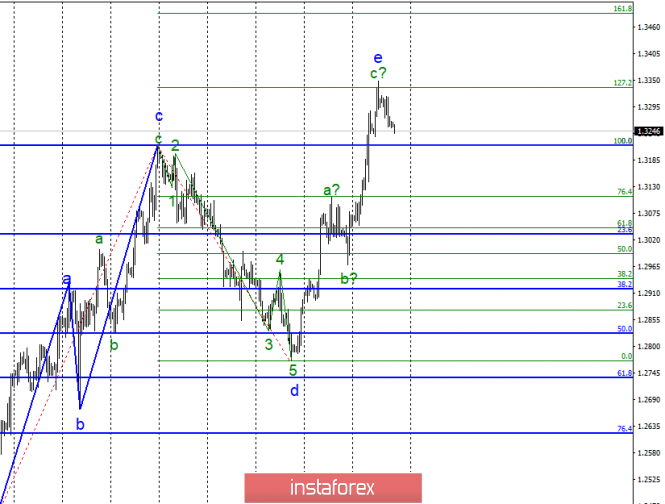

Wave counting analysis:

On February 28, the GBP / USD pair lost about 45 bp and made an unsuccessful attempt to break through the level of 127.2% Fibonacci. Therefore, there are now reasons for assuming the completion of the construction of the entire ascending wave and the entire upward trend section, which took a quite non-standard form. If this is true, as part of building a new downward set of waves. Just like before, the news background is not on the side of the pound sterling. Thus, reducing the pair is a very likely option.

Shopping goals:

1.3333 - 127.2% Fibonacci

1.3489 - 161.8% Fibonacci

Sales targets:

1.2734 - 61.8% Fibonacci

1.2619 - 76.4% Fibonacci

General conclusions and trading recommendations:

The wave pattern still assumes the completion of the construction of the ascending wave and the transition to the construction of a downward set of waves. . An unsuccessful attempt to break through the level of 127.2% is a strong signal. Hence, small sales are now expedient with a protective order above 1.3340.

The material has been provided by InstaForex Company - www.instaforex.com

Download NOW!

Download NOW!

No comments:

Post a Comment