The euro managed to sustain its gains over the yen despite the Eurozone economic slowdown and BREXIT challenges. The only source which has helped the euro to gain momentum during this difficult time is currently the investor morale, while the economic situation remains fragile.

Ahead of the ECB Press Conference and Main Refinancing Rate to be published this week, sustainable gains on the euro side indicate the cumulative strength and market sentiment that the euro has acquired along the way over the yen. Though no policy changes are expected at Wednesday's ECB meeting, but discussion on easing, global recession fears, and German Bonds underperforming for the first time in last 3 years can have a significant impact on the meeting outcome. The Eurozone is currently struggling with many factors and th ECB is expected to be strict with the current process, while the officials seem to be quite worried about the downside risks to growth and inflation forecasts.

Today, the Italian Retail Sales report is going to be published which is expected to decrease to -0.2% from the previous value of 0.5%. If the expectations are met, certain weakness of the euro growth may be observed along the way.

As for the yen, the Current Account report has recently showed a certain increase to 1.96T as expected from the previous figure of 1.83T, but Consumer Confidence and Economy Watchers Sentiment have showed results worse than expected which affected the market sentiment. Bank of Japan Governor Kuroda is still quite optimistic about the economic growth despite the fact that it is being affected by the recent challenges of exports and imports. Moreover, the Government's reflections on sales tax hike may also lead to lower consumer spending which would affect the long-term economic growth.

Recently, the Bank of Japan has cut its assessment for three of the country's nine regions which is the biggest number of downgrades in six years, as external impacts on the economy are extending. Tomorrow, the JPY Bank Lending report is going to be published which is expected to be unchanged at 2.3%, Core Machinery Orders are anticipated to increase to 3.0% from the previous value of -5.4%, and PPI is also expected to rise to 1.0% from the previous value of 0.8%.

As of the current scenario, both the euro and the yen facing tremendous economic challenges are currently expected to result in certain volatility, whereas any outcome from the ECB meeting and the yen with its optimistic expectations in the coming days may be followed by a price decline, resulting in regaining the momentum of the yen over the euro.

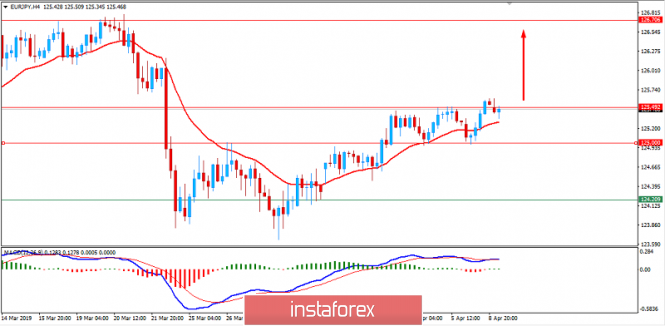

Now let's consider the pair from the technical point of view. The price is currently residing at the edge of the 125.50 resistance area while being carried by the dynamic level of 20 EMA as support. Though the price is still residing inside the corrective range between the 125.00-50 area but showing certain impulsive bullish momentum and rejecting the bearish pressure, this indicates that 125.50 is going to be broken above soon. As the price breaks above 125.50 with a daily close, further bullish momentum with the target towards the 126.50-70 resistance area is expected in the coming days.

Download NOW!

Download NOW!

No comments:

Post a Comment