The premium article will be available in00:00:00

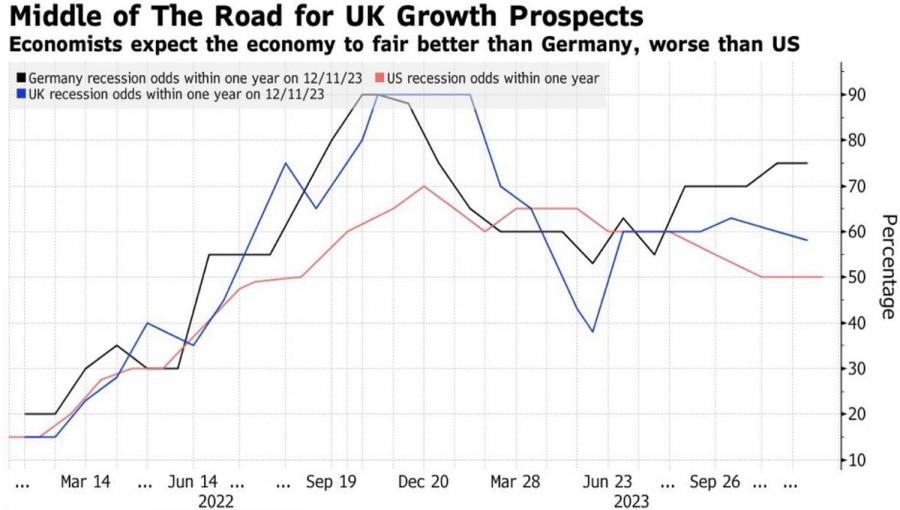

At the turn of 2023 and 2024, there was a lot of optimism regarding the British pound. The Bank of England is expected to make smaller repo rate cuts than the Federal Reserve and European Central Bank, as the UK economy begins to pick up and the growth in global risk appetite supports sterling as a pro-cyclical currency. Against this backdrop, Goldman Sachs' forecast of GBP/USD rising to 1.3 by the end of June seemed quite logical. Fidelity International even

Fresh articles are available only to premium users

Read analytics in early access, getting information first

Get

Download NOW!

Download NOW!

No comments:

Post a Comment