Just as needed to be proven. The US labor market report has shown that the economy is starting to cool down. This means that all the talk about raising the federal funds rate is baseless. In reality, the Federal Reserve is content with the work done and has no intention of doing more. However, their intention to keep borrowing costs elevated for an extended period is being seriously questioned. They allowed EUR/USD to break through the upper boundary of the 1.05-1.07 range. Is consolidation a thing of the past?

In October, employment in the United States increased by 150,000, and the unemployment rate rose to 3.9%. Both figures turned out worse than Bloomberg experts' forecasts, which led to a drop in Treasury yields and weakened the dollar. The slowdown in wage growth to 4.1% confirms the downward trend in inflation and has reduced the likelihood of monetary tightening in 2023 to 9% for derivatives. A month ago, that probability stood at 39%.

US employment

Considering how bullish bets on the dollar and bearish bets on Treasuries were, the EUR/USD rally could proceed very quickly. Markets are testing the idea of the Federal Reserve maintaining borrowing costs at a plateau for an extended period. If the US economy continues to deteriorate, the central bank will have fewer reasons to persist. At some point, there will be a "dovish" turn, which will finally break the downtrend in EUR/USD.

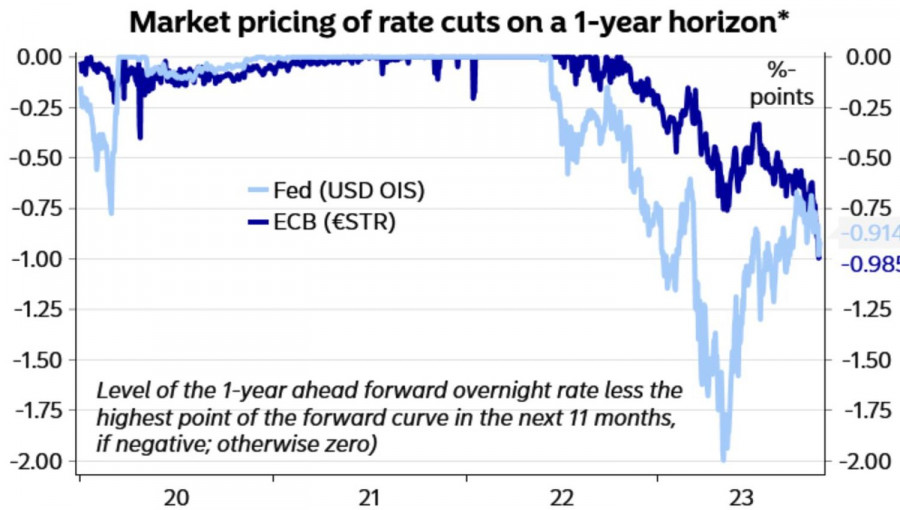

Currently, derivatives indicate a decrease in the federal funds rate by 80-100 basis points to 4.75% in 2024, which is at odds with the Fed's stance. The market principle "don't fight the Fed" has not been revoked. However, the central bank makes mistakes from time to time, and investors are well aware that it's possible to make good money from its missteps.

Market expectations for the Fed and ECB interest rates

Thus, the market narrative has changed in November. While previously, markets were wondering if the Fed would resume its monetary tightening cycle, they are now concerned about the truthfulness of its intentions to keep rates at a plateau. Investors don't believe them and are actively getting rid of the US dollar.

In such a situation, how weak the euro is doesn't matter. Yes, the Eurozone's economy leaves much to be desired. However, the ECB's Chief Economist, Philip Lane, looks to the future with optimism. He expects that the currency bloc will avoid a recession. His colleague on the Governing Council, Isabel Schnabel, believes that it cannot be stated with full certainty that interest rates have peaked. Even geopolitics and the impending energy crisis in Europe do not scare the bulls on the major currency pair.

Technically, on the daily chart, EUR/USD has broken out of the consolidation range of 1.05-1.07. This represents the execution of a "Breakout and Pullback" pattern. There is a high probability of transitioning to the trending stage, which allows for adding to long positions formed from 1.065 and 1.067. The targets are set at 1.08 and 1.09.

Download NOW!

Download NOW!

No comments:

Post a Comment