The dollar is strengthening since the opening of the new trading week, and geopolitical tensions in the Middle East have added to the bearish sentiment in the EUR/USD pair. Despite market expectations for the Federal Reserve to shift to a dovish stance regarding the prospects of its monetary policy, the dollar strengthened on Monday due to its status as a safe-haven asset.

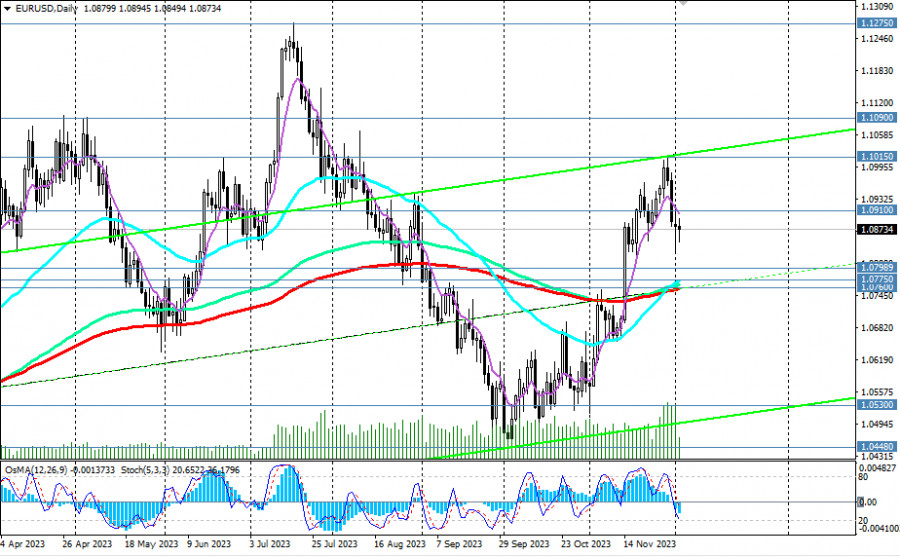

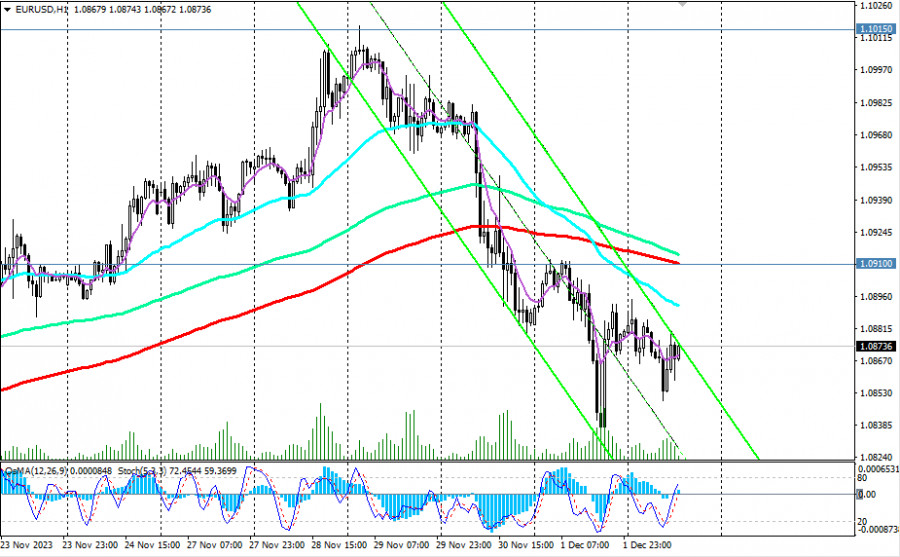

The first signal for entering short positions in EUR/USD has already been received. Last Thursday, after the publication of European CPIs, the price broke through the important support level of 1.0910 (144 EMA on the weekly chart and 200 EMA on the 1-hour chart at the moment).

A new signal for new short positions with a target at the support level of 1.0798 (200 EMA on the 4-hour chart) may be a breakdown of today's low at 1.0850.

Further decline and a breakdown of the zone of key support levels 1.0775 (50 EMA on the daily chart), 1.0760 (200 EMA on the daily chart, 50 EMA on the weekly chart) will lead EUR/USD into the zone of the medium-term bearish market, also confirming the revival of the long-term bearish trend of the pair, declining within a downward channel on the weekly chart.

Its lower boundary passes near the marks 1.0400, 1.0300. After breaking through local support levels 1.0530, 1.0450, they will become targets for the decline of EUR/USD.

In an alternative scenario, EUR/USD will resume its growth. The first signal for new long positions is a breakout of the resistance level 1.0910 with the probability of retesting the key resistance level of 1.1015 (200 EMA on the weekly chart). Its breakout and the breakout of local resistance at the level of 1.1100 will lead EUR/USD into the zone of the long-term bullish market.

Support levels: 1.0850, 1.0800, 1.0775, 1.0760, 1.0700, 1.0600, 1.0530, 1.0500, 1.0450, 1.0400

Resistance levels: 1.0900, 1.0910, 1.0945, 1.1000, 1.1015, 1.1090, 1.1100, 1.1200, 1.1275, 1.1300, 1.1400, 1.1500, 1.1600

Trading Scenarios

Sell Stop 1.0840. Stop-Loss 1.0920. Targets 1.0800, 1.0775, 1.0760, 1.0700, 1.0600, 1.0530, 1.0500, 1.0450, 1.0400

Buy Stop 1.0920. Stop-Loss 1.0840. Targets 1.0945, 1.1000, 1.1015, 1.1090, 1.1100, 1.1200, 1.1275, 1.1300, 1.1400, 1.1500, 1.1600

"Targets" correspond to support/resistance levels. This does not necessarily mean that they will be reached, but they can serve as a guide when planning and placing your trading positions.

Download NOW!

Download NOW!

No comments:

Post a Comment