Over the past few days, there has been a continuous decrease in demand for the currency of the European Union, whereas the demand for the British pound has remained unaffected. This singular observation prompts several questions. Specifically, one might inquire, "Why is this the case?" I would question if the demand for the British currency did not diminish despite positive developments in the UK. Conversely, it could be asked in the scenario of persistent adverse news from the European Union, which might clarify the Euro's decline and the British pound's resilience. However, the news background is different. We have been waiting for optimistic news from the UK, the European Union, and the US for quite some time. Nevertheless, over the past few months, the dollar has been steadily declining, and when it came time to build a downward wave for both pairs, only the Euro currency fell.

Today, the market had one important event that was supposed to reduce demand for the British Pound. Bank of England Governor Andrew Bailey stated that interest rates would not rise. It is still being determined whether he meant the upcoming meetings or the completion of the tightening monetary policy. The latter is more accurate. In any case, the Bank of England had a chance of a new interest rate hike, as inflation in the UK remains relatively high, and core inflation has slowed slightly from its peak values. However, today, Andrew Bailey made a decisive statement on this issue.

Nevertheless, the market did not react to the rather important statement by the head of the BoE. Therefore, the next question arises: what does the market need for demand for the British pound to decrease? The market may be waiting for data on the US labor market, which will be released this week. In this case, it all comes down to economic statistics in the US again. Then, British and European news and reports have no value. In my opinion, the current movements of the pair are not entirely logical, just like the market's reaction to important events. The British Pound is not making new attempts to resume the construction of wave 2 or b, but at this rate, this process will still resume because the market is unwilling to sell the pair.

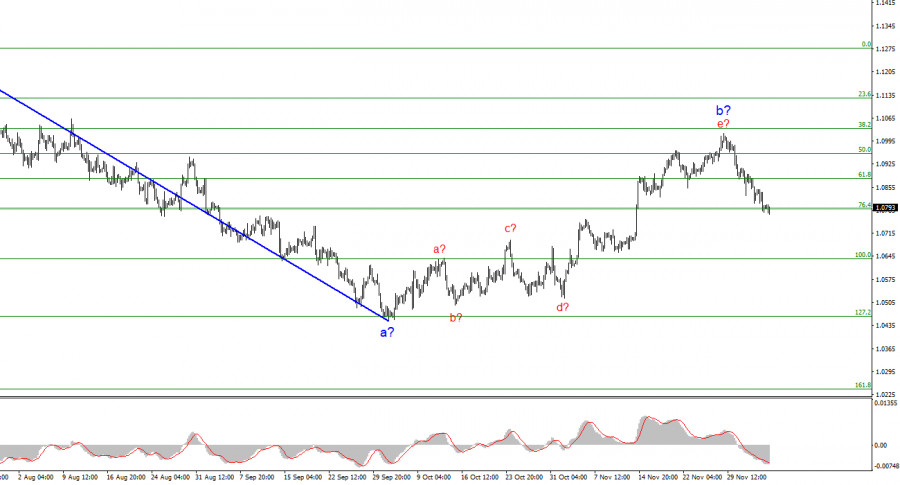

Based on the analysis conducted, the construction of a bearish wave set continues. The targets around the 1.0463 mark have been perfectly executed, and the unsuccessful attempt to break this mark indicated a transition to the construction of a corrective wave. Wave 2 or b has taken a completed form, so I expect the construction of an impulsive downward wave 3 or c soon with a significant decline in the pair. I still recommend selling with targets below the low of wave 1 or a. At this time, wave 2 or b can be considered complete.

The wave pattern of the pound/dollar pair suggests a decline within the downtrend. At most, the British pound can expect a correction. At this time, I recommend selling the pair with targets below the 1.2068 mark because wave 2 or b should eventually be complete and may finish at any moment. The longer it takes, the stronger the subsequent decline of the British pound will be. The narrowing triangle is a harbinger of the completion of the movement.

Download NOW!

Download NOW!

No comments:

Post a Comment