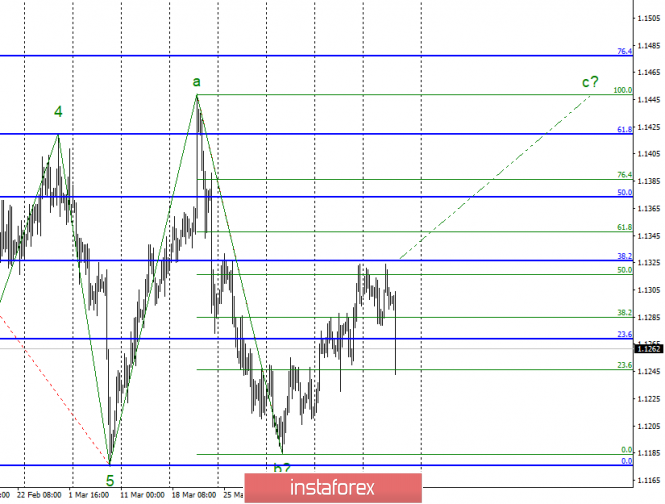

Wave counting analysis:

On Wednesday, April 17, trading ended for EUR / USD by 15 bp increase. However, today, after the third unsuccessful attempt to break the level of 50.0% Fibonacci, the pair fell down. However, so far this decrease in no way violates the current wave pattern, which still involves the construction of a wave C in the composition of the ascending set of waves. However, now we need a signal to resume the construction of the wave C, which may be an unsuccessful attempt to break the level of 23.6% on the lower Fibonacci grid. Or break the level of 50.0% Fibonacci. The news background for the euro, meanwhile, remains neutral. Even the inflation report released yesterday did not help either the euro or the dollar. In the current conditions, the forecast may be a failed attempt to break the level of 23.6% and the resumption of the increase.

Sales targets:

1.1177 - 100.0% Fibonacci

Purchase targets:

1.1448 - 100.0% Fibonacci

1.1476 - 76.4% on the highest Fibonacci grid.

General conclusions and trading recommendations:

The pair, presumably, remains within the framework of the construction of wave C, but now the construction of an internal downward wave has begun. I believe that the pair will bounce from 23.6% level and will resume rising with targets placed near the calculated marks of 1.1448 and 1.1476. But a successful attempt to break the level of 23.6% can lead to complications of the current wave marking.

The material has been provided by InstaForex Company - www.instaforex.com

Download NOW!

Download NOW!

No comments:

Post a Comment