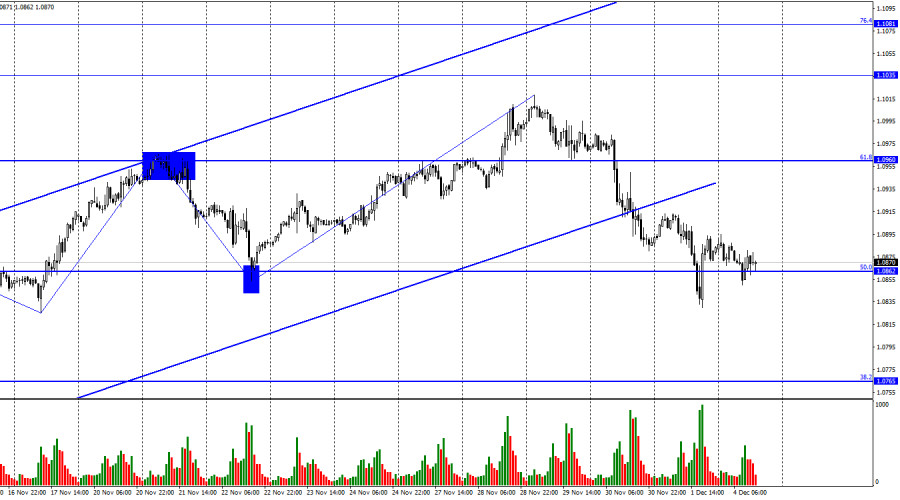

On Friday, the EUR/USD pair continued its downward movement towards the corrective level of 50.0% (1.0862) and closed the day above. Today, it attempted to consolidate below this level again but failed to do so. A rebound from the 1.0862 quotes will favor the euro and some growth towards the Fibonacci level of 61.8% (1.0960). The pair closing below the level of 1.0862 increases the likelihood of further decline towards the next corrective level of 38.2% (1.0765).

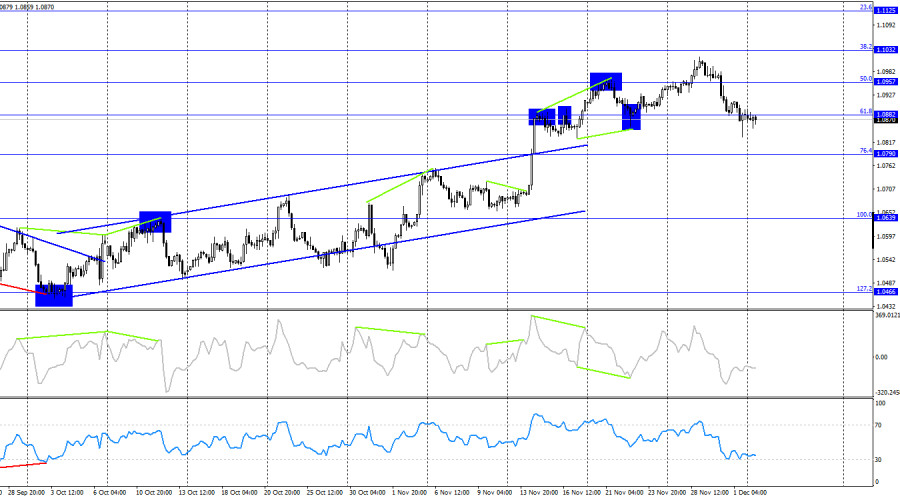

As of Monday, the wave situation is quite clear. The last downward wave that formed over the past few days broke the low of the previous wave. The bears also closed below the ascending trend corridor. Thus, I can now say that the "bullish" trend has become a "bearish" one. In the near future, an upward wave is possible, after which I will expect a new strong downward wave that should bring the pair to the minimum level of 1.0765.

