Today, in terms of news and events, we again have a day off Bright Monday in the UK and Europe. It is only in the United States where there are statistics on sales in the secondary housing market, and they expect a decline.

United States 17:00 MSK - Sales in the secondary housing market (Mar): Prev. 5.51M ---> Forecast 5.311

Further development

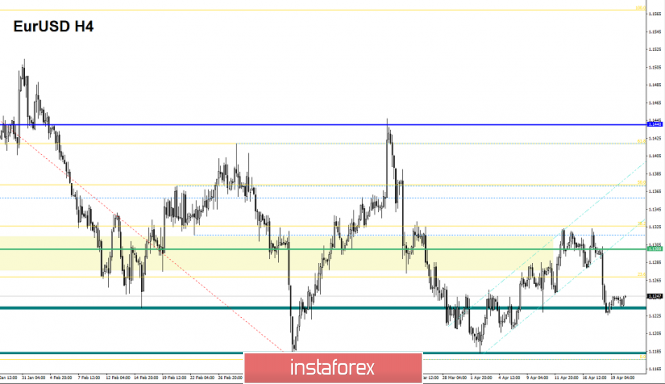

Analyzing the current trading chart, we see that the accumulation of 1.1235 / 1.1250 still takes place on the market, and the pullback that many are waiting for has not yet come. Traders, in turn, occupy a waiting position, tracking clear breakdown of the accumulation boundaries of 1.1235 / 1.1250 while maintaining the inertial move.

- Positions for the purchase are considered in the case of a clear price fixing higher than 1.1255, with preservation of bullish interest. The primary outlook is 1.1270.

- Positions for sale in the case of a clear price fixing lower than 1.1225 with preservation of bearish interest. The primary perspective is 1.1180.

Indicator Analysis

Analyzing a different sector of timeframes (TF ), we see that in the short term there is an upward interest, which reflects our stagnation with the attempt to rollback. Intraday and mid-term prospects are focused on the downward course, against the backdrop of a recent rally. It should be understood that today trading volumes have been reduced, and the price, after all, is in a range of clusters, thus indicators indicators can be changeable.

Weekly volatility / Measurement of volatility: Month; Quarter; Year

Measurement of volatility reflects the average daily fluctuation , based on monthly / quarterly / year.

(April 22, was based on the time of publication of the article)

The current time volatility is 13 points. It is likely to assume that due to reduced volumes, the volatility of the day may be low.

Key levels

Zones of resistance: 1.1300 **; 1.1440; 1.1550; 1.1650 *; 1.1720 **; 1.1850 **; 1.2100

Support areas: 1.1180; 1.1000

* Periodic level

** Range Level

The material has been provided by InstaForex Company - www.instaforex.com

Download NOW!

Download NOW!

No comments:

Post a Comment