Over the past few months, I have consistently mentioned that I expect a decline from the British currency. My conclusions are based not only on the wave pattern but also on the overall news background, the state of the economy, and the prospects for changes in central bank interest rates. The more I study these issues, the more confident I become that the current plan is correct. The problem lies in the timing of its implementation.

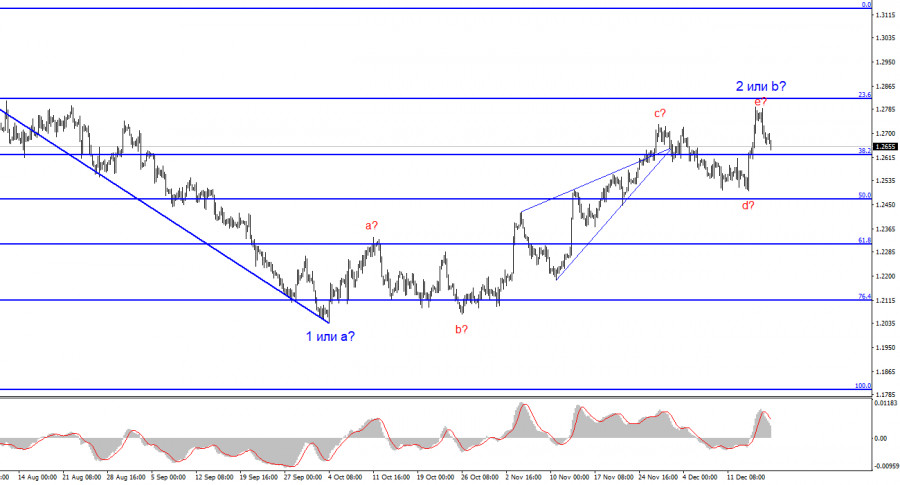

The presumed wave 2 or b for the British pound could have easily completed its construction as early as November. By that time, its size was already about 50% of wave 1 or a, which is a sufficient condition for transitioning to the construction of wave 3 or c. However, a series of weak U.S. data, followed by conflicting statements from Federal Reserve Chair Jerome Powell and Bank of England Governor Andrew Bailey, led to extending this wave. But the wave layout did not change because of this.

Sometimes it is worth paying attention to the opinions of other experts. For instance, MUFG Bank economists believe that the prospects for the British pound in 2024 are uncertain. They said that the pound exceeded all expectations in 2023 after the effects of Liz Truss's leadership hit the UK economy. The pound rose from the ashes and managed to recover, but the overall economic picture remains largely negative for the British currency.

According to MUFG analysts, at the beginning of 2024, the pound may remain afloat thanks to the BoE's cautious approach, which is not in a hurry to announce a transition to monetary easing, wanting to first make sure that inflation is moving in the right direction and will not bring surprises in the future. If inflation in the UK gradually slows down, the BoE's approach will persist longer, benefiting the pound once again. However, when the British central bank moves to rate cuts, the market will have no choice but to reduce demand for the pound amid a weakening economy, which may worsen further next year.

Changes in interest rates are like a "swing." One bank starts the tightening process earlier than it supports its currency. Then it starts cutting rates earlier than others, putting pressure on its currency. But overall, both the BoE, the Fed, and the European Central Bank act roughly the same way. If demand for the US dollar has decreased in recent months, it should start rising again.

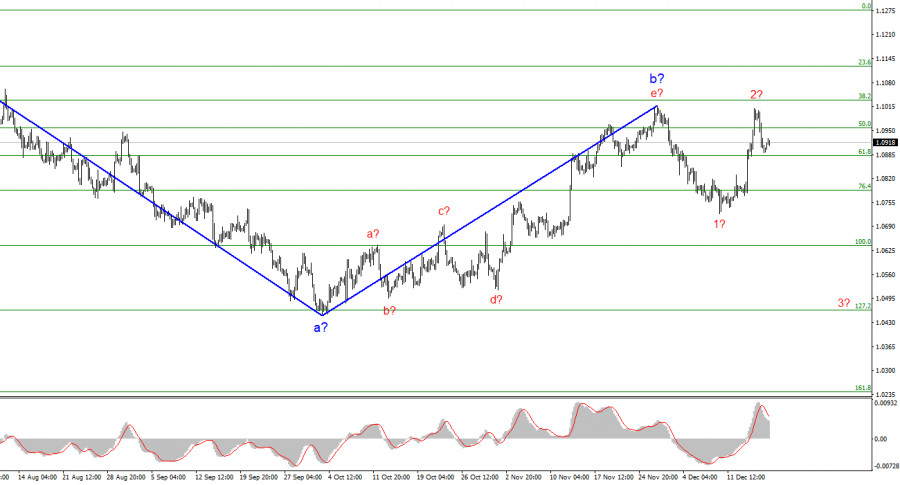

Based on the analysis, I conclude that a bearish wave pattern is still being formed. The pair has reached the targets around the 1.0463 mark, and the fact that the pair has yet to surpass this level indicates that the market is ready to build a corrective wave. Wave 2 or b has taken on a completed form, so in the near future I expect an impulsive descending wave 3 or c to form with a significant decline in the instrument. I still recommend selling with targets below the low of wave 1 or a. At the moment, wave 2 or b can be considered completed.

The wave pattern for the GBP/USD pair suggests a decline within the descending wave 3 or c. At this time, I can recommend selling the instrument with targets below the 1.2039 mark because wave 2 or b should end, and it could do so at any moment. The longer it takes, the stronger the fall. The peak of the assumed wave e in 2 or b can be used for short positions, and the order limiting possible losses on transactions can be placed above it.

Download NOW!

Download NOW!

No comments:

Post a Comment