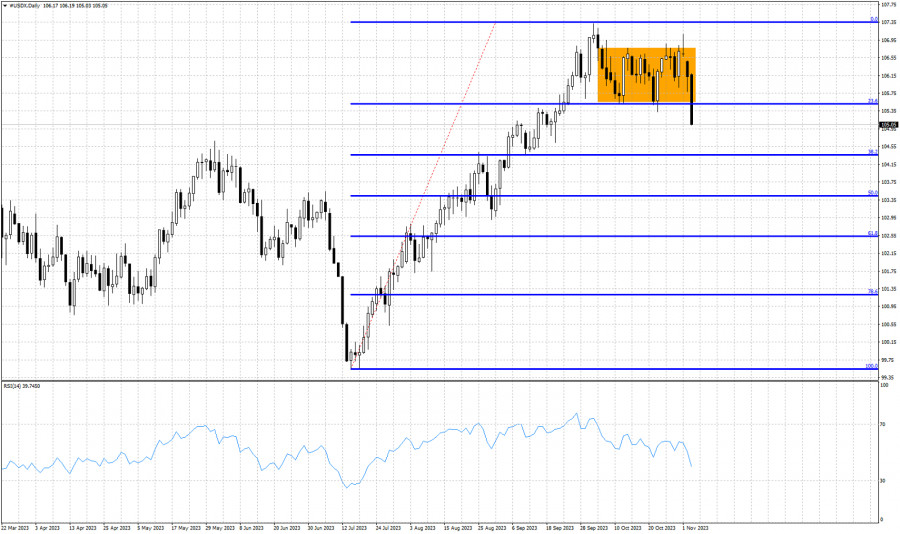

Blue lines- Fibonacci retracement levels

Orange rectangle- consolidation range

The Dollar index is under pressure. Today price broke below the consolidation range it was in for several days and has moved below the 23.6% Fibonacci retracement. Current price action implies that the entire upward movement from 99.55 is complete. The Dollar index has most probably started a corrective phase that will be expressed with a pull back that could bring the index towards 104.35 and 103.45. Over the coming days we expect the Dollar index to continue lower. The RSI is downward sloping making lower lows and still far away from oversold territory. Today's highs around 106.17 are considered key resistance level and as long as we trade below this level, we remain pessimistic.

Download NOW!

Download NOW!

No comments:

Post a Comment