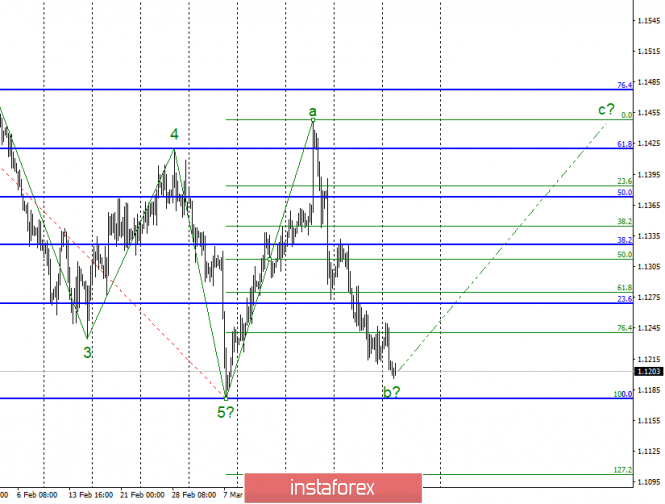

Wave counting analysis:

On Monday, April 1, trading ended for EUR / USD with a loss of another 15 bp. The previous price low has been updated, so there is every reason to assume the continuation of the construction of the downward wave, which continues to be identified as b. However, a successful attempt to break through the minimum of wave 5 will lead to the need to refine the wave marking and complicate the downward trend. At the same time, small chances that the tool will not update wave 5 at least still remain. The preliminary inflation rate in the European Union was only 1.4%, which is worse than what the markets is expecting to see. The news background remains neutral overall, but with a minimal bias in favor of the US currency.

Sales targets:

1.1177 - 100.0% Fibonacci

Shopping goals:

1.1448 - 0.0% Fibonacci

General conclusions and trading recommendations:

The pair is supposedly close to completing wave b. Now, I recommend waiting for a new signal to complete this wave and start buying a pair with targets near the 1.1455 mark, which corresponds to the maximum of wave a. There is an option in which the pair will go beyond the previous minimum, however, the rising wave in any case will be built and, most likely, will be commensurate with all previous waves.

The material has been provided by InstaForex Company - www.instaforex.com

Download NOW!

Download NOW!

No comments:

Post a Comment