Analysis of Friday's Trades

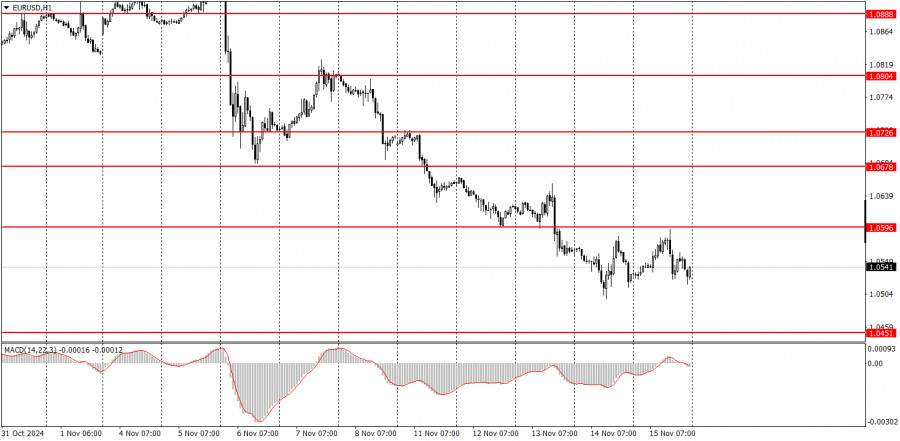

1H Chart of EUR/USD

On Friday, the EUR/USD currency pair continued trading within the range formed on Thursday. The price attempted another correction, but again, it failed. The euro couldn't even consolidate above the nearest level of 1.0596. As a result, it appears the price may linger in place for a while before resuming its decline. Currently, the macroeconomic and fundamental background is unimportant to market participants. In other words, the euro may continue falling, and the dollar may keep rising even without relevant news or reports. Regarding Friday's US reports, retail sales grew by 0.4%, beating the forecast of 0.3%, while the previous month's figure was revised upward from 0.4% to 0.8%. On the other hand, industrial production declined by 0.3%, aligning with forecasts, but the previous month's figure was revised downward from -0.3% to -0.5%. However, the retail sales report outweighed the impact of industrial production.

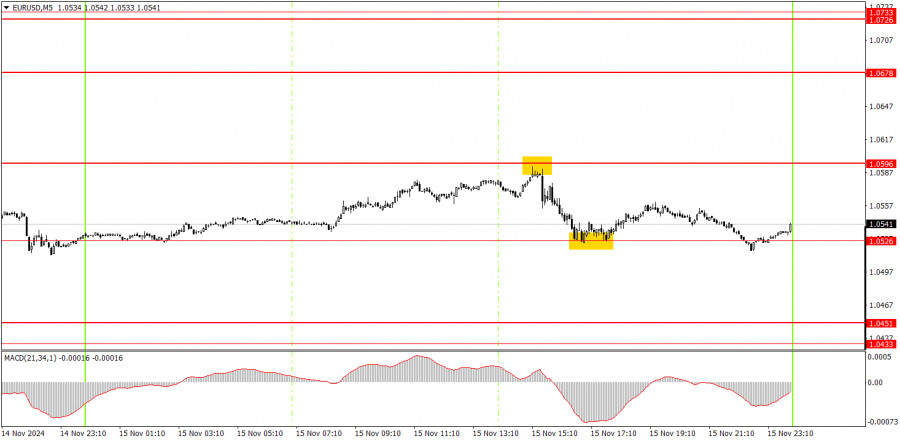

5M Chart of EUR/USD

On the 5-minute chart, two nearly perfect trading signals were formed on Friday. First, the price slightly rebounded from the 1.0596 level and later tested and rebounded from 1.0526. Novice traders could have opened short positions first and then long positions. At the same time, long trades didn't yield much profit, short positions allowed for gains of around 20–30 pips.

Trading Strategy for Monday:

The EUR/USD pair might attempt another correction on the hourly timeframe. However, the market shows no signs of buying the euro or taking profits in short positions. If it happens soon, we believe any new correction will likely be weak and require supportive news for the euro. Even then, such news might not always help, as the market currently favors the US dollar.

On Monday, we expect the decline to resume, especially after Powell's hawkish comments last week, and given the euro's inability to break above the 1.0596 level.

Consider the following levels for trading: 1.0433-1.0451, 1.0526, 1.0596, 1.0678, 1.0726-1.0733, 1.0797-1.0804, 1.0845-1.0851, 1.0888-1.0896, 1.0940-1.0951. The only significant event scheduled for Monday is a speech by European Central Bank President Christine Lagarde. However, given the recent dovish signals from the ECB, it's unlikely Lagarde will provide much support for the euro.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 points apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 15 points in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

The material has been provided by InstaForex Company - www.instaforex.com #

Download NOW!

Download NOW!

No comments:

Post a Comment