Recently, AUD/USD has been trading with a bullish bias which might continue, backed by positive employment reports that were published today.

The Australian cash rate was unchanged at 1.5%. This news came along with the RBA dovish statement which put AUD under pressure against other major currencies. However, the strong Chinese data is holding the AUD from a decline. Besides, the Australian labor market is strong which also provides support to AUD. Policymakers admitted softer economic growth, removing their forecast of 3% for this year. The global slowdown in the economy is affecting the international trade of Australia which has been decreasing recently. The long-term bond yields have fallen while short-term bank funding costs have weakened further.

Today Australia's employment change report was published with an increase to 25.7k from the previous figure of 10.7k which was expected to be at 15.2k. At the same time, the Unemployment Rate showed an increase to 5.0% as expected versus the previous level of 4.9%.

On the other hand, the US is struggling with the economic reports and negotiating the trade terms with China, Canada and Europe. The US 10-year Treasuries' rate is still low by historical standards, so policymakers may wish to hold more short-term securities. If the Federal Reserve fails to achieve the 2% inflation target, there will be a possible recession which might be avoided by changing short-term interest rates. The consumer price index increased by 1.9% before seasonal adjustment which is still below 2% target. Furthemore, the labor market is strong while the GDP is expected to bounce back according to the Fed's latest meeting. In February, the unemployment rate was at 3.8% while the production rate somehow rebounded.

The US retail sales will be published today where the expectation is 0.9% and the previous data was -0.2%. Additionally, the core retail sales is expected to increase to 0.7% from the previous value of -0.4%. What is more, the Philly Fed manufacturing index is expected to decrease to 11.2 from the previous figure of 13.7. Moreover, the unemployment claims is also expected to be negative with an increase to 207k from the previous figure of 196k.

As of the current scenario, AUD is still expected to sustain bullish momentum, whereas any positive outcome of the US upcoming economic reports is expected to lead to impulsive counter trend in the coming days.

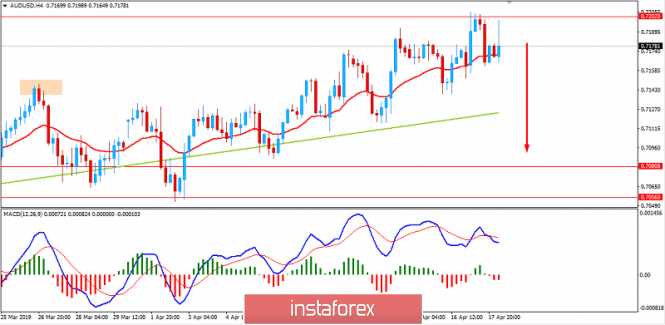

Now let us look at the technical view. The price has recently bounced off the 0.7200 area with a daily close which is expected to lead the price lower towards 0.7000-50 support area as it remains contained. The upward momentum is currently getting weaker and volatile which also indicates a possibility of a counter trend along the way. The strong bearish momentum is expected to lead to continuous pressure as the price remains below 0.7200 area with a daily close.

Download NOW!

Download NOW!

No comments:

Post a Comment