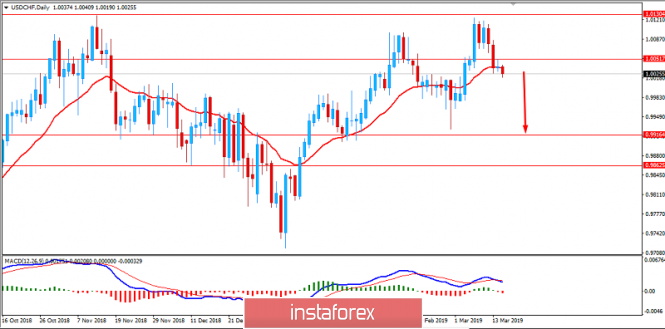

The USD/CHF pair has been quite volatile and impulsive with the recent bearish momentum rejecting off the 1.0130 area with a daily close which is expected to lead to further bearish pressure in the coming days.

The US Federal Reserve could announce a plan to shrink its bond stockpile which could be held between next week or late June. The Fed is going to hold a meeting on March 19 and 20 to discuss about the reducing bond portfolio and the possibility of another interest rates hike again. According to the reports, the Fed assets have increased to more than $4.5 trillion and the central bank is currently trying to reduce it to below $4 trillion.

The US having better data on Retail Sales failed to perform well with the CPI and PPI reports published this week, which led the currency to further weakness and certain CHF gains which can build up further in the coming days. Today, the US Empire State Manufacturing Index report is going to be published which is expected to increase to 10.1 from the previous figure of 8.8; Capacity Utilization Rate is anticipated to rise to 78.5% from the previous value of 78.2%; Industrial Production is expected to increase to 0.4% from the previous negative value of -0.6%; and Prelim UoM Consumer Sentiment is expected to grow to 95.5 from the previous figure of 93.8.

On the CHF side, CHF SECO Economic Forecast has been recently held with optimistic outcome which helped the currency to gain further momentum over USD. Moreover, PPI report has also been published with a significant increase to 0.2% from the previous negative value of -0.7% which was expected to be at -0.1%. Swiss Central Bank is still quite neutral about their policies despite the recent domination of USD, but as the things turns significantly, certain changes may occur in the coming months.

As of the current scenario, USD with its recent economic reports has underperformed resulting in the weakness of the impulsive gains against CHF. Moreover, CHF has been quite positive with the economic events and reports which also managed to attract the potential bears to push the price against USD as well. If the upcoming USD economic reports does not meet the expectation, further gains of CHF is expected.

Now let us look at the technical view. The price has been residing below the 1.0050 area after an impulsive bearish pressure since the bounce off the 1.0130 area. The price is currently quite volatile and is forming a bearish divergence which may lead the price further lower towards the 0.9900-50 support area in the coming days. As the price remains below the 1.0130 area with a daily close, the bearish pressure is expected to continue further.

Download NOW!

Download NOW!

No comments:

Post a Comment