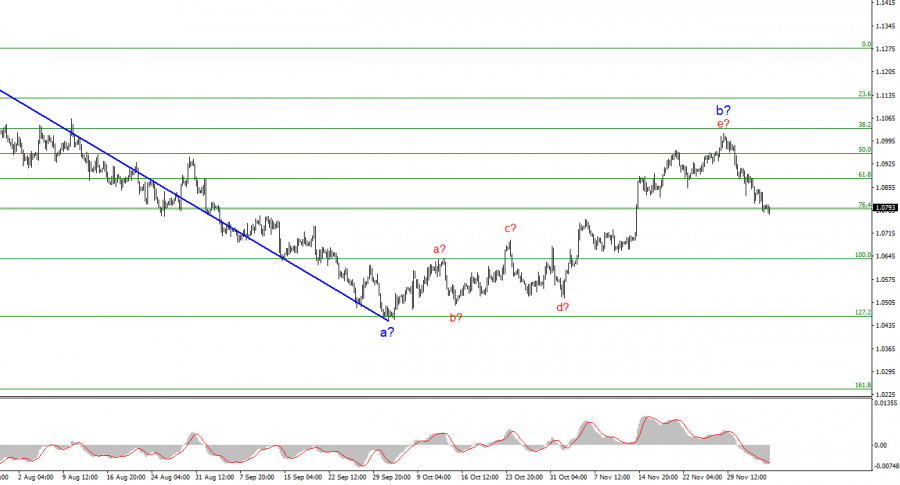

The wave analysis of the 4-hour chart for the euro/dollar pair remains quite clear. Over the past year, we have seen only three wave structures that constantly alternate with each other. Throughout 2023, I have regularly mentioned expecting the instrument around the 5th figure, where the construction of the last rising three-wave structure began. This target was achieved after the decline in July-October. After reaching this target, corrective wave 2 or b construction began, which had already taken a clear five-wave form. However, the inflation report in the U.S. led to this wave taking on an even more complex appearance. Nevertheless, the working scenario remains the same – wave 3 or c construction.

Regardless of how wave 2 or b turns out in the end (I warned that it could be much more complicated), the overall decline of the European currency will not be completed, as, in any case, the construction of the third wave of the downtrend is required. Most likely, wave e in 2 or b took a prolonged five-wave form but may already be completed.

Euro is under pressure again, but is it time for a correction?

The euro/dollar pair's rate decreased by ten basis points on Wednesday, but overall, the amplitude of movements today was very low. When writing this article, there were no significant events or reports, so the market traded lackluster today. The assumed first wave as part of 3 or c has already taken a convincing form and may be completed around the 1.0788 mark, corresponding to 76.4%, according to Fibonacci. However, I want to remind you that several important reports will be in the U.S. this week, so both sellers and buyers may still show themselves. If these reports coincide with the wave labeling in their nature, then the construction of the second wave as part of 3 or c, which should be corrective, can be expected. This means that a retreat from the achieved lows is imminent. At the same time, a successful attempt to break through the 1.0788 mark will indicate the market's readiness for further instrument sales.

Recently, many analysts have regularly said that economic statistics in the U.S. are disappointing. This is true, but European statistics rarely please the markets. This is explained by central banks' "restrictive" policy, which negatively affects the economy. Today, the business activity index in the EU construction sector increased from 42.7 points to 43.4 points. The increase is recorded but very weak, and the indicator's value is still too far from the saving of 50.0. Retail trade increased in volume by 0.1%, but the market expected an increase of 0.2%. Therefore, we are again talking about negativity.

General Conclusions:

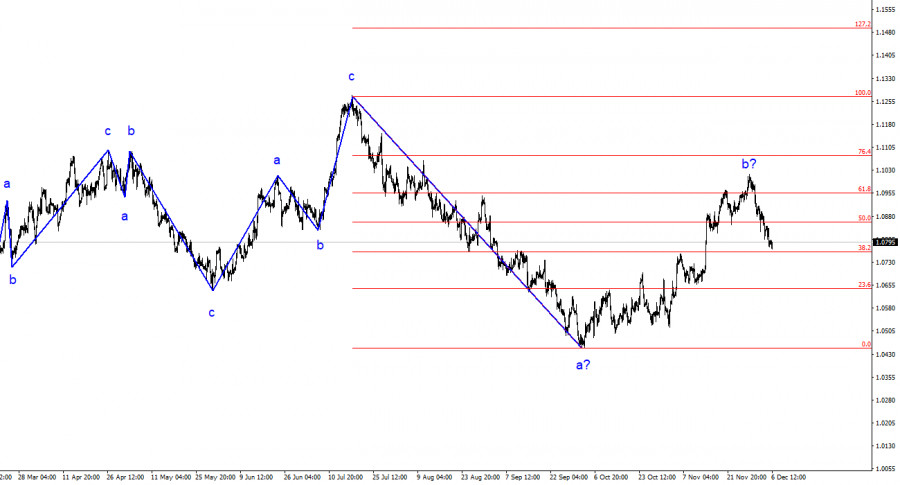

Based on the conducted analysis, I conclude that the construction of a bearish wave set continues. Targets around the 1.0463 mark have been perfectly worked out, and the unsuccessful attempt to break through this mark indicated a transition to the construction of a corrective wave. Wave 2 or b has taken a completed form, so in the near future, I expect the construction of an impulsive downward wave 3 or c with a significant decline in the instrument. I still recommend sales with targets located below the low of wave 1 or a. At the moment, wave 2 or b can be considered complete.

On the larger wave scale, it is seen that the construction of corrective wave 2 or b continues, which, in length, is already more than 61.8% from the first wave, according to Fibonacci. As I have already mentioned, this is not critical; the scenario with the construction of wave 3 or c and a decline in the instrument below the 4th figure remains valid.

Download NOW!

Download NOW!

No comments:

Post a Comment