Fresh winds of change. Inflation in the USA, the Eurozone, and Britain is confidently moving towards the target, the WTO predicts an expansion of global trade, and the market volatility index VIX falls to the lowest levels since January 2020. Investors have forgotten about fear. Greed rules the ranks, and in such a situation, the U.S. dollar, as a safe-haven asset, is having a tough time. The bulls on EUR/USD are gathering strength to storm the November high. And there, who knows, reaching 1.1 might be just around the corner.

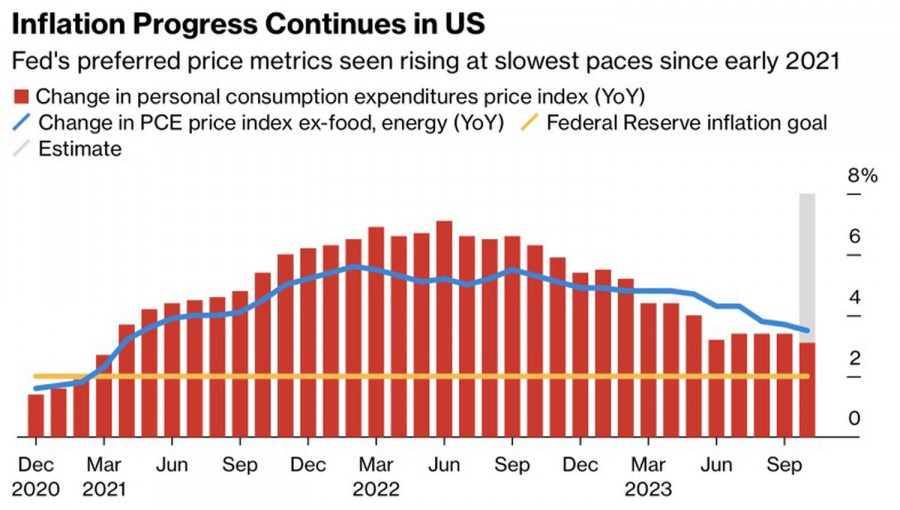

The Personal Consumption Expenditures (PCE) index, the Federal Reserve's preferred inflation indicator, according to Bloomberg experts, slowed down to 3.1% in October. Consumer prices in the Eurozone dropped to 2.7% in November. Indicators are confidently moving towards targets, and despite what the Fed and the ECB say, investors don't believe them. This has happened more than once in the current cycle of monetary tightening, and the markets got burned every time. But this time, they are determined to win—simply because they don't want to lose anymore.

Dynamics of American Inflation

Seemingly, the weakness of the Eurozone economy, likely in recession, and the rapid approach of inflation to the target dictate the need for a faster easing of the ECB's monetary policy compared to the Fed. Markets really believe that the deposit rate will be lowered for the first time in April, and the federal funds rate in May. However, for investors, it is important that all central banks act in unison, as their massive monetary stimulus fuel the rally in stock indices, improve global risk appetite, and give the green light to the bulls on EUR/USD.

Moreover, the WTO pleasantly surprised with the announcement of the growth of the periodic goods indicator above the 100 mark, signaling an expansion of global trade in the fourth quarter. In October, the organization reduced its forecast for this indicator to 0.8%. The figure is significantly below the historical average of 2.6%. Nevertheless, the WTO is optimistic about 2024. In its opinion, global trade will grow by 3.3%. It is quite possible that positive dynamics have already begun, which is good news for the export-oriented Eurozone and its currency—the euro.

If you add to this Deutsche Bank's forecast of S&P 500 growth to a record high of 5100 in 2024, as inflation slows down, and if there is a recession in the U.S. economy, it will likely be shallow and short-lived, then the optimism of the bulls on EUR/USD is understandable. The rally in U.S. stocks will harm the dollar. So, no matter how weak the euro may be, it has room to grow.

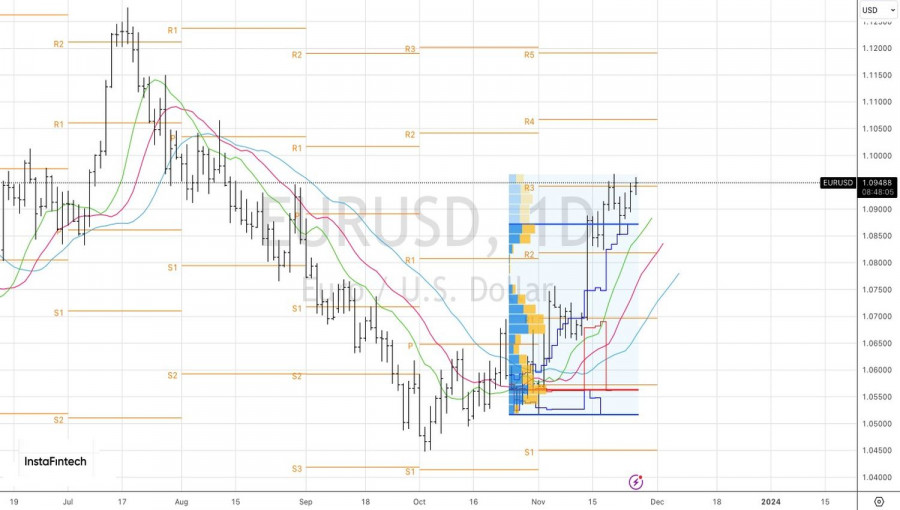

Technically, on the daily chart, EUR/USD has an upward movement. However, the battle for the important pivot level of 1.094 continues. If the bulls leave it behind, an update of the November high will provide an opportunity to increase long positions with targets at 1.102 and 1.106. On the contrary, a victory for the bears will increase the risks of forming a 1-2-3 pattern and a reason for short-term sales of the main currency pair.

Download NOW!

Download NOW!

No comments:

Post a Comment