On Friday, there needed to be more economic statistics. In the European Union and Germany, the final values of business activity indices in the manufacturing sectors for November were released. The index values were slightly higher than the initial forecasts, but traders were not particularly interested in these figures. The euro practically fell until late in the evening. In the evening in the United States, ISM and S&P business activity indices were released. Neither of them pleased the bears. The S&P index fell in November and again fell below the 50 level. The ISM index was expected to rise to 47.6 points but ultimately remained at 46.7.

Thus, the dollar's rise quickly ended because American statistics did not help it once again. With such data from the United States, it will be very difficult for the American currency to show growth, regardless of the chart picture and wave situation.

On the 4-hour chart, the pair reversed in favor of the American and fell to the Fibonacci level of 61.8% (1.0882). The pair's fixation below the level of 1.0882 increases the probability of further decline towards the next Fibonacci level at 76.4% (1.0790). However, if American statistics continue to disappoint constantly, it will be very difficult for the US currency to grow. There are no impending divergences with any of the indicators today.

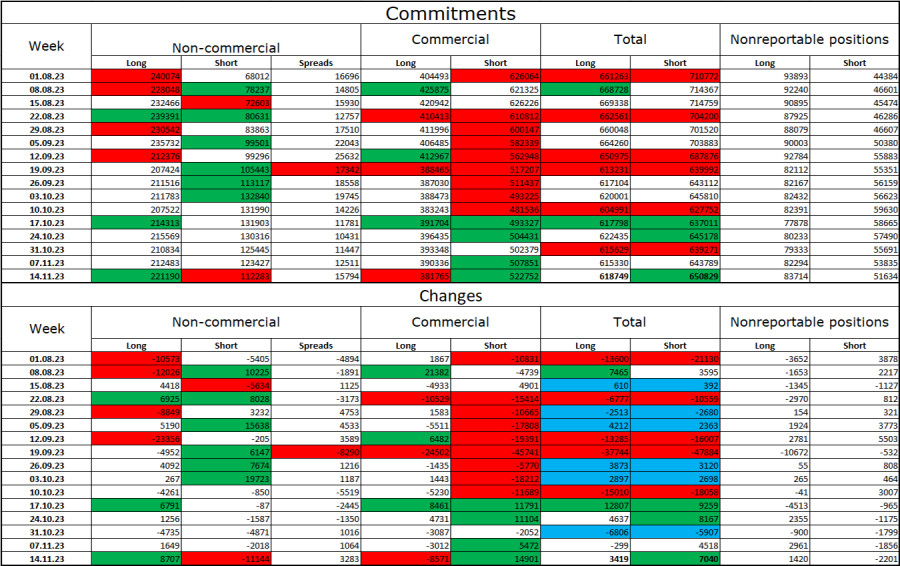

Commitments of Traders (COT) Report:

On the last reporting week, speculators opened 8707 long contracts and closed 11144 short contracts. The mood of major traders remains "bullish" and is starting to strengthen again. The total number of long contracts speculators hold is now 221 thousand, and Short contracts - 112 thousand. The difference is again twofold, although a few months ago, the gap was threefold. The situation will continue to change in favor of the bears. Bulls have dominated the market for too long, and now they need strong information support to start a new "bullish" trend. I don't see such a background now. Professional traders may continue to close Longs soon. The current figures allow for a resumption of the euro's decline in the coming months.

News Calendar for the US and the European Union:

European Union - Speech by ECB President Christine Lagarde (14:00 UTC).

On December 4, the economic events calendar contains only one speech by Christine Lagarde. The impact of the information background on traders' sentiment on Monday will be weak.

Forecast for EUR/USD and trader tips:

I recommend buying the pair today in case of a rebound above 1.0862 on the hourly chart with a target of 1.0960. I recommended selling when closing below 1.0960 on the hourly chart with a target of 1.0862. This level has been worked out. New sales or holding old ones are recommended when closing below 1.0862 with a target of 1.0765.

Download NOW!

Download NOW!

No comments:

Post a Comment