Gold took a step back amid the financial markets' reassessment of the prospects for a Federal Funds rate hike in 2024. Derivatives indicate a 77% chance of the start of a monetary policy tightening cycle in March, although at the end of last year the figure was 88%. This shift in views suggests that investors believe the Federal Reserve will not be as aggressive as previously thought. This is causing the S&P 500 to decline and the yield on U.S. Treasury bonds to fall. Simultaneously, the dollar is strengthening, creating headwinds for XAU/USD.

Despite 2023 being gold's first successful year in the last three, with it reaching a historical high in December, all its gains were made in the fourth quarter. From the beginning of October, its prices rose by 13%. With such a result, gold closed 2023 with a 13% increase. The rise from January to May due to fears of a recession in the U.S. economy was replaced by a fall from May to October due to fears that the Federal Reserve would raise rates higher than expected.

Gold Dynamics

The "bulls" in XAU/USD were aided by mass purchases by central banks and geopolitics, including armed conflicts in Ukraine and Israel, Houthi attacks on ships in the Red Sea, and the banking crisis in the U.S. last spring. On the other hand, capital outflows from gold-oriented ETFs restrained buyers' offensive spirit. In 2024, the situation is expected to change significantly. In 2023, capital was flowing into money market funds; now, it should move in the opposite direction. The question is worth $6 trillion, a portion of which will surely find refuge in the precious metal market.

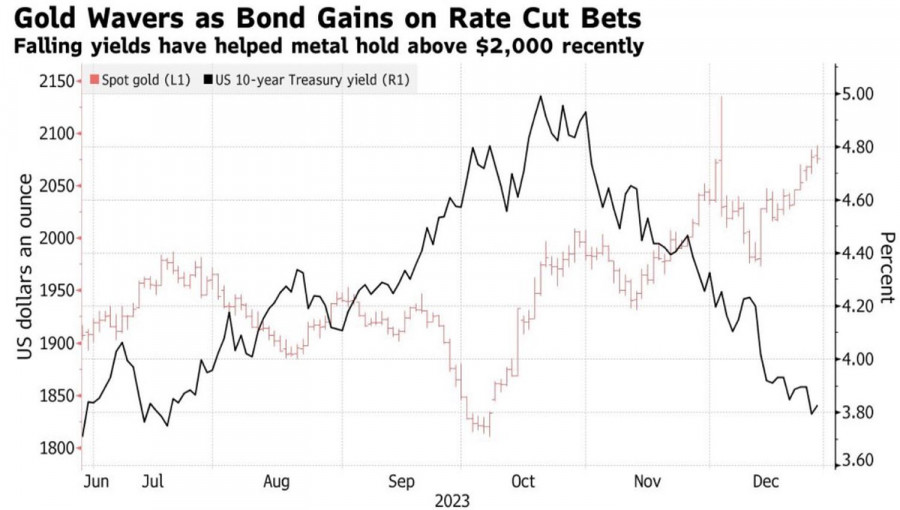

If gold grew on expectations of a dovish pivot by the Federal Reserve and the market's belief in the weakening of monetary policy by the world's leading central banks, what will happen when they actually start cutting rates? The prospects for XAU/USD look bullish. The question is how soon the precious metal will update its historical high. The answer should be sought in the debt and currency markets. If the United States expects a soft landing or recession, a decline in the yield of U.S. Treasury bonds will stimulate gold purchases. Conversely, an acceleration of the U.S. economy will be a reason for its sale.

Dynamics of U.S. Treasury bond yields and gold

In this regard, December's non-farm employment statistics in the U.S. are extremely important for understanding the future dynamics of XAU/USD. Bloomberg experts predict a slowdown from 199,000 to 163,000, which corresponds to a soft landing scenario. An increase to 200,000–250,000 will signal overheating of the American economy, force the Federal Reserve to reconsider its views, and provoke sales of the precious metal.

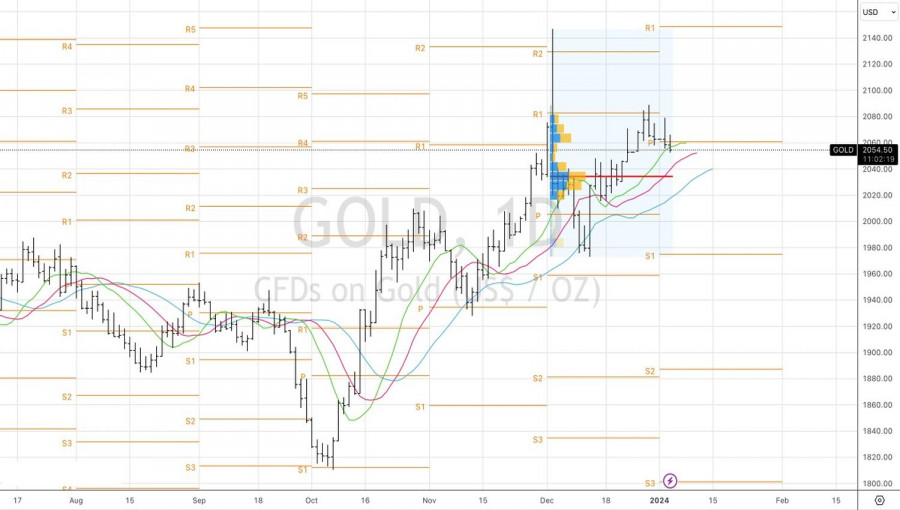

Technically, on the daily chart, a 1-2-3 reversal pattern is forming. The inability of the bulls to cling to the cluster of pivot levels near $2,060 per ounce is a sign of their weakness and a reason for short-term sales towards $2,035 and $2,005.

Download NOW!

Download NOW!

No comments:

Post a Comment