USD managed to sustain bullish momentum over JPY despite a series of downbeat reports published recently that indicates severe JPY weakness.

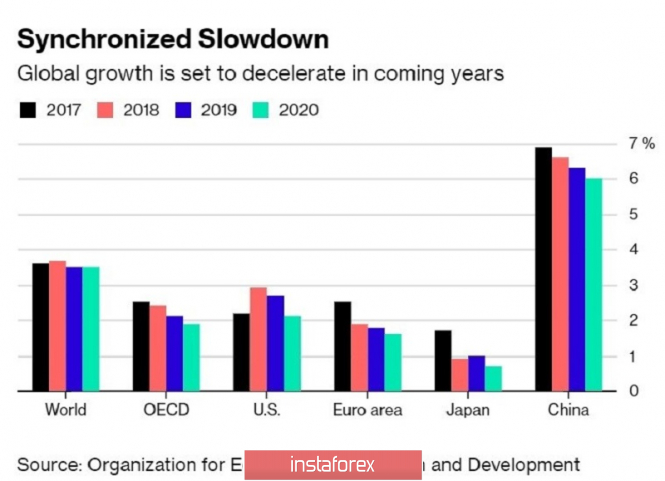

US Retail Sales unexpectedly fell below the 0 level in February that came as an unpleasant surpise as it is one of the most important criteria for consumer activity which signals a possible change in inflation. The Manufacturing activity showed an increase. However, a slump in Retail Sales and Core Retail Sales which entered the contraction area is expected to cause weakness of USD. The loss of momentum in consumer activity is viewed to be the result of higher interest rates, a slowdown in the globsl economy, the ongoing US-China trade conflict, and Brexit.

On Friday, the US Labor Department is due to release a report of major importance. Analysts have mixed expectations of the private employment data that could cap USD gains this week. Besides, Average Hourly Earnings report is going to be published with a possible decrease to 0.2% from the previous value of 0.4%, Non-Farm Employment Change is expected to surge to 175k from the previous figure of 20k, and Unemployment Rate is expected to be unchanged at 3.8%. Today US Core Durable Goods Orders report is going to be published which is expected to increase to 0.3% from the previous value of -0.2% and Durable Goods Orders is expected to drop to -1.1% from the previous value of 0.3%.

Download NOW!

Download NOW!

No comments:

Post a Comment