Bitcoin

Higher Timeframes

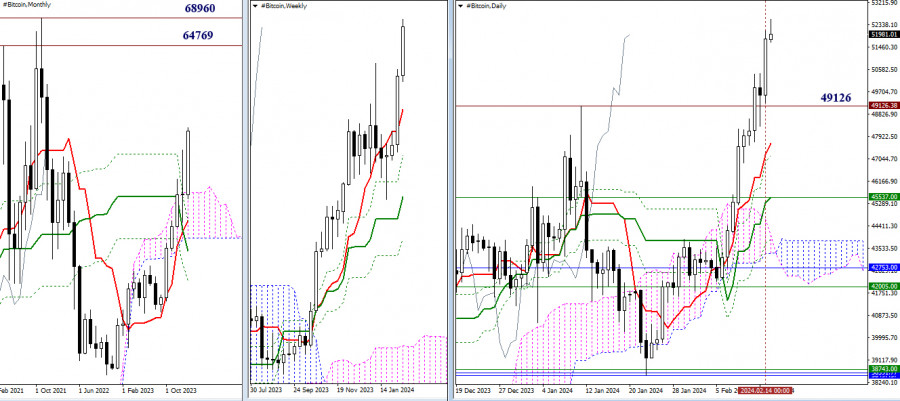

Bitcoin is active and productive for the second week in a row. It managed to overcome historical resistances in the range of 48,530 – 49,126, so its main task now is to maintain the achieved level and create conditions for further upward movement. All daily and weekly targets have been met, making the next significant upward targets in perspective the highs of 2021 at 64,768.80 and 68,959.73. The path is not very close, but these levels represent the current potential of Bitcoin overall.

If the bulls lack strength and relinquish initiative to the opponent, a significant weakening of bullish positions may occur if the price falls below the established boundaries of 48,530 – 49,126. In the current situation, the levels of the daily Ichimoku cross will be among the first to provide support, currently positioned at 47,663 – 47,195 – 45,537. However, in the subsequent days, during deceleration or consolidation, these levels will actively move closer to the price chart.

H4 – H1

On the lower timeframes, the advantage currently belongs to the bulls. They are developing an upward trend. The nearest targets for continuing the intraday ascent are the resistances of classic pivot points (52,832 – 53,884 – 55,666). The key levels of the lower timeframes, currently serving as supports, provide sufficient space for the development of corrective declines. The central pivot point of the day will be the first to meet Bitcoin in case of a decline; it is currently located at 51,049.

The weekly long-term trend, at the moment, is at the boundary of 49,390, and its breakthrough is of particular importance as the trend is responsible for the current balance of power. S1 (49,997) can provide intermediate support on this path.

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)Pentru mai multe detalii, va invitam sa vizitati stirea originala.

Higher Timeframes

Bitcoin is active and productive for the second week in a row. It managed to overcome historical resistances in the range of 48,530 – 49,126, so its main task now is to maintain the achieved level and create conditions for further upward movement. All daily and weekly targets have been met, making the next significant upward targets in perspective the highs of 2021 at 64,768.80 and 68,959.73. The path is not very close, but these levels represent the current potential of Bitcoin overall.

If the bulls lack strength and relinquish initiative to the opponent, a significant weakening of bullish positions may occur if the price falls below the established boundaries of 48,530 – 49,126. In the current situation, the levels of the daily Ichimoku cross will be among the first to provide support, currently positioned at 47,663 – 47,195 – 45,537. However, in the subsequent days, during deceleration or consolidation, these levels will actively move closer to the price chart.

H4 – H1

On the lower timeframes, the advantage currently belongs to the bulls. They are developing an upward trend. The nearest targets for continuing the intraday ascent are the resistances of classic pivot points (52,832 – 53,884 – 55,666). The key levels of the lower timeframes, currently serving as supports, provide sufficient space for the development of corrective declines. The central pivot point of the day will be the first to meet Bitcoin in case of a decline; it is currently located at 51,049.

The weekly long-term trend, at the moment, is at the boundary of 49,390, and its breakthrough is of particular importance as the trend is responsible for the current balance of power. S1 (49,997) can provide intermediate support on this path.

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)Pentru mai multe detalii, va invitam sa vizitati stirea originala.

Download NOW!

Download NOW!

No comments:

Post a Comment