Bitcoin, which has been in the shadows of the financial markets for many months, has finally exploded. For the first time since May 2022, BTC/USD quotes have exceeded 35,000, trading volumes have started to rise, and demand for cryptocurrency futures has increased. What are the reasons for Bitcoin's transformation? How did it manage to go from an ugly duckling to a beautiful swan? And what lies ahead for the token?

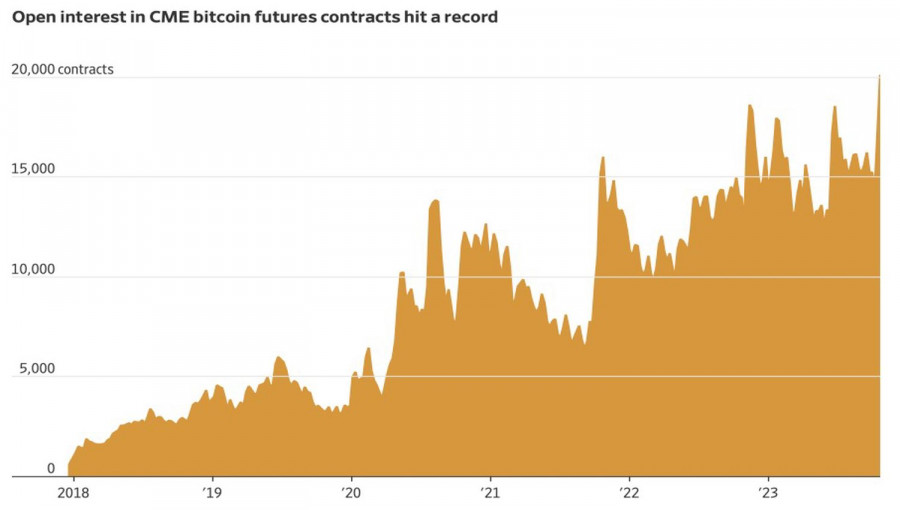

Bitcoin Futures Open Interest Dynamics

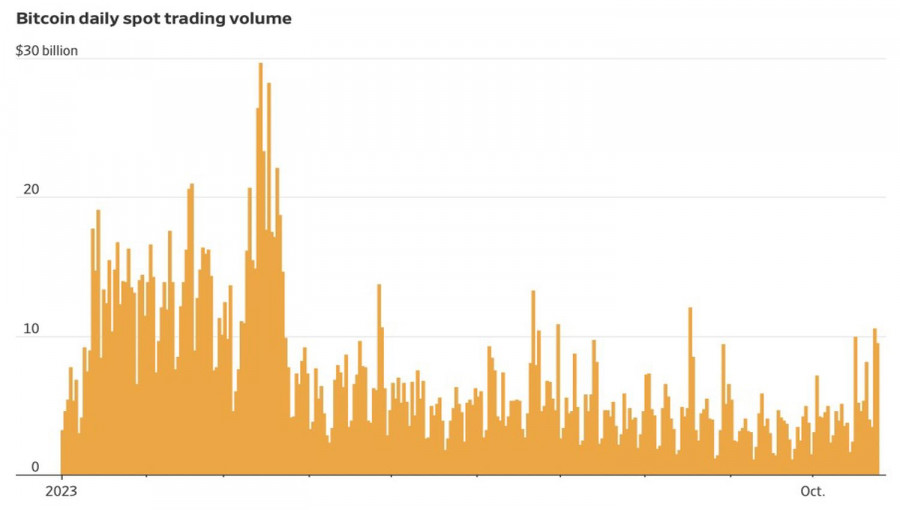

Markets are confident that the main driver behind the BTC/USD rally is the increased investor confidence in the approval of BlackRock's application by the Securities and Exchange Commission to create an ETF with Bitcoin as the underlying asset. After much intrigue and twists and turns, the markets exploded with fake news on social media and the registration of a new fund with a clearing company. There is an opinion that a positive SEC verdict will make the digital asset industry more transparent and bring new money into the market. The increase in trading volumes with cryptocurrency confirms these rumors.

The belief in improved market transparency and increased regulation is also linked to the guilty verdict for Sam Bankman-Fried, the founder of FTX. This sets a precedent for other scammers, making them think about the legality of their operations and increasing trust in the crypto market as a whole.

Bitcoin Trading Dynamics

Other possible drivers for the BTC/USD rally include the Bitcoin halving in 2024 and the intention of cryptocurrency advocate Tom Emmer to become the Speaker of the House of Representatives. A more likely version appears to be the improvement in global risk appetite after the FOMC meeting on October 31–November 1. According to its results, the market formed the opinion that the Federal Reserve will no longer raise interest rates, despite the central bank's plans in September to raise borrowing costs to 5.75% in 2023.

In reality, FOMC forecasts are the opinions of specific officials at a certain point in time, not action plans. They can be wrong, and investors believed that was the case. Now, the markets are testing the Federal Reserve's theory that rates will remain at 5.5% for an extended period. If the upcoming statistics, including U.S. employment data for October, show signs of a cooling U.S. economy, Treasury bond yields and the dollar will decline, while stock indices will rise.

As a result, Bitcoin is expected to benefit from the tailwind of improving global risk appetite. This could lead it to new highs, but not to the promised figure of 150,000, which is twice the record peak. However, the rally of the cryptocurrency sector leader has a good chance of continuing.

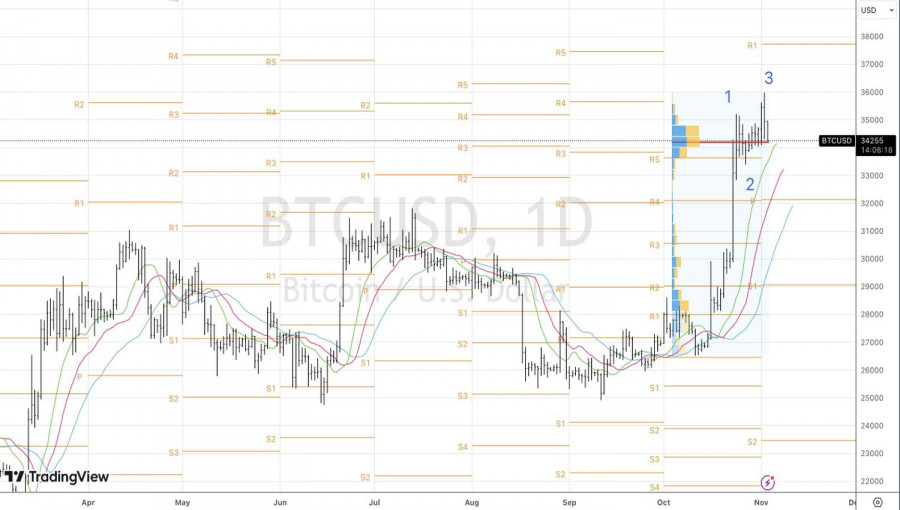

Technically, the formation of the reversal pattern "Anti-Turtles" on the daily BTC/USD chart increases the risk of a pullback. For short-term sales, a successful test of the fair value at 34,200 is suitable. Subsequently, a rebound from support levels at 33,700 and 32,950 will allow for a shift to long positions.

Download NOW!

Download NOW!

No comments:

Post a Comment