rate is currently analyzed as the best spot for the monetary policy as it is also unchanged. Though the Bank of Canada has set a goal of increasing the interest rate to 2.5%-3.5% but there is currently no hurry to get there. Canada's economy boosted in recent years but an increase in crediting muted the process. In this context, CAD is still struggling to assert strength over USD.

On Friday, Canada's Employment Change report is going to be published which is expected to have a significant decrease to 0.3k from the previous figure of 66.8k while Unemployment Rate is expected to be unchanged at 5.8%.

On the other hand, the US economy is currently quite healthy despite the ongoing trade conflict with China. In January, Fed officials confirmed the intention to pause in the cycle of monetary tigthening. This is viewed as a measure to support the growing economy. Thus, USD gained significant momentum. Recently FED Official Kashkari stated that the US labor market still has some improvements to be done along like an increase in wages. Ahead of NFP reports to be published on Friday this week, USD is expected to trade with higher volatility as the expectations are quite mixed. Today US ADP Non-Farm Employment Change is going to be published which is expected to decrease to 190k from the previous figure of 213k and Trade Balance is also expected to decrease to -57.8B from the previous figure of -49.3B.

Meanwhile, USD/CAD is expected to be quite volatile ahead of upcoming macroeconomic reports and events later this week. Though USD has a greater probability of dominating CAD further, the pair is likely to make certain retracements and corrections.

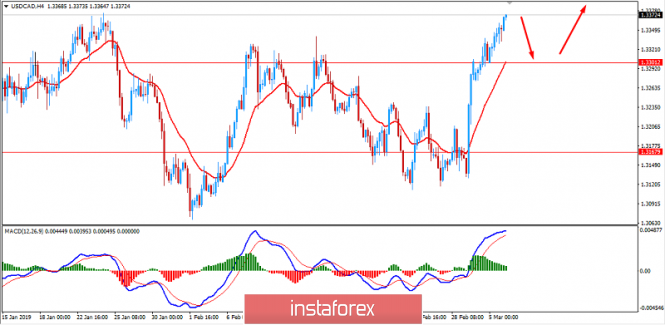

Now let us look at the technical view.The price is currently pushing higher quite impulsively in non-volatile manner which has recently formed Bearish Continuous Divergence. Though the price is propped up with the bullish momentum, it is expected to retrace back to the 1.3300 area before a further climb with a target towards 1.35 resistance area in the future.

Download NOW!

Download NOW!

No comments:

Post a Comment